After yesterday's big gains today's action was marked by volatile, choppy trade. But the indexes managed to close with modest to moderate gains nonetheless.

Key to today's volatile action was dollar strength, which saw the greenback tack on 0.9%. Considering its strong showing today, it certainly speaks volumes about the underlying strength of this market as it was able to close in positive territory regardless.

The anticipated October non-farm payrolls was released this morning and showed an increase of 151,000, while private payrolls jumped 159,000. Each was well above estimates of 60,000. In spite of the upward surprise, the unemployment rate stayed unchanged at 9.6%.

Gold and silver each hit new highs today at $1397.70 and $26.92 per ounce respectively.

Not surprisingly, the Sentinels remain on a buy. Here's the charts:

NAMO and NYMO are flashing buys.

Same with NAHL and NYHL.

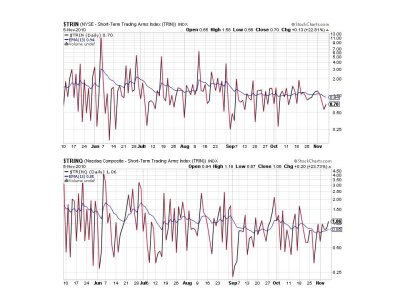

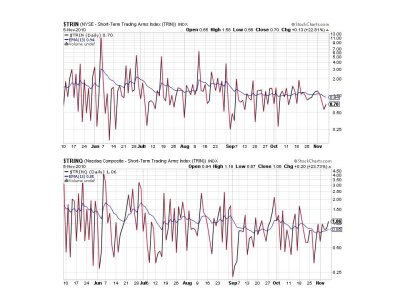

TRIN remains on a buy, but TRINQ remains on a sell.

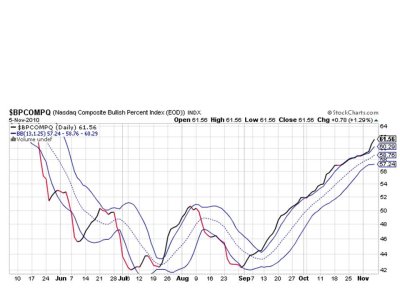

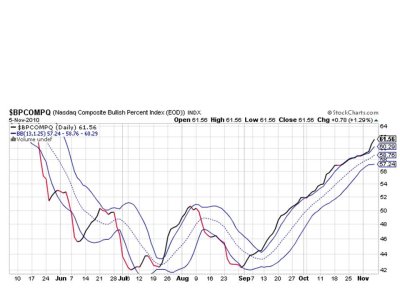

BPCOMPQ looks to be making a bullish move as it pulls away from the upper bollinger band.

So we have 6 of 7 signals flashing buys, which keeps the system on a buy.

This freight train has rarely stopped since it began going in early September, and with QE2 scheduled for release in monthly increments going into the 2nd quarter, it's hard to envision a hard correction anytime soon. But sentiment may be turning as our own sentiment survey was overwhelmingly bullish (bearish) for this coming week. That gets my attention as it has outperformed all but a handful of TSPers this year. If we get any weakness next week, I may be a buyer. See you this weekend when I post the weekly tracker charts.

Key to today's volatile action was dollar strength, which saw the greenback tack on 0.9%. Considering its strong showing today, it certainly speaks volumes about the underlying strength of this market as it was able to close in positive territory regardless.

The anticipated October non-farm payrolls was released this morning and showed an increase of 151,000, while private payrolls jumped 159,000. Each was well above estimates of 60,000. In spite of the upward surprise, the unemployment rate stayed unchanged at 9.6%.

Gold and silver each hit new highs today at $1397.70 and $26.92 per ounce respectively.

Not surprisingly, the Sentinels remain on a buy. Here's the charts:

NAMO and NYMO are flashing buys.

Same with NAHL and NYHL.

TRIN remains on a buy, but TRINQ remains on a sell.

BPCOMPQ looks to be making a bullish move as it pulls away from the upper bollinger band.

So we have 6 of 7 signals flashing buys, which keeps the system on a buy.

This freight train has rarely stopped since it began going in early September, and with QE2 scheduled for release in monthly increments going into the 2nd quarter, it's hard to envision a hard correction anytime soon. But sentiment may be turning as our own sentiment survey was overwhelmingly bullish (bearish) for this coming week. That gets my attention as it has outperformed all but a handful of TSPers this year. If we get any weakness next week, I may be a buyer. See you this weekend when I post the weekly tracker charts.