After the biggest three day gain since September, the market took a breather today, posting relatively modest losses on light volume.

It was a quiet day today too, with the same geopolitical risks in play, but these events seem to be stable for now with today's losses stemming more from an overbought condition then from any event driven risk.

Those who watch currencies have been very attentive to the Dollar Index of late. Today's action saw the Dollar drop to a 52-week low at one point during the trading day, but those losses evaporated towards the close. But this selling pressure could spook the market if the Dollar can't find a bottom soon.

Other than that there isn't much more to read into today's trading activity. One thing that I have not mentioned though, is that we are in the closing days of the 1st quarter and that means we could see some window dressing come into play by the end of next week, but with headline risk still a factor that's not a given.

Let's look at today's charts:

NAMO and NYMO backed off a bit today, but certainly nothing serious at this point. Both are still well within buy territory, but they are also well above their respective 6 day EMAs. I'm thinking we see a bit more weakness yet or at the very least chop around until those EMAs rise a bit more. That's assuming the low is in for the recent bout of selling.

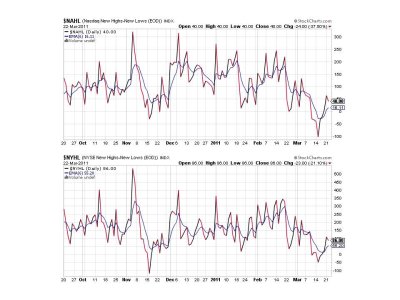

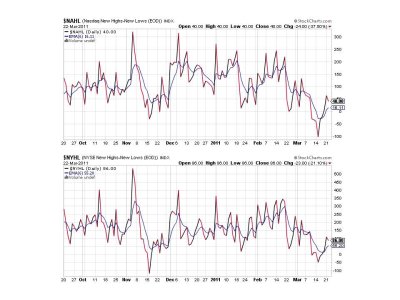

NAHL and NYHL also remain on buys.

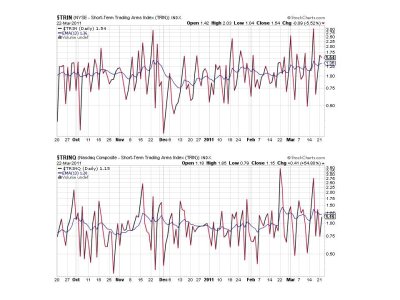

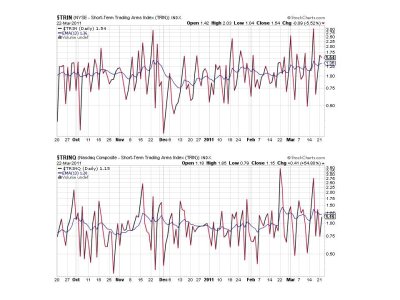

TRIN fell a bit today, while TRINQ rose. They are in a sell and buy condition respectively. They are also sitting very close to their 13 day EMAs, which is a neutral reading.

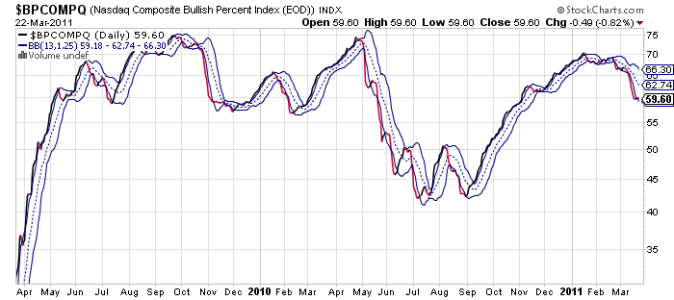

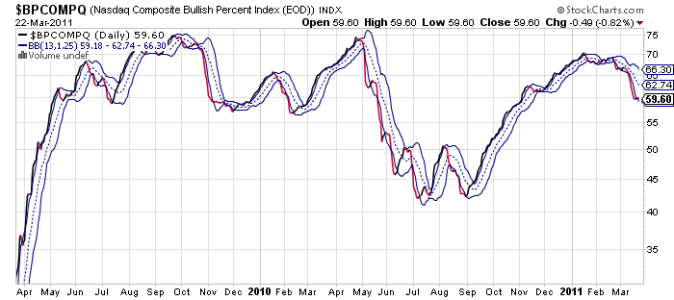

BPCOMPQ presents the biggest concern that I have regarding where this market is headed. While I am definitely leaning bullish overall, this trend indicator has really not made a substantial move higher, even with the buy signal that was triggered yesterday. Today it fell a bit, and while it remains on a buy, I am reminded of what happened early May of 2010 when this signal began falling from high levels and was unable to find longer term support for 2 months. It was not a time to be invested. But we also didn't have as much Fed support back then as we do now. But is that enough? This is a two year chart that also shows times where this signal found support much earlier than what we saw last Spring and Summer. Given Fed liquidity I'm more inclined to look for support sooner rather than later in this case.

So all but one signal remain in a buy condition, but the system remains on a sell. Yes, risk is still very much a factor, but I'm thinking we have seen the worst of the selling pressure. I could be wrong, but unless we test support and fail, I'm looking higher. Be advised though that I'm only half invested so I do take the risk seriously.

It was a quiet day today too, with the same geopolitical risks in play, but these events seem to be stable for now with today's losses stemming more from an overbought condition then from any event driven risk.

Those who watch currencies have been very attentive to the Dollar Index of late. Today's action saw the Dollar drop to a 52-week low at one point during the trading day, but those losses evaporated towards the close. But this selling pressure could spook the market if the Dollar can't find a bottom soon.

Other than that there isn't much more to read into today's trading activity. One thing that I have not mentioned though, is that we are in the closing days of the 1st quarter and that means we could see some window dressing come into play by the end of next week, but with headline risk still a factor that's not a given.

Let's look at today's charts:

NAMO and NYMO backed off a bit today, but certainly nothing serious at this point. Both are still well within buy territory, but they are also well above their respective 6 day EMAs. I'm thinking we see a bit more weakness yet or at the very least chop around until those EMAs rise a bit more. That's assuming the low is in for the recent bout of selling.

NAHL and NYHL also remain on buys.

TRIN fell a bit today, while TRINQ rose. They are in a sell and buy condition respectively. They are also sitting very close to their 13 day EMAs, which is a neutral reading.

BPCOMPQ presents the biggest concern that I have regarding where this market is headed. While I am definitely leaning bullish overall, this trend indicator has really not made a substantial move higher, even with the buy signal that was triggered yesterday. Today it fell a bit, and while it remains on a buy, I am reminded of what happened early May of 2010 when this signal began falling from high levels and was unable to find longer term support for 2 months. It was not a time to be invested. But we also didn't have as much Fed support back then as we do now. But is that enough? This is a two year chart that also shows times where this signal found support much earlier than what we saw last Spring and Summer. Given Fed liquidity I'm more inclined to look for support sooner rather than later in this case.

So all but one signal remain in a buy condition, but the system remains on a sell. Yes, risk is still very much a factor, but I'm thinking we have seen the worst of the selling pressure. I could be wrong, but unless we test support and fail, I'm looking higher. Be advised though that I'm only half invested so I do take the risk seriously.