___Although we have seen some volatile price action, this week the damage was not as extensive as the perception might be. This was a week where gains were made, then promptly given back, only to have us close just south of flat. But it’s the sting from the previous week’s large decline which still leaves a bitter taste and it appears traders aren’t happy about the current state of the economy. Thus far, this month isn’t trending with the historical norm, month-to-date the S&P 500 is on target for the 4th worst December over the past 65 years.

Looking back to previous Week 50:

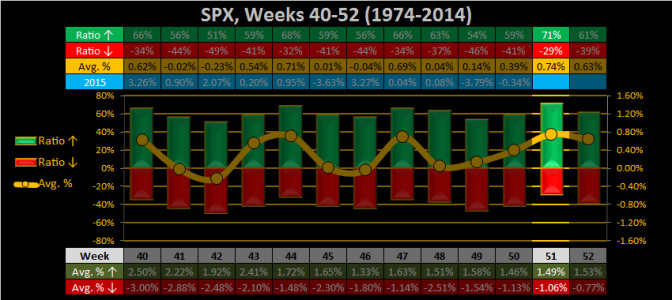

Looking ahead to week 51: There are just two more trading weeks left in the year and they are both short 4-day trading weeks.

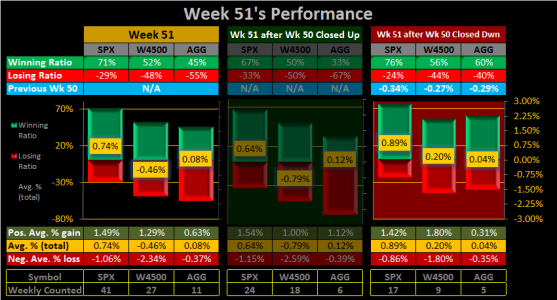

SPX’s week 51 ranks as the 1st best week in the 13-week 4th quarter period (HOT)

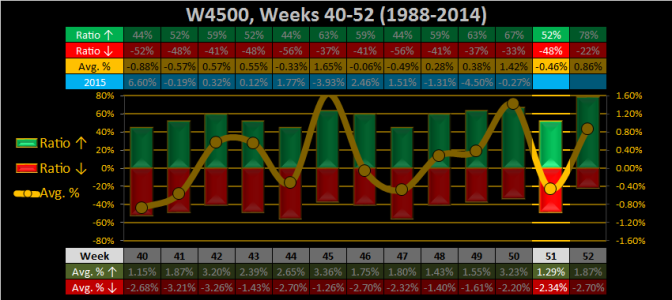

W4500’s week 51 ranks as the 11th best week in the 13-week 4th quarter period (COLD)

AGG’s week 51 ranks as the 5th best week in the 13-week 4th quarter period (WARM)

Taking a look at what has historically happened to week 51 when the previous week has closed up or down.

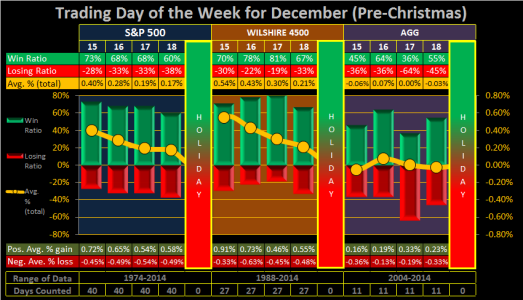

DAILY, Pre-Christmas - Trading day of the week: Monday starts trading day 15, we have half-day on Thursday and a holiday on Friday. For both SPX & W4500 the winning ratios are very good, but as you can see from the yellow average gains line, profits decline as we head into the holiday weekend.

Note TSP.Gov: Because December 25 is a federal holiday, the TSP will be closed. Transactions that would have been processed Friday night (December 25) will be processed Monday night (December 28) at Monday’s closing share prices.

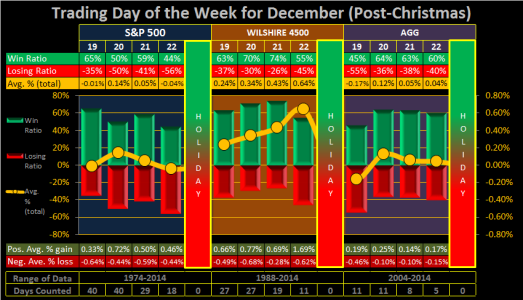

DAILY, Post-Christmas - Trading day of the week: Looking out further to the last week of the year, Monday starts trading day 19, we have a holiday on Friday. SPX appears relatively flat, while W4500 trends strong. If you look at the “Day Counted” row, you will see there are less days Wednesday & Thursday. This is because the range of data I’ve chosen to use, only covers the months of December where there were 22 trading days, such as the case of this year’s 2015.

Note TSP.Gov: Because January 1 is a federal holiday, the TSP will be closed. Transactions that would have been processed Friday night (January 1) will be processed Monday night (January 4) at Monday’s closing share prices.

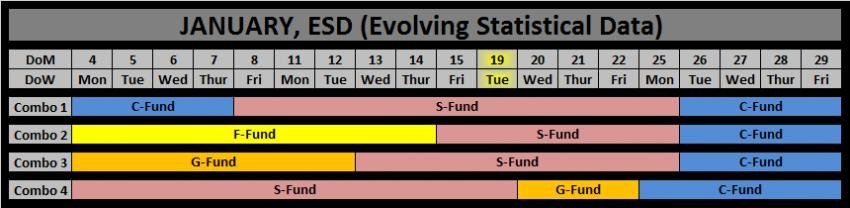

JTH-ESD (Evolving Statistical Data): Month-to-Date, ESD is down -4.79 % this loss is reflective of the current market’s conditions not trading alongside with the historical trends. For 2016, JTH-ESD will start off in the C-Fund and although I’ve outlined its projected path, next year I’ll apply additional filters in an attempt to extend or delay the signals (as needed). The projected path will remain unchanged, but the filters will blend current market data with the stats, potential helping to avoid blindly jumping in or out of the markets.

Next week, I’ll be preparing the stats for next year, and reading up on my latest copy of the Trader’s Almanac, it should be fun.

Stay invested…Jason

Looking back to previous Week 50:

- SPX closed down -.34%

- W4500 closed down -.27%,

- AGG closed down -.29%

Looking ahead to week 51: There are just two more trading weeks left in the year and they are both short 4-day trading weeks.

SPX’s week 51 ranks as the 1st best week in the 13-week 4th quarter period (HOT)

- 1st best winning ratio

- 10th best positive average gains

- 1st best average gains

- 2nd best negative average gains

W4500’s week 51 ranks as the 11th best week in the 13-week 4th quarter period (COLD)

- 8th best winning ratio

- 12th best positive average gains

- 10th best average gains

- 7th best negative average gains

AGG’s week 51 ranks as the 5th best week in the 13-week 4th quarter period (WARM)

- 10th best winning ratio

- 2nd best positive average gains

- 6th best average gains

- 6th best negative average gains

Taking a look at what has historically happened to week 51 when the previous week has closed up or down.

- SPX gains a slight historical edge, with a slightly stronger winning ratio & slightly stronger average gains.

- W4500 gains a slight historical edge, with a slightly stronger winning ratio & stronger average gains.

- AGG gains a mixed historical edge, with a stronger winning ratio, but weaker average gains.

DAILY, Pre-Christmas - Trading day of the week: Monday starts trading day 15, we have half-day on Thursday and a holiday on Friday. For both SPX & W4500 the winning ratios are very good, but as you can see from the yellow average gains line, profits decline as we head into the holiday weekend.

Note TSP.Gov: Because December 25 is a federal holiday, the TSP will be closed. Transactions that would have been processed Friday night (December 25) will be processed Monday night (December 28) at Monday’s closing share prices.

DAILY, Post-Christmas - Trading day of the week: Looking out further to the last week of the year, Monday starts trading day 19, we have a holiday on Friday. SPX appears relatively flat, while W4500 trends strong. If you look at the “Day Counted” row, you will see there are less days Wednesday & Thursday. This is because the range of data I’ve chosen to use, only covers the months of December where there were 22 trading days, such as the case of this year’s 2015.

Note TSP.Gov: Because January 1 is a federal holiday, the TSP will be closed. Transactions that would have been processed Friday night (January 1) will be processed Monday night (January 4) at Monday’s closing share prices.

JTH-ESD (Evolving Statistical Data): Month-to-Date, ESD is down -4.79 % this loss is reflective of the current market’s conditions not trading alongside with the historical trends. For 2016, JTH-ESD will start off in the C-Fund and although I’ve outlined its projected path, next year I’ll apply additional filters in an attempt to extend or delay the signals (as needed). The projected path will remain unchanged, but the filters will blend current market data with the stats, potential helping to avoid blindly jumping in or out of the markets.

Next week, I’ll be preparing the stats for next year, and reading up on my latest copy of the Trader’s Almanac, it should be fun.

Stay invested…Jason