-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSLA - Tesla

- Thread starter tsptalk

- Start date

bmneveu

TSP Pro

- Reaction score

- 91

JP Morgan just raised their Tesla price target up $10 to $90.

It is respectable that they are taking such a contrarian view of this most beloved company.

That is strange. Why even bother if their assessment is still almost exactly the same?

Bullitt

Market Veteran

- Reaction score

- 75

Cramer

https://www.thestreet.com/video/jim-cramer-tesla-stock-biding-time

I think Tesla is biding it's time. A lot of investors got involved in the stock market because of Tesla and it made people feel invulnerable. Tesla is kind of like the treasury 10 year benchmark. It has to keep going higher.

https://www.thestreet.com/video/jim-cramer-tesla-stock-biding-time

James48843

TSP Talk Royalty

- Reaction score

- 905

So- question-

If TESLA begins to tank today, and ends up being worth, oh, say, 20 times earnings, (like a normal stock)

What would that do to the S&P500 value?

Sent from my iPhone using TSP Talk Forums

If TESLA begins to tank today, and ends up being worth, oh, say, 20 times earnings, (like a normal stock)

What would that do to the S&P500 value?

Sent from my iPhone using TSP Talk Forums

Bullitt

Market Veteran

- Reaction score

- 75

I don't think anyone knows what would happen. For TSLA to go down to 20x earnings, it would take a real collapse.

Depending on how fast it happened there would be ripple effects across the market as trades are unwound. So if it collapsed in a few days due to accounting fraud for example, we'd all feel it. If it went down over the course of time, it may or may not matter.

Depending on how fast it happened there would be ripple effects across the market as trades are unwound. So if it collapsed in a few days due to accounting fraud for example, we'd all feel it. If it went down over the course of time, it may or may not matter.

- Reaction score

- 2,450

So- question-

If TESLA begins to tank today, and ends up being worth, oh, say, 20 times earnings, (like a normal stock)

What would that do to the S&P500 value?

Sure, that would be the case, but in my mind I keep getting reminded of Amazon from the dot com days. It had an astronomical P/E, yet it refused to go down - other than with the gyrations of the market. What seems expensive today for Tesla, could be a bargain 5 - 10 years from now.

I mentioned before that I recall shorting AMZN at $50 a share, and that was before they started splitting their stock, so it was more like the equivalent of $5 or $10. Today, $3200.

Bullitt

Market Veteran

- Reaction score

- 75

Wonder if Amazon would have made it if they didn't pull the rabbit out of their hat in 'Amazon Web Services'. That coupled with the tax advantage allowed them to charge super low prices. I remember in 1999 or so ebay was the place to buy stuff from. How things have changed.

WSJ showed a chart that short interest in TSLA is the lowest it's been in over 10 years. Everyone got blown out in the past nine months. The short squeeze has been a major catalyst with over $39B from TSLA short sellers lost this year alone.

https://www.wsj.com/amp/articles/tesla-bulls-double-down-as-stock-reaches-new-heights-11608460200

WSJ showed a chart that short interest in TSLA is the lowest it's been in over 10 years. Everyone got blown out in the past nine months. The short squeeze has been a major catalyst with over $39B from TSLA short sellers lost this year alone.

https://www.wsj.com/amp/articles/tesla-bulls-double-down-as-stock-reaches-new-heights-11608460200

Bullitt

Market Veteran

- Reaction score

- 75

Don't mistake luck for skill. Toxic and symptomatic of a society that failed to save during the earnings years and now must take on extraordinary risk to... have more?

Pretty soon we'll be hearing the stories from the thousands it didn't work out for.

Of course, it's all you know who's fault.

https://www.wsj.com/articles/invest...cks-pushing-margin-debt-to-record-11609077600

Pretty soon we'll be hearing the stories from the thousands it didn't work out for.

Mr. Burnworth, a civil engineer in Incline Village, Nev., who is nearing retirement age, is using all of those strategies after turning a roughly $23,000 options gamble on Tesla last year into a nearly $2 million windfall. His growing Tesla stake had enabled him to borrow against his position to convert Tesla options into shares that have soared sevenfold this year. He says he also helped his daughter buy a home and purchased a Tesla sport-utility vehicle for another family member.

“Before, I wasn’t doing particularly well financially. Now, I’m well beyond where I wanted to be for retirement,” said Mr. Burnworth, who added that he also sold his own home and used some of the proceeds to buy more Tesla options.

Of course, it's all you know who's fault.

Mary Roberts made her first big investment last year, using some spare cash and a leftover retirement account from a previous job to buy up shares of Tesla. Like Mr. Burnworth, her investment portfolio swelled in value this year as the electric-car maker’s stock ran up, leading her to dabble in options trading for the first time using margin debt.

Ms. Roberts, who is 53 years old and lives in Vancouver, Wash. She and her husband run a chemicals-distribution business that she says has struggled because of Mr. Trump’s trade war with China. Between her investments and her spouse’s, their combined portfolio is now worth seven figures, with two-thirds of that consisting of Tesla stock, Ms. Roberts said.

https://www.wsj.com/articles/invest...cks-pushing-margin-debt-to-record-11609077600

James48843

TSP Talk Royalty

- Reaction score

- 905

Those are the stories that really scare the hell out of me. Someone sold their house, so they could dabble in options contracts???

Tesla WILL crash at some point in time. Whether it is next week, next year, or five years from now, it’s gonna happen.

One should make sure they have a place to sleep, before the crash sends them out in the street.

Sent from my iPhone using TSP Talk Forums

Tesla WILL crash at some point in time. Whether it is next week, next year, or five years from now, it’s gonna happen.

One should make sure they have a place to sleep, before the crash sends them out in the street.

Sent from my iPhone using TSP Talk Forums

rktect1

TSP Analyst

- Reaction score

- 11

For me, Tesla is just too volatile. The downward possibility and loss that COULD be incurred outweighed the possible gains. I will stick with Apple and I am happy with my measly 80% gains year to year.Those are the stories that really scare the hell out of me. Someone sold their house, so they could dabble in options contracts???

Tesla WILL crash at some point in time. Whether it is next week, next year, or five years from now, it’s gonna happen.

One should make sure they have a place to sleep, before the crash sends them out in the street.

Sent from my iPhone using TSP Talk Forums

rktect1

TSP Analyst

- Reaction score

- 11

JP Morgan just raised their Tesla price target up $10 to $90.

It is respectable that they are taking such a contrarian view of this most beloved company.

And the scary thing is that they could eventually be correct. I like Tesla and I like Musk, but the company isn't actually worth what the stock is valued at. I always wonder if people who invest in this TSLA just sort of believe they are as close to getting SpaceX as they ever will.

Bullitt

Market Veteran

- Reaction score

- 75

Oh yeah, I like some of the tweets Musk throws out there, but it's a story stock I don't wish to be involved in. Over valued or fully valued, what's the difference? Under valued? I doubt it.

Big name car dealerships need to take a page out of his book and get rid of this upselling BS when you go to buy a car. Dealers pray you'll take that next tier car for a test drive and then end up going for the lease on the upgraded vehicle over the purchase on the lower or middle tier one. There used to be a company called Saturn (GM). You'd walk in, say I want that one, and that was basically it besides a few minor details.

The WSJ article, I wonder where they find these people. If people are taking risks like that in the market, then they failed to save during the working years, made very poor major financial decisions (house broke), have life long ambitions of just wanting more, or a combination of all three.

Ok, so a few people made some coin, but I doubt they're smart enough to walk away for good. The problem comes when they eventually lose it all again and find themselves unemployable due to age without a pot to **** in. Then, their problem then becomes everyone else's problem.

Big name car dealerships need to take a page out of his book and get rid of this upselling BS when you go to buy a car. Dealers pray you'll take that next tier car for a test drive and then end up going for the lease on the upgraded vehicle over the purchase on the lower or middle tier one. There used to be a company called Saturn (GM). You'd walk in, say I want that one, and that was basically it besides a few minor details.

The WSJ article, I wonder where they find these people. If people are taking risks like that in the market, then they failed to save during the working years, made very poor major financial decisions (house broke), have life long ambitions of just wanting more, or a combination of all three.

Ok, so a few people made some coin, but I doubt they're smart enough to walk away for good. The problem comes when they eventually lose it all again and find themselves unemployable due to age without a pot to **** in. Then, their problem then becomes everyone else's problem.

- Reaction score

- 2,450

Tesla hits $800 today and that makes Elon Musk the richest person on the planet, passing Bezos.

https://finance.yahoo.com/m/f300e205-5680-3df9-9e87-0c8714d1216e/elon-musk-dethrones-jeff.html

https://finance.yahoo.com/m/f300e205-5680-3df9-9e87-0c8714d1216e/elon-musk-dethrones-jeff.html

Bullitt

Market Veteran

- Reaction score

- 75

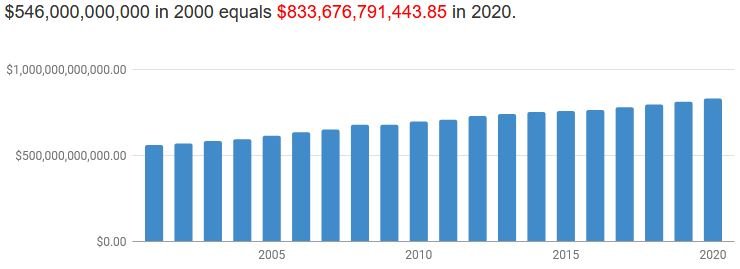

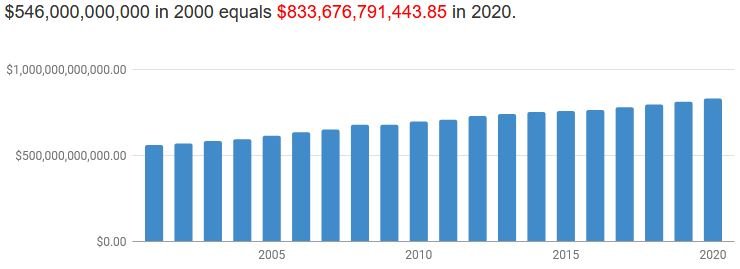

Saw someone talking about market caps and made me think.

CSCO had a market cap of $546B in 2000. In 2020 that comes out to $833B.

https://www.fool.com/investing/2016/09/23/cisco-stock-history-what-investors-need-to-know.aspx

Tesla's current market cap is $832B.

CSCO had a market cap of $546B in 2000. In 2020 that comes out to $833B.

At its peak in 2000, Cisco stock traded above $79 a share, for a market cap of $546 billion -- surpassing Microsoft as the world's most valuable company and inspiring estimates that it could surpass a $1 trillion valuation.

https://www.fool.com/investing/2016/09/23/cisco-stock-history-what-investors-need-to-know.aspx

Tesla's current market cap is $832B.

I don't think the car is very good, although besides my affluent sister I don't know anyone who owns one. The stock is overpriced and while it has had a run, it can and has moved double digits down in the process. Like 25% in a week. I recall owning it once, buying at the close the day before earnings, selling at the open for a 10% gain, and the stock was down 8% at the close. What's the PE?: 1500:1? Could it go higher? sure. so can bitcoin. It can also turn on a dime at any time and go down 50% or more in a heartbeat and dozens of analysts will claim they predicted it.

There are other companies, and there will have to be other companies, to supply electric vehicles.....XH, RIDE, to name a few....which are both down today, and charging stations (BLNK, SBE (SPAC for electrify america or some such)), and battery components (ALB, LIT) if the world converts to this technology. But at $800/share, I'm ready to delete TSLA and their cramped, heavy cars, from my watch list.

There are other companies, and there will have to be other companies, to supply electric vehicles.....XH, RIDE, to name a few....which are both down today, and charging stations (BLNK, SBE (SPAC for electrify america or some such)), and battery components (ALB, LIT) if the world converts to this technology. But at $800/share, I'm ready to delete TSLA and their cramped, heavy cars, from my watch list.

wavecoder

TSP Pro

- Reaction score

- 24

Those are the stories that really scare the hell out of me. Someone sold their house, so they could dabble in options contracts???

Tesla WILL crash at some point in time. Whether it is next week, next year, or five years from now, it’s gonna happen.

One should make sure they have a place to sleep, before the crash sends them out in the street.

Sent from my iPhone using TSP Talk Forums

Sounds like that person has a gambling problem. That usually ends in disaster. I dabbled with options in the past, and although the rush of calling a move perfectly can be awesome, you can lose your money just as fast. That and the time decay makes things even more stressful. A couple months after getting into it, i went back to just trading shares, it wasn't for me.

bmneveu

TSP Pro

- Reaction score

- 91

Sounds like that person has a gambling problem. That usually ends in disaster. I dabbled with options in the past, and although the rush of calling a move perfectly can be awesome, you can lose your money just as fast. That and the time decay makes things even more stressful. A couple months after getting into it, i went back to just trading shares, it wasn't for me.

Same here. I go long traditional shares only. I don't even short stocks. And never touched an option. Way too much risk.

As for Tesla, it's the most technologically advanced vehicle I have ever sat in, but that's only a small part of the valuation at this point. People are betting on the battery technology more than the car. It is years ahead of any other battery maker.

wavecoder

TSP Pro

- Reaction score

- 24

Same here. I go long traditional shares only. I don't even short stocks. And never touched an option. Way too much risk.

As for Tesla, it's the most technologically advanced vehicle I have ever sat in, but that's only a small part of the valuation at this point. People are betting on the battery technology more than the car. It is years ahead of any other battery maker.

Same here, I stopped trying to play the short game a long time ago, and started to win a lot more as a result. Learned that it's usually an exercise in futility betting against something that's designed to keep going up

Similar threads

- Replies

- 0

- Views

- 144

- Replies

- 0

- Views

- 109

- Replies

- 0

- Views

- 184

- Replies

- 0

- Views

- 314

- Replies

- 1

- Views

- 284