The bulls fought back the first half of the trading session today, driving the major averages to fairly strong gains by noon. But that would be as far as the bulls could take it as the afternoon session saw a slow chop downward, which ultimately led the major averages to post mixed results by the close. Of course the debt ceiling talks continue to take center stage and were blamed for the late day swoon.

There's still time for Washington to pull a rabbit out of its hat, but time's running out.

Here's today's charts:

Not much change in NAMO and NYMO. Both remain in a sell condition.

Same for NAHL and NYHL.

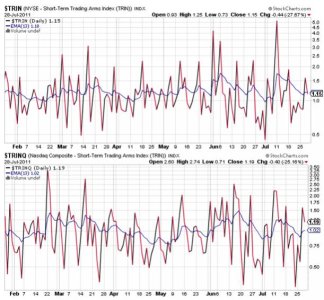

TRIN just did flip to a buy on today's action, while TRINQ remained on a sell. Both are relatively neutral at the moment.

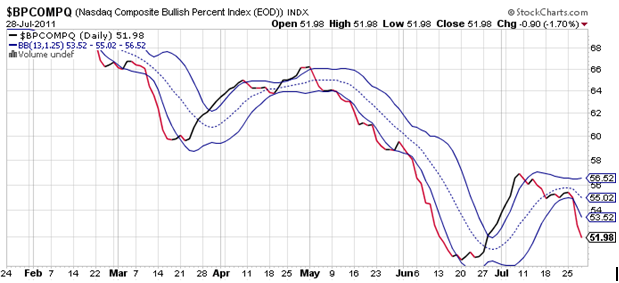

BPCOMPQ continued its drop and remains in a sell condition.

So all but one signal remain on sells, which keeps the system in a sell condition.

As long as the debt ceiling talks continue with no resolution, I would expect the market to react negatively. But I'm not sure how much lower we can go. I'm also not sure what the Fed would do, if anything, should a deal not be reached on time. The GOP are suppose to be voting on raising the debt ceiling this evening, so things could get interesting in a hurry depending on how that vote goes.

I moved into the S fund yesterday in response to the oversold conditions and rising fear. And while we were down today, it wasn't by a whole lot. I'm really expecting a deal to be reached before the deadline as I just don't see who can be served by allowing the country to hit a financial wall. You can bet I'll be watching both the news out of D.C. and the market's reaction to it in the days ahead.