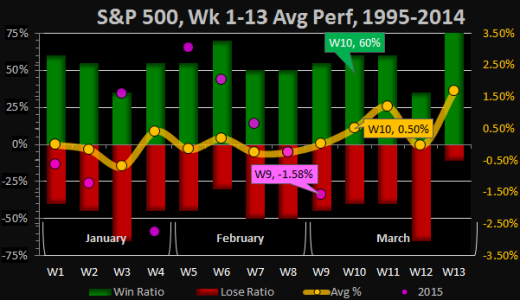

For the S&P 500, the first week of March (week 9 of 52) closed down -1.58% this is below the 0.00% average week 9 returns, is the 17th best week over the past 21 years, and the 55th best over the past 66 years, basically it was a "bad week"

___

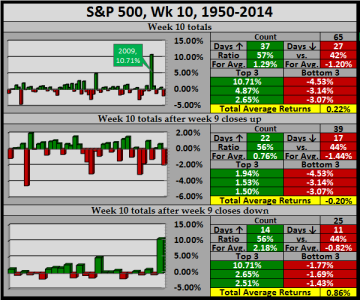

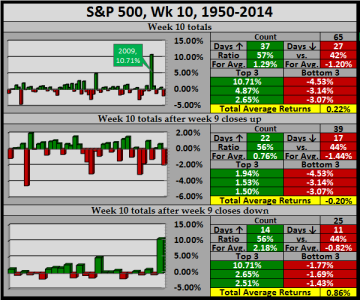

WARNING: The second week of March 2009 closed up 10.71% (for the lowest & highest chart, the average returns are distorted)

Contrasting upcoming week 10 against an up/down week 9 from 1950-2014

___

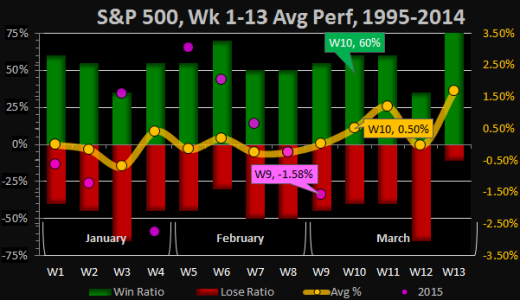

Contrasting week 10 against the 52 weeks of the year, from 1995-2014

___

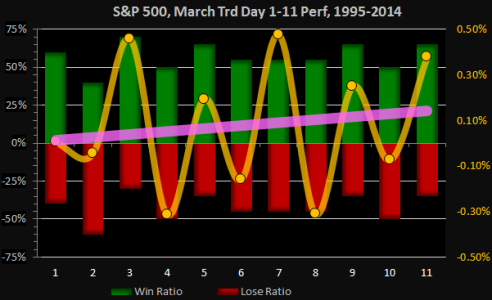

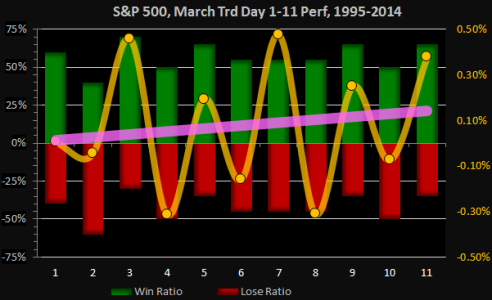

For week 10, we have trading days 6-10

___

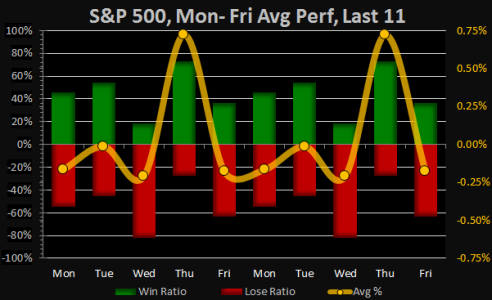

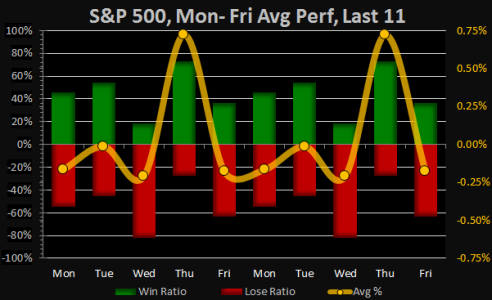

For the last 11 Monday through Fridays

___

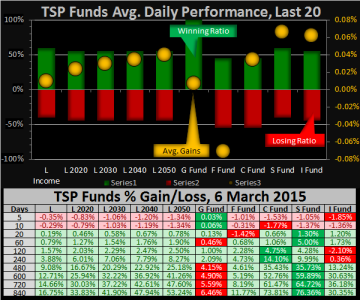

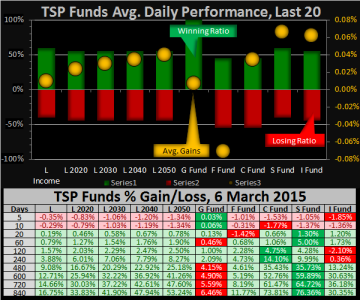

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

___

These stat blogs have been fun, to free up some time to pursue other items of interest, I may start tapering off at the end of the 1st quarter. Until then, I hope you've enjoyed them as much as I have, hopefully they've helped you evaluate the statistical long-term trends and have given you a different perspective to work with.

I'm leaving town this weekend, won't be back till mid-week, please try not to let the markets fall apart while I'm gone...

Take care…Jason

___

WARNING: The second week of March 2009 closed up 10.71% (for the lowest & highest chart, the average returns are distorted)

Contrasting upcoming week 10 against an up/down week 9 from 1950-2014

- We show the last 65 week 10s have an average 57% winning ratio with .22% average returns (minus 2009 it's .05%)

- For the 39 years when week 9 closed up, week 10 shows a 56% winning ratio with -.20% average returns

- For the 25 years when week 9 closed down, week 10 shows a 56% winning ratio with .86% average returns (minus 2009 it's .45%)

- In 1962, week 9 closed flat with 0.00% this data is not included in the lower 2 charts

- Under current conditions, week 10 has a positive bias with strong average returns

___

Contrasting week 10 against the 52 weeks of the year, from 1995-2014

- We show a 60% winning ratio, which is above average, ranking in a 11-way tie for 13th

- We show .50% average returns, which is above average, ranking 12th

- We show 2.30% average positive returns, which is above average, ranking 8th

- We show -2.20% average negative returns, which is below average, ranking 38th

- There is a nice historical positive bias for week 10, but overall it ranks 40th because of the strong negative average returns

- Take notice, since week 5, we've had a straight line decline for the 2015 pink dots

___

For week 10, we have trading days 6-10

- The average 5-day winning ratio is 56%

- The cumulative 5-day average return is .18%

___

For the last 11 Monday through Fridays

- Last Mondays closed up (3rd best day)

- Last 4 of 5 Tuesdays closed up (2nd best day)

- Last 6 Wednesdays closed down (worst day)

- Last 3 Thursdays closed flat (best day)

- Last 2 Fridays closed down (2nd worst day)

- Overall, for the S&P 500, Mon/Wed/Fri winning ratios stink

___

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- S-Fund ranks 1st with a 60% winning ratio and .07% average returns

- I -Fund ranks 2nd with a 55% winning ratio and .06% average returns

- C-Fund ranks 3rd with a 45% winning ratio and .03% average returns

- F-Fund ranks 4th with a 45% winning ratio and -.07% average returns

- G-Fund takes the lead on the 5 & 10 day timeframes, while the S-Fund leads over the 20 & 60 day timeframes

- The overall results of this chart fall in line with the analysis of the charts I've been posting in the Per Diem blogs

___

These stat blogs have been fun, to free up some time to pursue other items of interest, I may start tapering off at the end of the 1st quarter. Until then, I hope you've enjoyed them as much as I have, hopefully they've helped you evaluate the statistical long-term trends and have given you a different perspective to work with.

I'm leaving town this weekend, won't be back till mid-week, please try not to let the markets fall apart while I'm gone...

Take care…Jason