It's too early to say that the pullback is over, but with last week's decline seemingly holding at some support and, this being a post options expiration week where there is a tendency for markets to reverse the prior week's direction, it was good action for the bulls. The Dow and the Transports were down, but tech and small caps helped lift the broader market indices.

The DWCPF (S-fund) had a strong day leading the large caps modestly, but more importantly, the support area near 2300 that I have been highlighting, held again yesterday. It's too early to declare victory, but this was a good place for it to hold, although many do expect that open gap to get filled. I have not been one of them. I am leaning toward the market not making it easy for the folks who missed the post election rally, to get in at a good price. The dip buyers looking for a chance to get in may not be patient enough to wait for it to fill that gap before doing their buying. But even if it does fill the gap, the chart has plenty of support below 2300 so I'm not too concerned yet.

Once again the 10-year Treasury Yield closed well off the highs again, and near the lows of the day, but the rising trading channel has continued to hold. It's not a runaway rally in yields but the trend is climbing and the longer the chart below trends higher, the less likely stocks can stay near the recent highs. I think whether this channel holds or not may determine whether stocks can bounce back toward the recent highs. The higher yields go, the less likely we continue to see new highs in the indices. A breakdown in that channel, and stocks could start another leg higher.

Wal-Mart and Lowe's report earnings today so it's a good gauge of the retail sector and consumer strength. Of course these could change the market tone from yesterday's rally if weaker than expected, but again this being a post options expiration week, there is a tendency to see the market reverse direction, and with stocks down last week, that means the new direction has a bullish bias.

Nvidia's earnings will be the highlight of the week and they will be reported after the closing bell on Wednesday.

The S&P 500 (C-fund) looks similar to the small caps chart up above as the top of the open gap, the 20-day EMA, and one of the rising support lines, all held right where it needed to. Maybe "needed" is too bearish, because it could fall even further and still been OK technically with the other layers of support going down to above 5770.

The ACWX ETF was up 0.75% yesterday. The "MSCI ACWI IMI ex US ex China ex Hong Kong Index" Index was up 0.12% yesterday. And the EFA was up 0.54%

Knowing that, let's see what return the TSP gives the I-fund. You can see the updated TSP prices and returns posted by about 9:15 PM ET daily here: https://www.tsptalk.com/tsp_share_prices.php

BND (bonds / F-fund) was up modestly yesterday as it continues to hover near the recent lows and above the 200-day EMA. Yields do need to stop going up before this becomes worth buying again.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

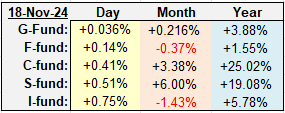

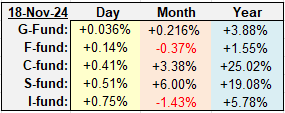

| Daily TSP Funds Return More returns |

The DWCPF (S-fund) had a strong day leading the large caps modestly, but more importantly, the support area near 2300 that I have been highlighting, held again yesterday. It's too early to declare victory, but this was a good place for it to hold, although many do expect that open gap to get filled. I have not been one of them. I am leaning toward the market not making it easy for the folks who missed the post election rally, to get in at a good price. The dip buyers looking for a chance to get in may not be patient enough to wait for it to fill that gap before doing their buying. But even if it does fill the gap, the chart has plenty of support below 2300 so I'm not too concerned yet.

Once again the 10-year Treasury Yield closed well off the highs again, and near the lows of the day, but the rising trading channel has continued to hold. It's not a runaway rally in yields but the trend is climbing and the longer the chart below trends higher, the less likely stocks can stay near the recent highs. I think whether this channel holds or not may determine whether stocks can bounce back toward the recent highs. The higher yields go, the less likely we continue to see new highs in the indices. A breakdown in that channel, and stocks could start another leg higher.

Wal-Mart and Lowe's report earnings today so it's a good gauge of the retail sector and consumer strength. Of course these could change the market tone from yesterday's rally if weaker than expected, but again this being a post options expiration week, there is a tendency to see the market reverse direction, and with stocks down last week, that means the new direction has a bullish bias.

Nvidia's earnings will be the highlight of the week and they will be reported after the closing bell on Wednesday.

The S&P 500 (C-fund) looks similar to the small caps chart up above as the top of the open gap, the 20-day EMA, and one of the rising support lines, all held right where it needed to. Maybe "needed" is too bearish, because it could fall even further and still been OK technically with the other layers of support going down to above 5770.

The ACWX ETF was up 0.75% yesterday. The "MSCI ACWI IMI ex US ex China ex Hong Kong Index" Index was up 0.12% yesterday. And the EFA was up 0.54%

Knowing that, let's see what return the TSP gives the I-fund. You can see the updated TSP prices and returns posted by about 9:15 PM ET daily here: https://www.tsptalk.com/tsp_share_prices.php

BND (bonds / F-fund) was up modestly yesterday as it continues to hover near the recent lows and above the 200-day EMA. Yields do need to stop going up before this becomes worth buying again.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.