It was a horrible week, perhaps it's a good time to follow it up with a rally.

For the S&P 500, the 4th week of March (week 12 of 52) closed down -2.23% this is the 2nd worst week this year, the 20th worst over the past 21 years, and the 61st worst over the past 66 years.

___

Contrasting upcoming week 13 against an up/down week 12 from 1950-2014

- We show the last 65 week 13s have an average 52% winning ratio with .13% average returns

- For the 31 years when week 12 closed up, week 13 shows a 39% winning ratio with -.20% average returns

- For the 34 years when week 12 closed down, week 13 shows a 65% winning ratio with .43% average returns

- Under current conditions, week 13 has an above average positive bias

___

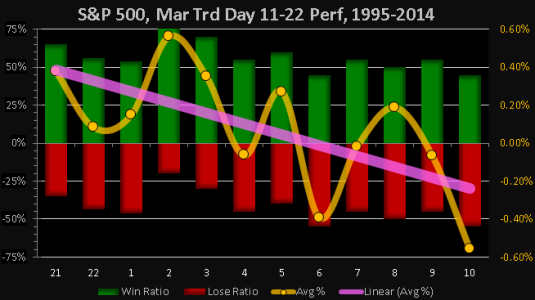

For week 13, we have the last 2 trading days of March (21, 22) and the 1st 3 trading days of April

- The average 5-day winning ratio is 65% (very good)

- The cumulative 5-day average return is 1.52% (very good)

___

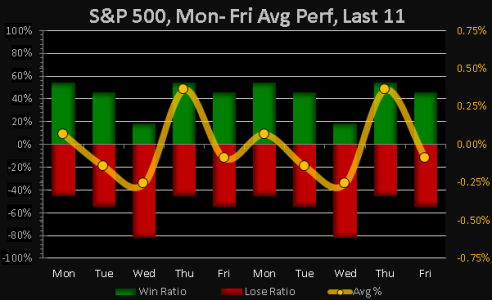

For the last 11 Monday through Fridays

- Mondays have a 55% winning ratio with .07% average returns (2nd best day)

- Tuesdays have a 45% winning ratio with -.14% average returns (2nd worst day)

- Wednesdays have a 18% winning ratio with -.26% average returns (worst day w/last 4 closing down)

- Thursdays have a 55% winning ratio with .36% average returns (best average returns)

- Fridays have a 45% winning ratio with .09% average returns (3rd worst day)

___

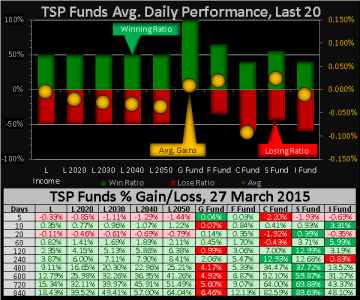

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- F-Fund ranks 1st with a 65% winning ratio and .02% average returns

- S-Fund ranks 2nd with a 55% winning ratio and .02% average returns

- I -Fund ranks 3rd with a 40% winning ratio and -.01% average returns

- C-Fund ranks 4th with a 40% winning ratio and -.09% average returns

The I-Fund leads YTD

___

My expectations for week 13 are for a positive close, but I do consider the recent lows from Thursday to be very important, they need to hold, they must hold. The Transports have tested the Dec 2014 lows 3 times, if you've been reading my PnF Blog, then you know the Transports have lead the other indexes by 1-2 days, sort of like the canary in the coalmine, so we'd like to see them lead us back up. Sometime this week, I'll do a follow-up on the 1st quarter's performance to see if we can correlate it with the End of year result, perhaps this will give us some insight on what to expect as we trudge through the rest of the year.

Take care…Jason