So far, it's a long overdue pullback. It could be something more, but we haven't seen enough damage yet to draw any further conclusions. Sentiment will continue to play a big part in how the market trades in the coming weeks. This is something to watch, as rising bullishness in a down-trending market can be difficult to reverse. So far sentiment does not suggest that is the case, but only time will tell if this condition develops.

Here are the current Seven Sentinels signals.

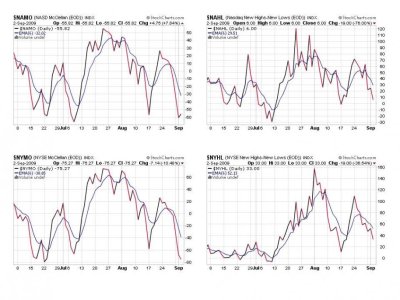

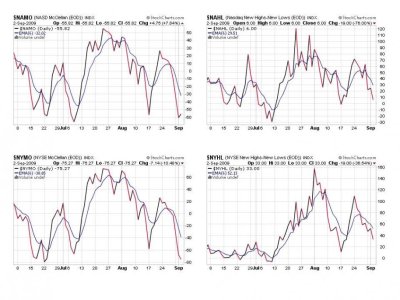

All four in this cart are in sell mode.

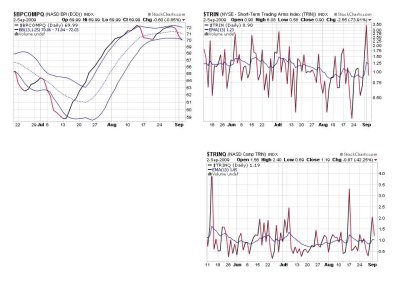

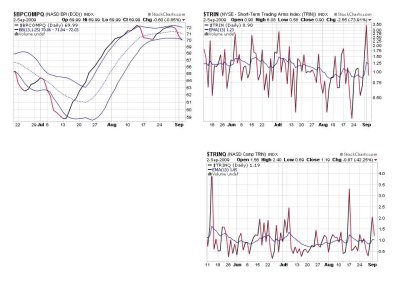

This chart shows $BPCOMPQ and $TRINQ in sell mode with $TRIN the only signal flashing a buy, although not by much.

The question now is, can the market find support soon or are we in for more pain. As I said before, I think sentiment will be key in this regard.

Here are the current Seven Sentinels signals.

All four in this cart are in sell mode.

This chart shows $BPCOMPQ and $TRINQ in sell mode with $TRIN the only signal flashing a buy, although not by much.

The question now is, can the market find support soon or are we in for more pain. As I said before, I think sentiment will be key in this regard.