If you entertain the idea in this article, that tariffs have yet to unfold their full effect on inflation, then you may also put yourself at odds the current price of the stock market.

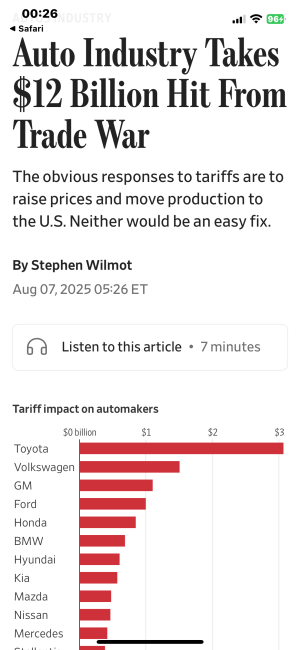

"Barclays research suggests that inflation hasn’t increased that much partly because the U.S. hasn’t collected tariffs on many goods—for now. In June, just 48% of U.S. imports were actually subject to tariffs, thanks to myriad exemptions, according to the bank’s analysis of U.S. Census Bureau data."

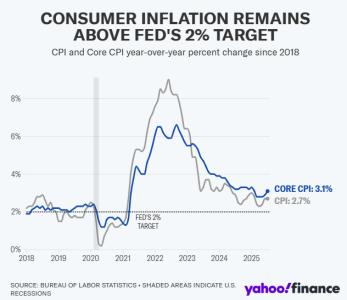

Stock prices were inflated Tuesday after the

latest Consumer Price Index was low enough for the market to price in a

92% chance of a 25 bp Fed Fund rate cut in the September Federal Open Market Committee (FOMC) meeting.

S&P 500 Weekly Chart (last five days)

The market is also projecting a 42% chance of another 50-bps cut by the December FOMC meeting.

But if the effect of tariffs hasn't reached its potential, the latest CPI may be setting investors up for disappointment. If the FOMC sees inflation nudging the other way in next wave of data, then they will divert back to cautiously waiting.

The market may have to correct its rate cut expectations in the next month or two, I'd rather have some cash available when it does. I hold stocks, a majority SPY ETFs, but I've also have a healthy amount of cash in my portfolio waiting for the next discount to buy.

"Ultimately, Barclays expects weighted-average tariffs to end up at around 15%, up from a current 10% and 2.5% last year. Other economists calculate even higher rates. That could mean much of the likely tariff hit is still in the future."