An earnings miss at Alcoa is being blamed for the first loss of the new year.

Notable among the sectors, the Commodity Index dropped 1.7%, the worst single session percentage loss in more than one month.

News that the government wants to impose fees on banks to help recoup TARP funds contributed to weakness in the financial sector as well.

It is difficult during any OPEX week to draw any conclusions about market action, but the market was due for a pullback. It just needed an excuse or two. As I'd mentioned yesterday, OPEX in January has not been good for much of the past eleven years, and today is only Tuesday. I'm pretty sure we'll see another rally this week, but things could begin to get volatile.

The bond fund looked like it caught a bid today. Should be good news for those folks in the F fund.

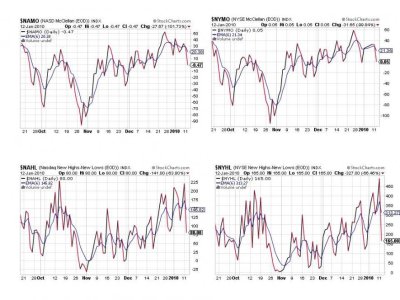

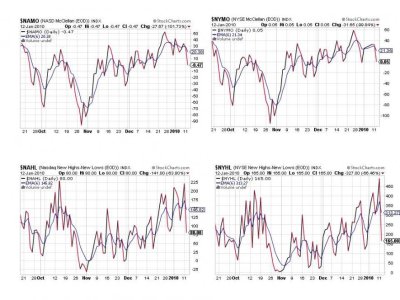

The Seven Sentinels remain on a buy, but not by much. Here's the charts:

All four signals went to a sell here.

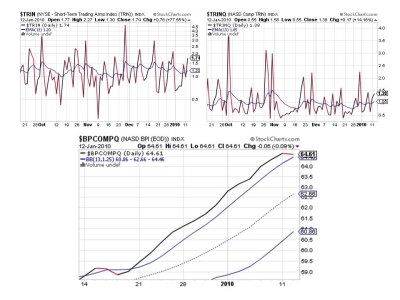

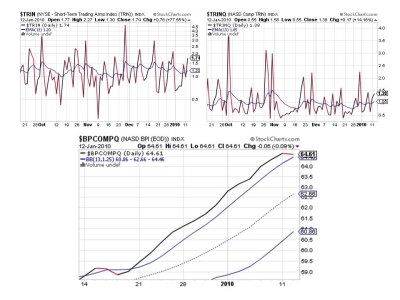

TRIN and TRINQ are also flashing sells. Predictably, BPCOMPQ remained on a buy, but it is close to crossing that upper bollinger band to the downside, which would trigger a sell. We need all 7 signals to be in a sell condition simultaneously to flip the system from a buy to a sell.

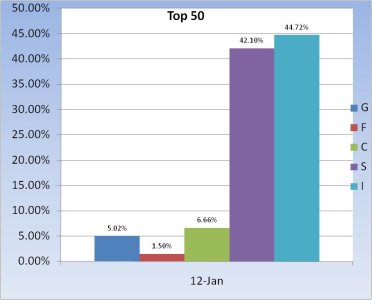

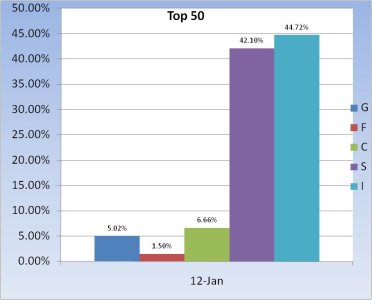

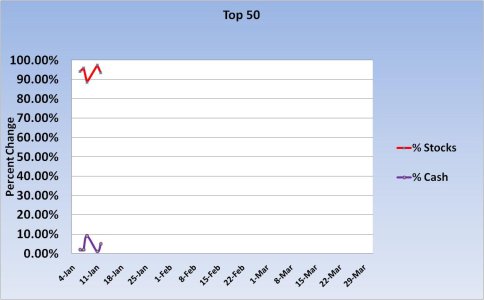

This is how our Top 50 were positioned for today's action. It will probably change after today though.

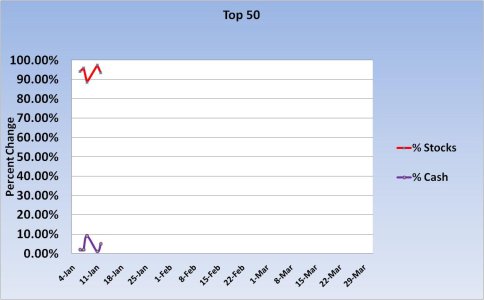

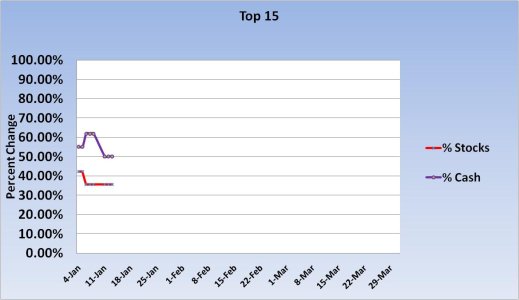

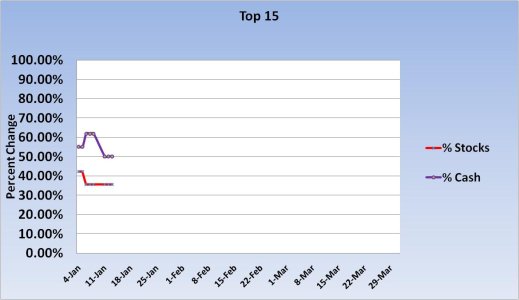

Our Top 15 did not make any changes going into tomorrow's action. They are still largely holding cash.

Notable among the sectors, the Commodity Index dropped 1.7%, the worst single session percentage loss in more than one month.

News that the government wants to impose fees on banks to help recoup TARP funds contributed to weakness in the financial sector as well.

It is difficult during any OPEX week to draw any conclusions about market action, but the market was due for a pullback. It just needed an excuse or two. As I'd mentioned yesterday, OPEX in January has not been good for much of the past eleven years, and today is only Tuesday. I'm pretty sure we'll see another rally this week, but things could begin to get volatile.

The bond fund looked like it caught a bid today. Should be good news for those folks in the F fund.

The Seven Sentinels remain on a buy, but not by much. Here's the charts:

All four signals went to a sell here.

TRIN and TRINQ are also flashing sells. Predictably, BPCOMPQ remained on a buy, but it is close to crossing that upper bollinger band to the downside, which would trigger a sell. We need all 7 signals to be in a sell condition simultaneously to flip the system from a buy to a sell.

This is how our Top 50 were positioned for today's action. It will probably change after today though.

Our Top 15 did not make any changes going into tomorrow's action. They are still largely holding cash.