-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TopNotch Account Talk

- Thread starter TopNotch

- Start date

- Reaction score

- 2,450

Welcome! Have you joined the AutoTracker yet? We'll track your return when you enter your transactions...

http://www.tsptalk.com/mb/rules-tos-and-info-please-read/9658-autotracker-rules-how-get-started.html

http://www.tsptalk.com/mb/rules-tos-and-info-please-read/9658-autotracker-rules-how-get-started.html

Cactus

TSP Pro

- Reaction score

- 38

Welcome aboard, Top! Looks like your moves this year have been Top Notch.

I would 2nd tsptalk's recommendation to join and record your IFTs in the AutoTracker. It's an excellent way of seeing your IFT gains/losses separate from your existing balance and contributions.

I would 2nd tsptalk's recommendation to join and record your IFTs in the AutoTracker. It's an excellent way of seeing your IFT gains/losses separate from your existing balance and contributions.

- Reaction score

- 2,450

Hey Tom, Not really sure how the auto tracker works or how to set it up. Is there a video that explains how to use it?

No video but here's how it works...

Create your account (Username should match forum username)

TSP Talk AutoTracker

Once that's done, enter your current account allocation as a percentage in each fund...

https://www.tsptalk.com/tracker/tsp_user_menu.php - Choose "My IFT Allocation" from menu to input allocation.

Use that menu to explore other members' data.

Here's more AutoTracker menu choices... TSP Talk AutoTracker

So any time you make an Interfund Transfer (IFT) in your TSP account, you can also enter it in our AutoTracaker and we'll track the returns.

TopNotch

Investor

- Reaction score

- 1

Hmm, seems hard to use. I get this message.

Whoa! Your initial IFT has not processed yet. We can't proceed.Please contact the site administrator at support@tsptalk.com, and

let him know what you are trying to do. We will get it taken care of.

Thanks!

I just use this spread sheet it seems to track things for me pretty well.

https://drive.google.com/file/d/1EaK1g9fNKxVuvHtO0Nl0mWsGSLUIyDTP/view

Whoa! Your initial IFT has not processed yet. We can't proceed.Please contact the site administrator at support@tsptalk.com, and

let him know what you are trying to do. We will get it taken care of.

Thanks!

I just use this spread sheet it seems to track things for me pretty well.

https://drive.google.com/file/d/1EaK1g9fNKxVuvHtO0Nl0mWsGSLUIyDTP/view

TopNotch

Investor

- Reaction score

- 1

Weekly Review for TopNotch.

Markets took a slight step back this week. From a chart perspective we could see our second pullback for the year. Though I can't show my videos, I will try and describe what we did. Two weeks ago we moved all funds into the G fund. We did this to mitigate risk and damage to our portfolio it turned out to be a great move as markets are lower this week. This also puts us ahead of all funds for the TSP currently. Which means, yes, we are beating the markets! BUT... The year is only halfway over so we really can't claim that. The second part would be when do we put our funds back in? Aw that is the million dollar question. You can wait a certain amount of time, for a certain price, or wait for the tech picture to improve. We will wait until the end of next week to reinsert our funds if not sooner. We don't want to miss what we have gained. Which would be about a 2% advantage on the S and C funds. Questions? Let me know or hit me up on my YouTube channel.

Currently 100% G

ITF's left for JUNE 0

Yearly return 6.60% TSP 7.34% TSP (without fees)

-Top

Markets took a slight step back this week. From a chart perspective we could see our second pullback for the year. Though I can't show my videos, I will try and describe what we did. Two weeks ago we moved all funds into the G fund. We did this to mitigate risk and damage to our portfolio it turned out to be a great move as markets are lower this week. This also puts us ahead of all funds for the TSP currently. Which means, yes, we are beating the markets! BUT... The year is only halfway over so we really can't claim that. The second part would be when do we put our funds back in? Aw that is the million dollar question. You can wait a certain amount of time, for a certain price, or wait for the tech picture to improve. We will wait until the end of next week to reinsert our funds if not sooner. We don't want to miss what we have gained. Which would be about a 2% advantage on the S and C funds. Questions? Let me know or hit me up on my YouTube channel.

Currently 100% G

ITF's left for JUNE 0

Yearly return 6.60% TSP 7.34% TSP (without fees)

-Top

userque

TSP Legend

- Reaction score

- 36

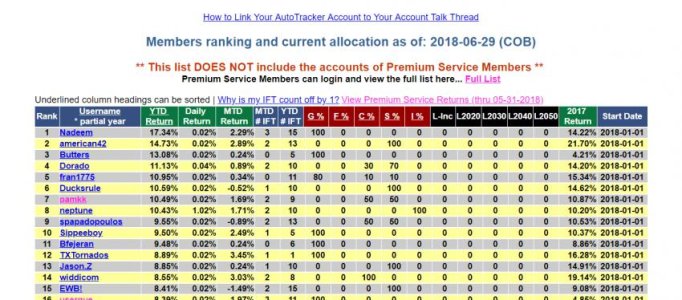

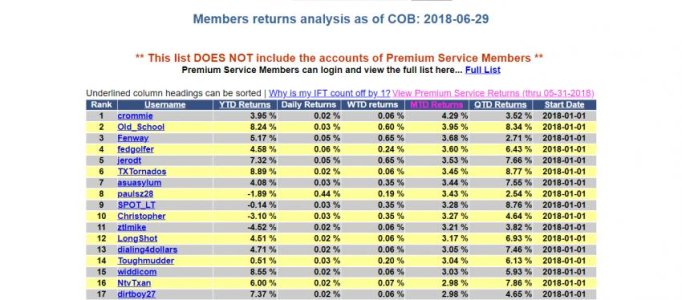

TSP Talk AutoTracker

TSP Talk AutoTracker

One benefit that I believe comes from using trackers like this site has are that it's easy to verifiably compare your performance to others.

While others like you on the intrawebs post trades in advance, there is work involved in a viewer going back to verify that the posited returns are true and accurate.

Also, one guy might think she's doing great just beating the G fund year after year...until she realizes the returns others are getting, for example.

TSP Talk AutoTracker

One benefit that I believe comes from using trackers like this site has are that it's easy to verifiably compare your performance to others.

While others like you on the intrawebs post trades in advance, there is work involved in a viewer going back to verify that the posited returns are true and accurate.

Also, one guy might think she's doing great just beating the G fund year after year...until she realizes the returns others are getting, for example.

Hmm, seems hard to use. I get this message.

Whoa! Your initial IFT has not processed yet. We can't proceed.Please contact the site administrator at support@tsptalk.com, and

let him know what you are trying to do. We will get it taken care of.

Thanks!

I just use this spread sheet it seems to track things for me pretty well.

https://drive.google.com/file/d/1EaK1g9fNKxVuvHtO0Nl0mWsGSLUIyDTP/view

- Reaction score

- 2,450

That just means your 1st allocation wasn't processed yet before you tried to make another change. Our deadline is 12:10 ET, 10 minutes after the TSP's deadline, and since you entered your 1st initial allocation Thursday evening, making a change on Friday wouldn't have worked. That's all.

Hmm, seems hard to use. I get this message.

Whoa! Your initial IFT has not processed yet. We can't proceed.Please contact the site administrator at support@tsptalk.com, and

let him know what you are trying to do. We will get it taken care of.

Thanks!

I just use this spread sheet it seems to track things for me pretty well.

https://drive.google.com/file/d/1EaK1g9fNKxVuvHtO0Nl0mWsGSLUIyDTP/view

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 78

Can't wait to find out who "we" are..............:laugh:

Weekly Review for TopNotch.

Markets took a slight step back this week. From a chart perspective we could see our second pullback for the year. Though I can't show my videos, I will try and describe what we did. Two weeks ago we moved all funds into the G fund. We did this to mitigate risk and damage to our portfolio it turned out to be a great move as markets are lower this week. This also puts us ahead of all funds for the TSP currently. Which means, yes, we are beating the markets! BUT... The year is only halfway over so we really can't claim that. The second part would be when do we put our funds back in? Aw that is the million dollar question. You can wait a certain amount of time, for a certain price, or wait for the tech picture to improve. We will wait until the end of next week to reinsert our funds if not sooner. We don't want to miss what we have gained. Which would be about a 2% advantage on the S and C funds. Questions? Let me know or hit me up on my YouTube channel.

Currently 100% G

ITF's left for JUNE 0

Yearly return 6.60% TSP 7.34% TSP (without fees)

-Top

Tsunami

TSP Pro

- Reaction score

- 62

Can't wait to find out who "we" are..............:laugh:

Looks like this is "we": https://www.youtube.com/user/eggenclark/videos and the videos start out by using Tom's commentary and charts.

- Reaction score

- 2,450

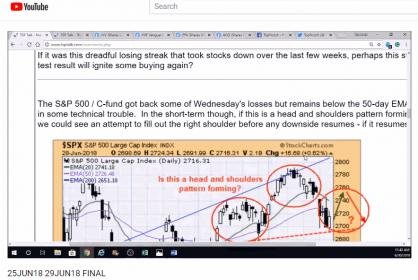

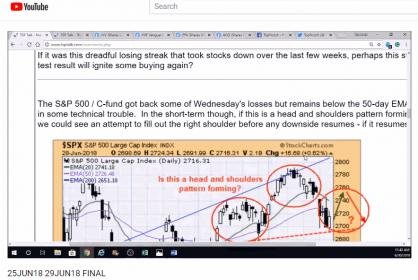

I just watched one of the videos and apparently TSP Talk is part of "we" because he's using the charts I post in my commentary? Flattering, I guess, but no mention or credit to us?

Be careful Topnotch. These are copyright issues. And you're posting our stuff on your twitter and Facebook accounts? That's not good.

Friday's TSP Talk commentary...

http://www.tsptalk.com/mb/blogs/tsptalk/4441-bounce-back-financials-pass-test.html

Looks familiar...

Although he does do his own analysis later in the video.

On his Twitter account:

View attachment 43306

I'll have to lock this thread until I get some answer.

Be careful Topnotch. These are copyright issues. And you're posting our stuff on your twitter and Facebook accounts? That's not good.

Friday's TSP Talk commentary...

http://www.tsptalk.com/mb/blogs/tsptalk/4441-bounce-back-financials-pass-test.html

Looks familiar...

Although he does do his own analysis later in the video.

On his Twitter account:

View attachment 43306

I'll have to lock this thread until I get some answer.

TopNotch

Investor

- Reaction score

- 1

Well well. Swing trade didn't work as well as I wanted it too. Waited for the two-day signal / PPO and missed most of the action. I don't want to be chasing so it was time to get back in the market. Here is how my performance worked out.

Looked at my share prices for the swing trade. Start price on the 19th of June was 52.91 for all S and end price through today was 52.72. Picked up 0.37% on the S fund. I did gain a little on the S fund but not much. Not a loss. Thankful for what I made. Markets will be markets and it is important to not get greedy. I see one more possible swing trade for this month but we will have to wait and see.

It's soooo hard starting the month off in the G fund on a swing trade because that really means you only have one IFT to move into the funds other than G before moving back to G on a swing trade... Makes it very hard to judge when to pull the trigger. I pulled a little late but I did gain on the S fund and I did my first ITF almost 2/3 of the month remaining. I would call it a win but a small win. With my luck, we will have a red week next week but at least I am a little closer to beating out all funds for the year. Though I wish I would of pulled the trigger earlier it is important to stick to your trading strategy and not get greedy. I feel that I did both of those very well. You will never get out at a perfect top or get in at a perfect bottom but the few small victories are what help you get on top of the funds throughout the year. If you have questions let me know.

Currently 100% S

ITF's left for JULY 1

Yearly return 6.38% TSP 7.25% TSP (without fees)

Looked at my share prices for the swing trade. Start price on the 19th of June was 52.91 for all S and end price through today was 52.72. Picked up 0.37% on the S fund. I did gain a little on the S fund but not much. Not a loss. Thankful for what I made. Markets will be markets and it is important to not get greedy. I see one more possible swing trade for this month but we will have to wait and see.

It's soooo hard starting the month off in the G fund on a swing trade because that really means you only have one IFT to move into the funds other than G before moving back to G on a swing trade... Makes it very hard to judge when to pull the trigger. I pulled a little late but I did gain on the S fund and I did my first ITF almost 2/3 of the month remaining. I would call it a win but a small win. With my luck, we will have a red week next week but at least I am a little closer to beating out all funds for the year. Though I wish I would of pulled the trigger earlier it is important to stick to your trading strategy and not get greedy. I feel that I did both of those very well. You will never get out at a perfect top or get in at a perfect bottom but the few small victories are what help you get on top of the funds throughout the year. If you have questions let me know.

Currently 100% S

ITF's left for JULY 1

Yearly return 6.38% TSP 7.25% TSP (without fees)

Last edited:

James48843

TSP Talk Royalty

- Reaction score

- 905

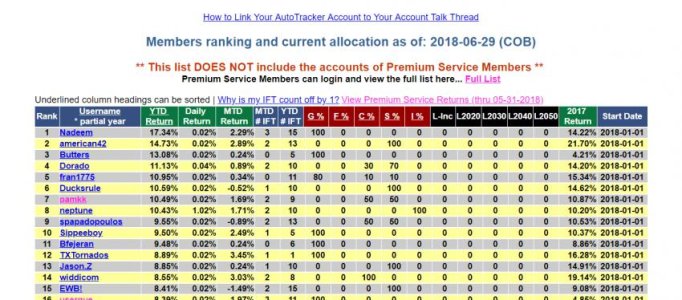

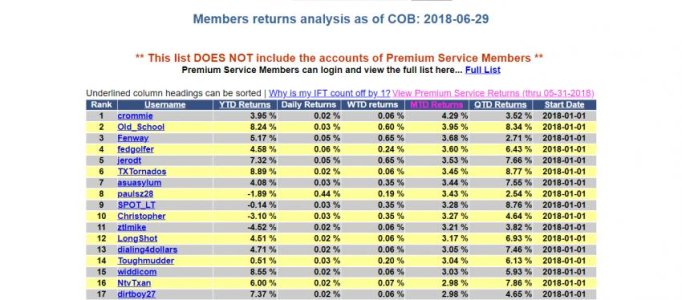

Topnotch- welcome, but you don’t get much attention or credit here unless you should your work on the autotracker.

When you demonstrate you can consistently beat the index funds, I’ll watch.

When you consistently are in the top 20, I’ll pay attention to your theories .

Right now I have a great deal of trust in about a dozen people on this board who have demonstrated consistent progress and superior returns. I wish you all the best in convincing me to pay attention. Good luck.

Sent from my iPhone using TSP Talk Forums

When you demonstrate you can consistently beat the index funds, I’ll watch.

When you consistently are in the top 20, I’ll pay attention to your theories .

Right now I have a great deal of trust in about a dozen people on this board who have demonstrated consistent progress and superior returns. I wish you all the best in convincing me to pay attention. Good luck.

Sent from my iPhone using TSP Talk Forums

userque

TSP Legend

- Reaction score

- 36

TopNotch, I have a different perspective.

There are long-term posters here with dubious tracker histories that consistently receive 'likes' when they post their regular commentary. Point is: Your record, or lack thereof, may not be a strong factor in amassing a following...assuming that's your ultimate goal.

You will get folks watching you because they want a clue.

And, you'll get folks watching you because they want to have a front row seat to your demise. Everyone loves, and hates, a train wreck.

But I see you. opcorn:

opcorn:

Welcome.

There are long-term posters here with dubious tracker histories that consistently receive 'likes' when they post their regular commentary. Point is: Your record, or lack thereof, may not be a strong factor in amassing a following...assuming that's your ultimate goal.

You will get folks watching you because they want a clue.

And, you'll get folks watching you because they want to have a front row seat to your demise. Everyone loves, and hates, a train wreck.

But I see you.

Welcome.

TSP-roulette

Market Veteran

- Reaction score

- 56

Similar threads

- Replies

- 0

- Views

- 290

- Article

- Replies

- 1

- Views

- 500