Stocks tumbled as Microsoft, the 3rd largest company in the US market, sold off over 5% after reporting earnings on Wednesday evening. Earnings were solid but they guided lower for the next quarter. Meta also dropped over 4% so the large cap indices could not escape the weight of these Magnificent 7 stock losses. Apple and Amazon reported after hours yesterday. We also got some inflationary data in the Core PCE Prices report yesterday, and that kept yields buoyant, but they did back off during afternoon trading.

Small caps were down in sympathy, but the losses weren't quite as bad as the large caps, which could be a good sign as small caps are usually the first to be sold when the market weakens. It looked like there was going to be some buying into the close, but that changed in the final 15 - 20 minutes of trading when the selling intensified in front of Apple and Amazon's earnings release after the bell, and this morning's jobs report.

Apple's earnings beat estimates but it initially traded down 2% after hours, while Amazon posted big numbers and was up about 4% shortly after the release, which basically only got back yesterday's losses. Intel was up about 10% after reporting, so over all it was a pretty good showing from the large caps, but it wasn't moving the needle much in the futures market - at least not initially. Conference calls were still pending and those could change things in a hurry.

By the time some of you read this on Friday morning the market may also be digesting the October jobs report so it's really tough to speculate. This market was probably due for some kind of pullback, but with seasonality on the bulls' side this week, and Election Day next Tuesday, I'm a little surprised at the severity of the selling after getting through the tough September and most of October period unscathed. I suppose I was not alone in thinking things would be OK until after the election but we know the market likes to fool the most people possible.

The question now is, how will the market respond to the selling? Is this where the bargain hunters show up, or is this the sign that stocks are about to start a correction? Perhaps the reaction to the jobs report this morning will set that tone.

Yesterday's Core PCE Prices and Spending reports came in a little inflationary while income was a little lighter than expected which helped ease inflation concerns a little. Yields were up on all of this news, but it was a volatile day and the gain in the 10-year Treasury Yield was minor by the close. The rising channel remains intact however, and this trend may need to change before the stock market finds its footing again.

The selling was broad and one of the few markets that were up was oil. Even the inflation plays in gold and silver were down sharply despite the dollar being on the flat side for the day. As for stocks, the losses were a little more than was comfortable as we see some cracks developing in the charts. With the weak open yesterday, there is now an open gap above on the S&P chart that could be a rebound target, but will the new approach for traders change from buying dips to selling rallies? Any positive open today is likely to be sold at some point, just because of the short-term momentum, but the key will be who remains at the party by Friday's close, the bulls or the bears? The calendar tells us it will be the bulls, but the market is always trying to get us leaning the wrong way.

Estimates for this morning's jobs report are looking for a gain of about 125,000 jobs for October, and the unemployment rate estimates are 4.1% to 4.2%.

The October AutoTracker winners have been posted and while the TSP funds may not have held onto the early October gains, Our winners id. Here are the winners and here are the monthly and annual (non-premium members) standings through August. Track your return on the AutoTracker - it's free!

The S&P 500 (C-fund) gapped lower, fell through the first level of support and all the way down to the 50-day EMA on fairly high trading volume. This is not uncommon periodically in a bull market but anytime you lose almost 2% in one day you have to wonder if something has changed. The September, July, and May pullbacks did come down to at least test the 50-day EMA, and the August and September losses took it down to the 100-day EMA before catching a bid and rallying back. With the election coming up, it wouldn't be too surprising to see that happen again in the next couple of weeks, but seasonality is on the bulls' side for several more days so unfortunately nothing would surprise me - up or down, making it tough to make a call.

The DWCPF (S-fund) fell sharply as well although not as deeply as the S&P 500, and the closing price of 2180 was right on a couple of support lines, but the 20-day EMA, which was holding most of the day, finally failed with that late push lower.

The I-fund: The EFA tracking ETF was down 0.61% yesterday and the "ex USA ex China ex Hong Kong Index" was down 0.79%. You can see the TSP's eventual final daily price and return posted on our site each evening.

The EFA did find support near the 200-day EMA and reverse to close well off the lows, but still lost 0.61%. It looks like a good place for it to hold.

BND (Bonds / F-fund) was flat after an up and down day in yields. Nothing changed technically as the old gap is still holding as support, but the trend is still down.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

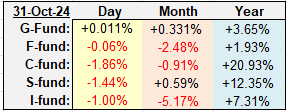

| Daily TSP Funds Return More returns |

Apple's earnings beat estimates but it initially traded down 2% after hours, while Amazon posted big numbers and was up about 4% shortly after the release, which basically only got back yesterday's losses. Intel was up about 10% after reporting, so over all it was a pretty good showing from the large caps, but it wasn't moving the needle much in the futures market - at least not initially. Conference calls were still pending and those could change things in a hurry.

By the time some of you read this on Friday morning the market may also be digesting the October jobs report so it's really tough to speculate. This market was probably due for some kind of pullback, but with seasonality on the bulls' side this week, and Election Day next Tuesday, I'm a little surprised at the severity of the selling after getting through the tough September and most of October period unscathed. I suppose I was not alone in thinking things would be OK until after the election but we know the market likes to fool the most people possible.

The question now is, how will the market respond to the selling? Is this where the bargain hunters show up, or is this the sign that stocks are about to start a correction? Perhaps the reaction to the jobs report this morning will set that tone.

Yesterday's Core PCE Prices and Spending reports came in a little inflationary while income was a little lighter than expected which helped ease inflation concerns a little. Yields were up on all of this news, but it was a volatile day and the gain in the 10-year Treasury Yield was minor by the close. The rising channel remains intact however, and this trend may need to change before the stock market finds its footing again.

The selling was broad and one of the few markets that were up was oil. Even the inflation plays in gold and silver were down sharply despite the dollar being on the flat side for the day. As for stocks, the losses were a little more than was comfortable as we see some cracks developing in the charts. With the weak open yesterday, there is now an open gap above on the S&P chart that could be a rebound target, but will the new approach for traders change from buying dips to selling rallies? Any positive open today is likely to be sold at some point, just because of the short-term momentum, but the key will be who remains at the party by Friday's close, the bulls or the bears? The calendar tells us it will be the bulls, but the market is always trying to get us leaning the wrong way.

Estimates for this morning's jobs report are looking for a gain of about 125,000 jobs for October, and the unemployment rate estimates are 4.1% to 4.2%.

The October AutoTracker winners have been posted and while the TSP funds may not have held onto the early October gains, Our winners id. Here are the winners and here are the monthly and annual (non-premium members) standings through August. Track your return on the AutoTracker - it's free!

The S&P 500 (C-fund) gapped lower, fell through the first level of support and all the way down to the 50-day EMA on fairly high trading volume. This is not uncommon periodically in a bull market but anytime you lose almost 2% in one day you have to wonder if something has changed. The September, July, and May pullbacks did come down to at least test the 50-day EMA, and the August and September losses took it down to the 100-day EMA before catching a bid and rallying back. With the election coming up, it wouldn't be too surprising to see that happen again in the next couple of weeks, but seasonality is on the bulls' side for several more days so unfortunately nothing would surprise me - up or down, making it tough to make a call.

The DWCPF (S-fund) fell sharply as well although not as deeply as the S&P 500, and the closing price of 2180 was right on a couple of support lines, but the 20-day EMA, which was holding most of the day, finally failed with that late push lower.

The I-fund: The EFA tracking ETF was down 0.61% yesterday and the "ex USA ex China ex Hong Kong Index" was down 0.79%. You can see the TSP's eventual final daily price and return posted on our site each evening.

The EFA did find support near the 200-day EMA and reverse to close well off the lows, but still lost 0.61%. It looks like a good place for it to hold.

BND (Bonds / F-fund) was flat after an up and down day in yields. Nothing changed technically as the old gap is still holding as support, but the trend is still down.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: