___

The first week of February (week 5 of 52) closed up 3.03%% this is above the -.16% average week 5 returns, is the 4th best week over the past 21 years, and the 7th best week over the past 66 years.

___

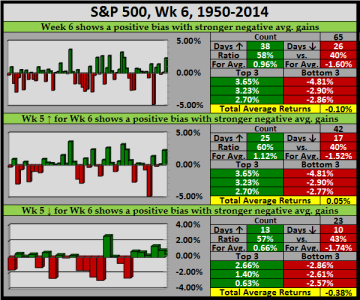

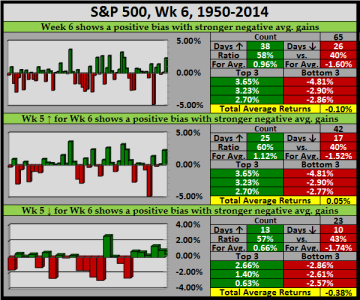

Contrasting week 6 against an up/down week 5 from 1950-2014

___

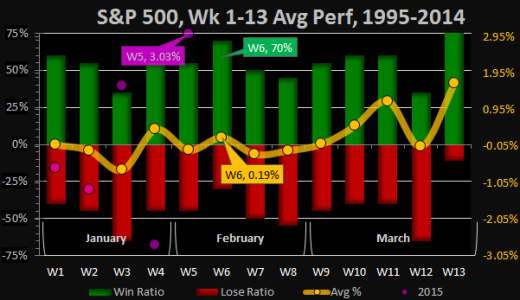

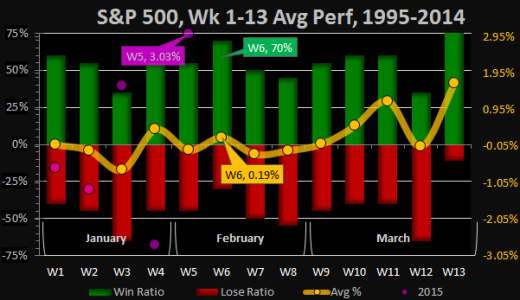

For week 6, we'll contrast against the 52 weeks of the year, from 1995-2014

___

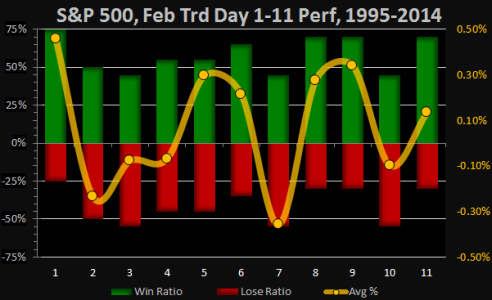

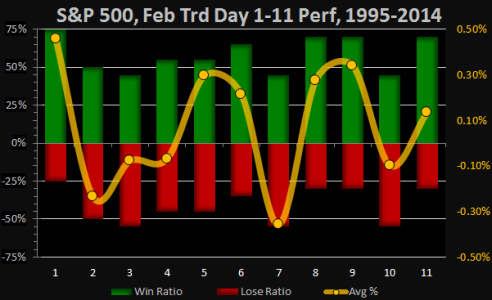

For week 6, we have trading days 6-10

___

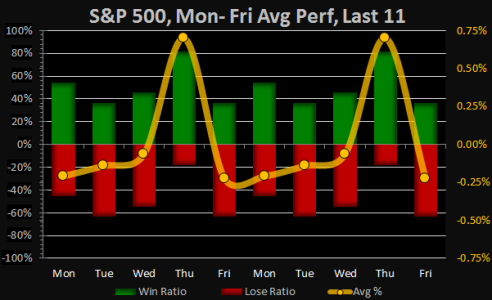

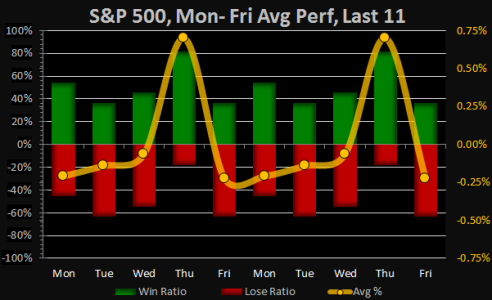

For the last 11 Monday through Fridays

___

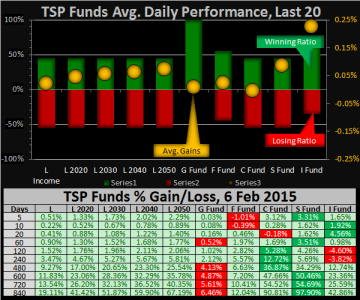

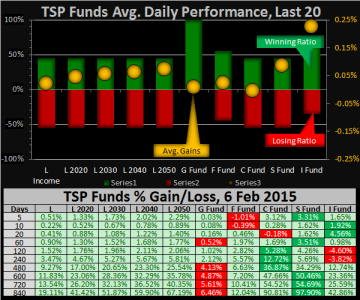

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

___

When it comes to performance and edges, there are 3 times of the year which I believe to be the most critical. These 3 areas of time tend to statistically underperform all other times of the year and if we don't get it right, then we can end up spending the rest of year playing "catch up." I do my best to save my "foot stomps" for the times when it's most crucial, and I want to tell you, we are approaching the 2nd worst performing 52 weeks and without question the worst performing time of the 1st quarter. Looking ahead of week 6, collectively, weeks 7-9 rank as some of the worst performing weeks of the year.

Now with saying this, we should understand the data behind the stats. Over the past 20 years, 11 of those 20 three-week periods closed down, which may not seem significant, but some of those 3-week periods were big movers. 4 of those 3-week periods closed up more than 3.00% and 4 closed down more than -3.00% with 2009 closing down -18.44%. Point being, 8 of the last 20 years have been what I call "big movers"

Wrapping things up, for myself, IFTs are planned weeks in advance, so I'm fortunate not to let the daily price action wreak havoc on my subconscious. As of this writing I'm performing well within my expectations, with an edge over the GFCS funds. I have to be honest with you, life is so much easier when you play the "slow" game, making subtle moves and gaining subtle edges.

While the rabbit may get the glory, the turtle gets the paycheck

Trade hard…Jason

The first week of February (week 5 of 52) closed up 3.03%% this is above the -.16% average week 5 returns, is the 4th best week over the past 21 years, and the 7th best week over the past 66 years.

___

Contrasting week 6 against an up/down week 5 from 1950-2014

- We show the last 64 week 6s have an average 58% winning ratio and -.10% average returns

- For the 42 years when week 5 closed up, week 6 shows a 60% winning ratio with .05% average returns

- For the 23 years when week 5 closed down, week 6 shows a 57% winning ratio with -.38% average returns

- The winning ratios are near even, meaning there is no strategic advantage to be had. However, there is a difference between the average returns for all three charts.

___

For week 6, we'll contrast against the 52 weeks of the year, from 1995-2014

- We show a 70% winning ratio, which is above average, ranking 7th

- We show .19% average returns, which is above average, ranking 21st

- We show 1.06% average positive returns, which is below average, ranking 49th

- We show -1.85% average negative returns, which is above average, ranking 24th

- Historically, week 6 is a positive week but the returns are not strong

___

For week 6, we have trading days 6-10

- The average 5-day winning ratio is 59%

- The cumulative 5-day average return is .37%

- Presidents day is on Monday the 16th, so trading day 11 is on a Tuesday

___

For the last 11 Monday through Fridays

- It's still ugly, last 3 Thursdays closed up while last 3 Fridays closed down

- Tuesdays & Friday's have a 36% winning ratio with 4 of 11 closing up, while Thursday has an 82% winning ratio

___

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- I-Fund ranks 1st with a 65% winning ratio and .23% average returns

- S-Fund ranks 2nd with a 45% winning ratio and .09% average returns

- F-Fund ranks 3rd with a 55% winning ratio and .02% average returns

- C-Fund ranks 4th with a 45% winning ratio and .00% average returns

- While the I-Fund leads over the past 20 days, the S-Fund is catching up in the short-term

___

When it comes to performance and edges, there are 3 times of the year which I believe to be the most critical. These 3 areas of time tend to statistically underperform all other times of the year and if we don't get it right, then we can end up spending the rest of year playing "catch up." I do my best to save my "foot stomps" for the times when it's most crucial, and I want to tell you, we are approaching the 2nd worst performing 52 weeks and without question the worst performing time of the 1st quarter. Looking ahead of week 6, collectively, weeks 7-9 rank as some of the worst performing weeks of the year.

Now with saying this, we should understand the data behind the stats. Over the past 20 years, 11 of those 20 three-week periods closed down, which may not seem significant, but some of those 3-week periods were big movers. 4 of those 3-week periods closed up more than 3.00% and 4 closed down more than -3.00% with 2009 closing down -18.44%. Point being, 8 of the last 20 years have been what I call "big movers"

Wrapping things up, for myself, IFTs are planned weeks in advance, so I'm fortunate not to let the daily price action wreak havoc on my subconscious. As of this writing I'm performing well within my expectations, with an edge over the GFCS funds. I have to be honest with you, life is so much easier when you play the "slow" game, making subtle moves and gaining subtle edges.

While the rabbit may get the glory, the turtle gets the paycheck

Trade hard…Jason