First things first, congratulation to my friend Birchtree for hitting 10,000 posts. I'm on target to join you in another 10 years.

It's kind of fitting that BT hit that level right now, since in my last blog I spoke about riding through some volatility. BT likes to call it wearing sticky pants, and right now appears to be a great time to put some on.

After last weeks rally,we are due for a pullback any day. The Seven Sentinels finally triggered a buy signal Thursday, and I plan to follow that buy signal through any volatility that's thrown our way. This board is pretty bulled up, and longer term that's good. If we get enough downside action to trigger a sell signal on the SS I may disregard it unless sentiment or technicals dictate otherwise. I didn't expect the last sell signal to be deep, and it wasn't, but once again the strength came back in spades before another buy signal could be triggered. So now I'm wearing sticky pants.

Our top 25% are holding over 90% equities and about 8% cash. That's about as bullish as we've seen since I started monitoring their action in mid-August.

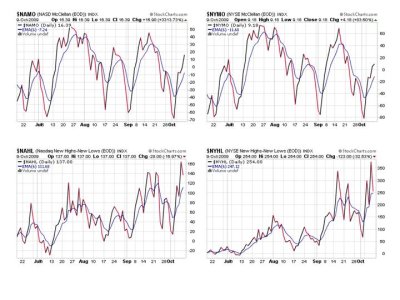

Here's the Friday's Seven Sentinels charts:

These are all still on a buy, but NYHL came close to a sell on Friday.

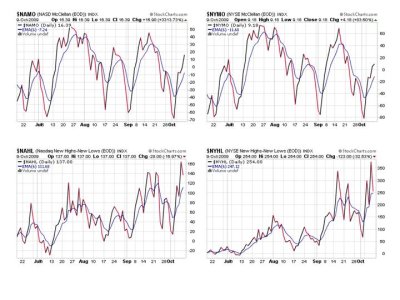

TRIN remains on a buy, but TRINQ looks like it just did flash a sell. BPCOMPQ remains on a buy.

The SS is in buy mode right now and our top 25% are longer term bullish. I am planning on modifying my moves a bit as we move forward in an effort to keep from getting taken out of position over short term action unnecessarily. I can't explain that much beyond what I've said as I have to take it one signal at a time. But I'll be using other indicators to ascertain whether a given signal is worth following.

It's kind of fitting that BT hit that level right now, since in my last blog I spoke about riding through some volatility. BT likes to call it wearing sticky pants, and right now appears to be a great time to put some on.

After last weeks rally,we are due for a pullback any day. The Seven Sentinels finally triggered a buy signal Thursday, and I plan to follow that buy signal through any volatility that's thrown our way. This board is pretty bulled up, and longer term that's good. If we get enough downside action to trigger a sell signal on the SS I may disregard it unless sentiment or technicals dictate otherwise. I didn't expect the last sell signal to be deep, and it wasn't, but once again the strength came back in spades before another buy signal could be triggered. So now I'm wearing sticky pants.

Our top 25% are holding over 90% equities and about 8% cash. That's about as bullish as we've seen since I started monitoring their action in mid-August.

Here's the Friday's Seven Sentinels charts:

These are all still on a buy, but NYHL came close to a sell on Friday.

TRIN remains on a buy, but TRINQ looks like it just did flash a sell. BPCOMPQ remains on a buy.

The SS is in buy mode right now and our top 25% are longer term bullish. I am planning on modifying my moves a bit as we move forward in an effort to keep from getting taken out of position over short term action unnecessarily. I can't explain that much beyond what I've said as I have to take it one signal at a time. But I'll be using other indicators to ascertain whether a given signal is worth following.