___

___

Useless Data (strength follows strength)

___

View attachment 35543

Statically speaking, October is a tricky month to analyze due to the recent 2008 Bear Market's steep decline

___

Conversely, October 2008 also has 3 of the top 20 best days over the past 66 years

___

4th Quarter Update (covering the past 40 years)

-

Monthly Update (covering the past 20 years)

-

Weekly update (covering the past 11 years)

-

View attachment 35546

Trading Day of the Month (Octobers over the past 11 years)

-

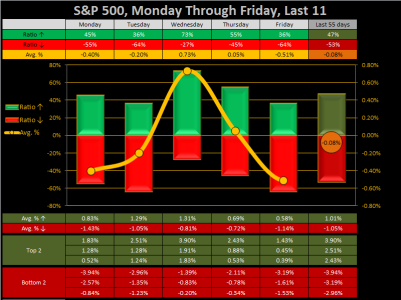

Day of the Week

-

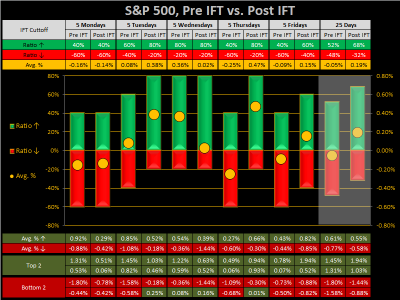

Pre IFT vs. Post IFT

-

Take care…Jason

___

Useless Data (strength follows strength)

___

Over the past 788 months, the average monthly return is .69%

Like this month, from 1950, there have only been 16 months which have started out with trading days 1-3 up, 4th day down, and days 5-7 up

Of those 16 occasions, 15 closed positive, with a total average monthly return of 4.18%

The one month which did close down was -.10%

View attachment 35543

Statically speaking, October is a tricky month to analyze due to the recent 2008 Bear Market's steep decline

___

October 2008 has 4 of the top 20 worst days over the past 66 years

2nd with -9.03%, 6th with -7.62%, 16th with -6.10% and 18th with a -5.74% loss

Conversely, October 2008 also has 3 of the top 20 best days over the past 66 years

___

1st with 11.58%, 2nd with 10.79%, 19th, with a 4.77% gain

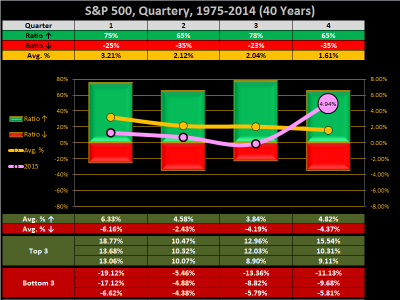

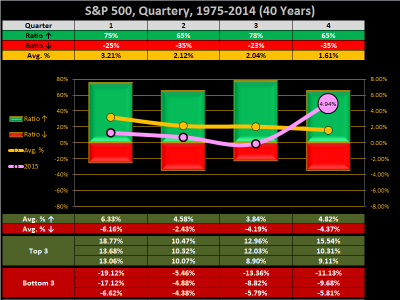

4th Quarter Update (covering the past 40 years)

-

Currently the index is sitting at 4.94%

Over the past 40 years, this is substantially higher than the average gains of 1.61% and on target with the average positive gains of 4.82%

Over the past 40 years, this is substantially higher than the average gains of 1.61% and on target with the average positive gains of 4.82%

Monthly Update (covering the past 20 years)

-

Currently, the index is sitting at 4.94%

Over the past 20 years, this is substantially higher than the average gains of 1.65% and on target with the average positive gains of 4.62%

Over the past 20 years, this is substantially higher than the average gains of 1.65% and on target with the average positive gains of 4.62%

Weekly update (covering the past 11 years)

-

Week 40 closed at 3.26%

This is the 2nd best close over the past 12 years, and the 7th best over the past 66 years.

-This is the 2nd best close over the past 12 years, and the 7th best over the past 66 years.

Comparing week 13-week range of week 40-52, here are the week 41 stats

4th best winning ratio at 64%

3rd best average positive gains at 2.18%

5th best average gains at .91%

4th best average negative gains at -1.31%

-

Overall, week 41 ranks in a 2-way tie as the 3rd best week in the 4th quarter's 40-52 week range

3rd best average positive gains at 2.18%

5th best average gains at .91%

4th best average negative gains at -1.31%

-

Overall, week 41 ranks in a 2-way tie as the 3rd best week in the 4th quarter's 40-52 week range

View attachment 35546

Trading Day of the Month (Octobers over the past 11 years)

-

Trading days 8-9 have shown weak winning ratios

On trading day 9, the Top 1 gain of 11.58% skews the .94% average gains

On trading day 11, the top 1 loss of -9.03% skews the -.99% average gains

On trading day 9, the Top 1 gain of 11.58% skews the .94% average gains

On trading day 11, the top 1 loss of -9.03% skews the -.99% average gains

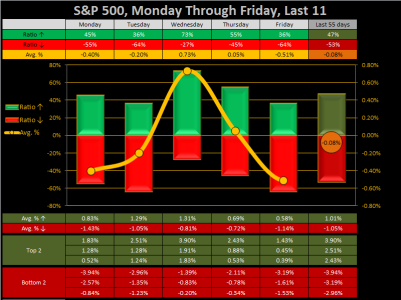

Day of the Week

-

Friday has been the best day to buy, with a 36% winning ratio and -.51% average gains

Wednesday has been the best day to sell, with a 73% winning ratio and .73% average gains

Wednesday has been the best day to sell, with a 73% winning ratio and .73% average gains

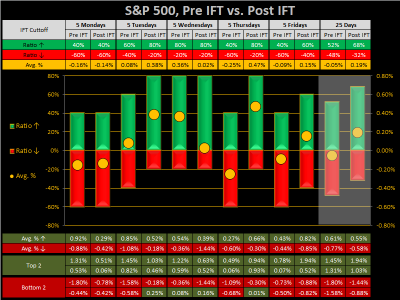

Pre IFT vs. Post IFT

-

The Pre-IFT deadline has a 52% winning ratio with -.05% average gains

The Post-IFT deadline has a 68% winning ratio with .19% average gains

When the Pre-IFT closed positive, the post IFT closed positive 62% of the time

When the Pre-IFT closed negative, the post IFT closed negative 25% of the time

The Post-IFT deadline has a 68% winning ratio with .19% average gains

When the Pre-IFT closed positive, the post IFT closed positive 62% of the time

When the Pre-IFT closed negative, the post IFT closed negative 25% of the time

Take care…Jason