The last month of the trading year is my favorite. For myself, it’s a time of reflection of the year’s past and preparation for our next year’s future. Good or bad, it’s when we lock in our yearly performance, and if we’re lucky, we get to apply those learned lesson, and carry them forward.

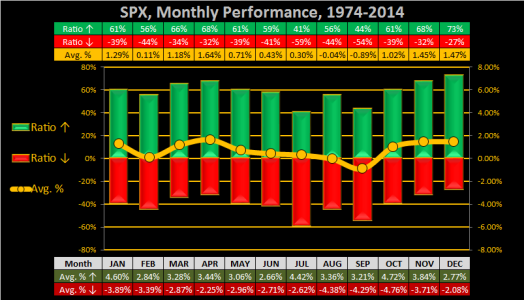

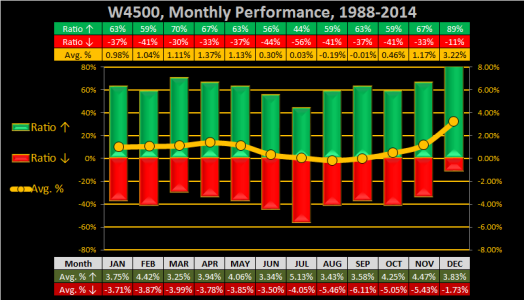

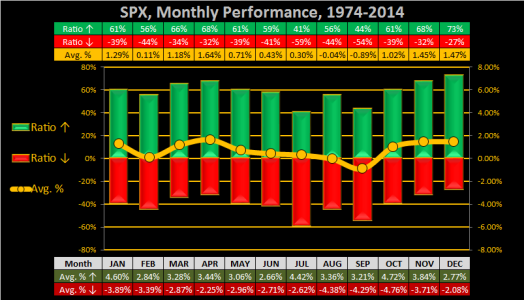

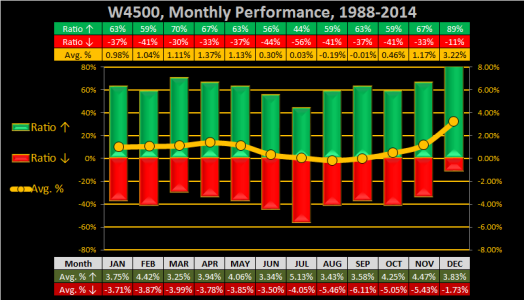

Statistically speaking, December is an awesome month to be invested, with both the SPX & W4500 recording both strong winning ratios and average returns. For SPX, 17% of the year’s average monthly gains are made in December.

Monthly:

(Very good) December’s S&P 500 ranks as the 2[SUP]nd[/SUP] best month of the year. We are also entering the beginning of the 3[SUP]rd[/SUP] best 2-month, 4[SUP]th[/SUP] best 3-month, best 4-month, best 5-month and 3[SUP]rd[/SUP] best 6-months of the year.

___

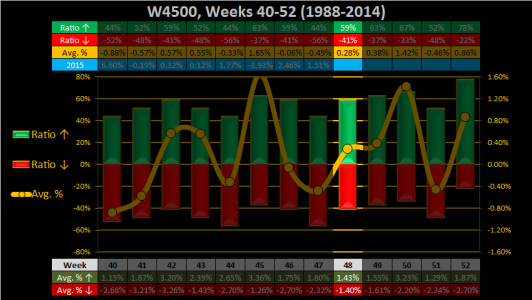

(Very good, but very odd…) December’s Wilshire 4500 ranks as the best month of the year. We are also entering the beginning of the best 2-month, 3-month, 4-month, 5-month and 2nd best 6-months of the year!

___

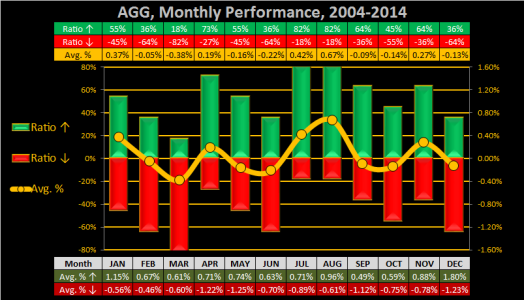

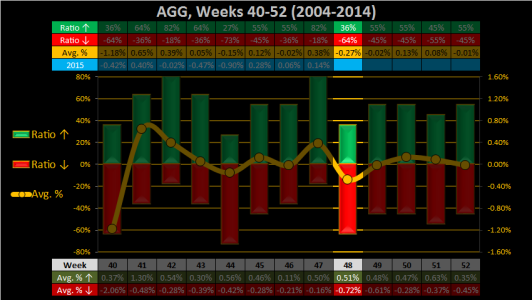

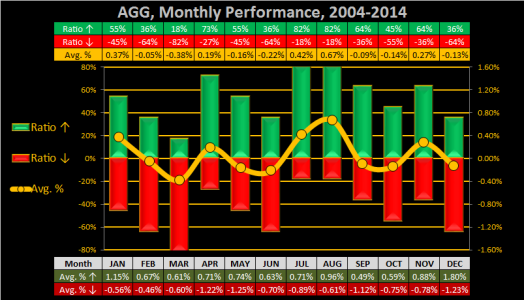

(In contrast) December’s AGG ranks as the 7th best month of the year. The 2-6 month performance varies from average to below average, but this falls within seasonal expectations of the overall performance of bonds.

___

Finishing out the third week of November, week 46 closed flat for SPX, strong for W4500, & decent for AGG

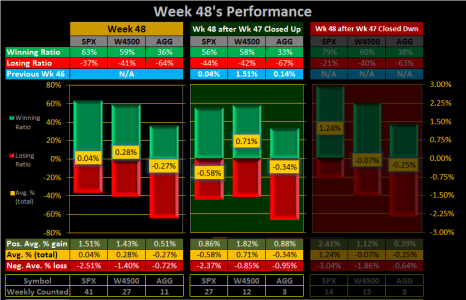

Previous Week 47: SPX closed up .04%, W4500 up 1.51%, and AGG up .14%

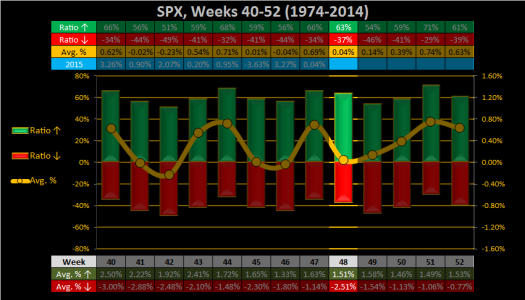

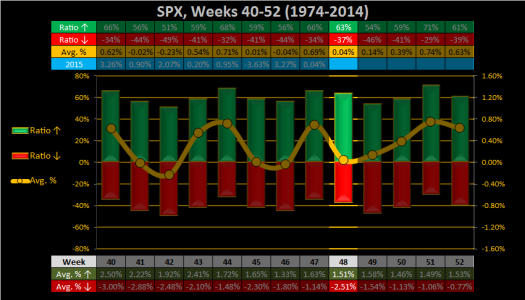

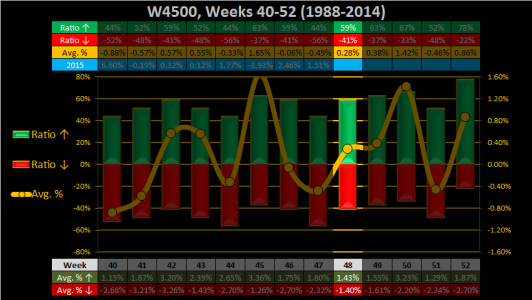

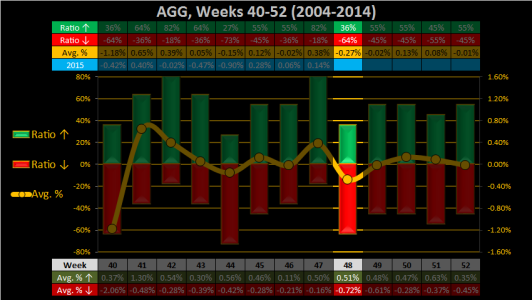

Week 48: Looking ahead to week 48, SPX is below average, W4500 is average and AGG’s is significantly below average.

(Below Average) Wk 48 SPX ranks as the 10th best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 5[SUP]th[/SUP] best winning ratio, 10[SUP]th[/SUP] best positive average gains, 9th best average gains, and 11[SUP]th[/SUP] best negative average gains.

___

(Above Average) Wk 48 W4500 ranks as the 6th best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 5th best winning ratio, 11[SUP]th[/SUP] best positive average gains, 7th best average gains, and 2nd best negative average gains.

___

(Disappointing) Wk 48 AGG ranks as the 12st best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 11th best winning ratio, 5[SUP]th[/SUP] best positive average gains, 12th best average gains, and 12th best negative average gains.

___

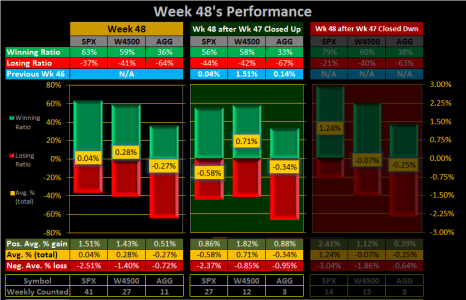

Let’s see what happens to week 48 after week 47 closes up

After week 47 closes up, the stats for both SPX & AGG are better than average. Regardless, the stats for AGG are not good, with only 4 of the last 11 years closing up.

___

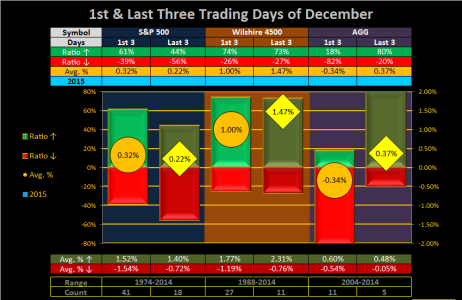

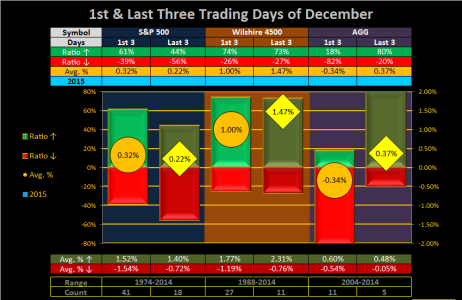

DAILY: The first 3 days of December start on Tuesday 1 December, and show W4500 has a strong edge over SPX/AGG. For the last 3 trading days of December, there is less data to work with because there are a full 22 days (normally we don’t get to trading day 22) For SPX instead of having the usual 41 points of data (or 41 trading day 22s) we only have 18 points of data.

___

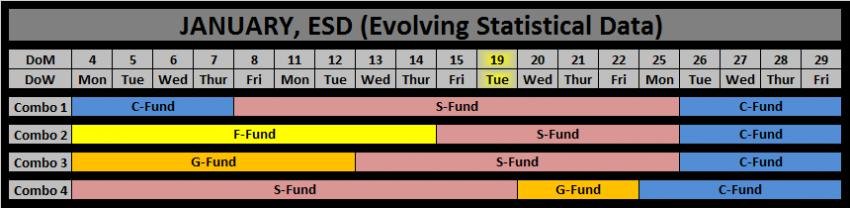

JTH-ESD (Evolving Statistical Data): Month-to-Date, ESD is up 4.02%

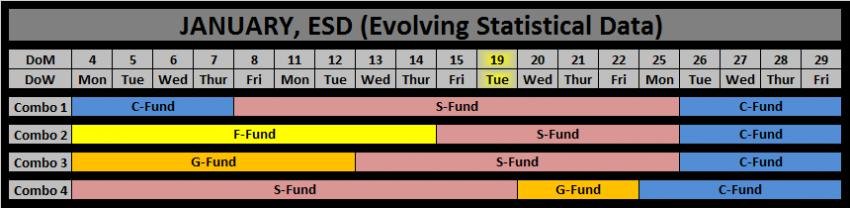

For December, ESD starts off in the S-Fund, switching to the F-Fund on 9-Dec, then back into the S-Fund on 16 Dec. In January, the best combo starts off in the C-Fund and since it’s a new year, I may deviate ESD’s last IFT, finishing out the year in the C-Fund (instead of the S-Fund).

View attachment 36106

___

Miscellaneous: In case you haven’t noticed W4500 has outperformed SPX over the past 5 days, perhaps this is the beginning of a much needed rotation?

Stay invested…Jason

Statistically speaking, December is an awesome month to be invested, with both the SPX & W4500 recording both strong winning ratios and average returns. For SPX, 17% of the year’s average monthly gains are made in December.

Monthly:

(Very good) December’s S&P 500 ranks as the 2[SUP]nd[/SUP] best month of the year. We are also entering the beginning of the 3[SUP]rd[/SUP] best 2-month, 4[SUP]th[/SUP] best 3-month, best 4-month, best 5-month and 3[SUP]rd[/SUP] best 6-months of the year.

___

(Very good, but very odd…) December’s Wilshire 4500 ranks as the best month of the year. We are also entering the beginning of the best 2-month, 3-month, 4-month, 5-month and 2nd best 6-months of the year!

___

(In contrast) December’s AGG ranks as the 7th best month of the year. The 2-6 month performance varies from average to below average, but this falls within seasonal expectations of the overall performance of bonds.

___

Finishing out the third week of November, week 46 closed flat for SPX, strong for W4500, & decent for AGG

Previous Week 47: SPX closed up .04%, W4500 up 1.51%, and AGG up .14%

Week 48: Looking ahead to week 48, SPX is below average, W4500 is average and AGG’s is significantly below average.

(Below Average) Wk 48 SPX ranks as the 10th best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 5[SUP]th[/SUP] best winning ratio, 10[SUP]th[/SUP] best positive average gains, 9th best average gains, and 11[SUP]th[/SUP] best negative average gains.

___

(Above Average) Wk 48 W4500 ranks as the 6th best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 5th best winning ratio, 11[SUP]th[/SUP] best positive average gains, 7th best average gains, and 2nd best negative average gains.

___

(Disappointing) Wk 48 AGG ranks as the 12st best week in the 13-week 4[SUP]th[/SUP] quarter period, with the 11th best winning ratio, 5[SUP]th[/SUP] best positive average gains, 12th best average gains, and 12th best negative average gains.

___

Let’s see what happens to week 48 after week 47 closes up

After week 47 closes up, the stats for both SPX & AGG are better than average. Regardless, the stats for AGG are not good, with only 4 of the last 11 years closing up.

___

DAILY: The first 3 days of December start on Tuesday 1 December, and show W4500 has a strong edge over SPX/AGG. For the last 3 trading days of December, there is less data to work with because there are a full 22 days (normally we don’t get to trading day 22) For SPX instead of having the usual 41 points of data (or 41 trading day 22s) we only have 18 points of data.

___

JTH-ESD (Evolving Statistical Data): Month-to-Date, ESD is up 4.02%

For December, ESD starts off in the S-Fund, switching to the F-Fund on 9-Dec, then back into the S-Fund on 16 Dec. In January, the best combo starts off in the C-Fund and since it’s a new year, I may deviate ESD’s last IFT, finishing out the year in the C-Fund (instead of the S-Fund).

View attachment 36106

___

Miscellaneous: In case you haven’t noticed W4500 has outperformed SPX over the past 5 days, perhaps this is the beginning of a much needed rotation?

Stay invested…Jason