Market data wasn't so hot today, but that didn't prevent the broader market from posting modest gains anyway.

Retail sales for December were up a paltry 0.1%, while sales actually fell 0.2% less autos. That was below economists estimates of 0.4% and 0.3% respectively. Prior month numbers were upwardly revised, however.

Initial weekly jobless claims climbed to 399,000 from 375,000 last week. Estimates were looking for something closer to last week's totals. Continuing jobless claims were also up, to 3.63 million from 3.61 in the prior week. Given these numbers are post Christmas, they may not be as soft as they otherwise may appear, but economically speaking, we're still running in molasses.

Overseas, bond sales for both Spain and Italy were successful, which helped offset our domestic data's less than encouraging results. The ECB decided to keep target interest rates steady at 1.00%, which was a positive for Europe, but press conference comments by ECB President Draghi were cautious with respect to the EU's economic future.

Here's today's charts:

NAMO and NYMO continue to trek North. Both remain on buys.

NAHL and NYHL flipped back to buys today.

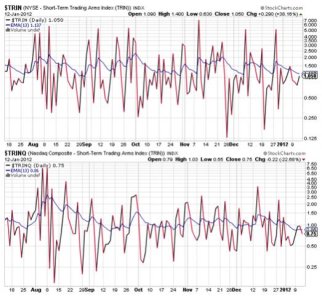

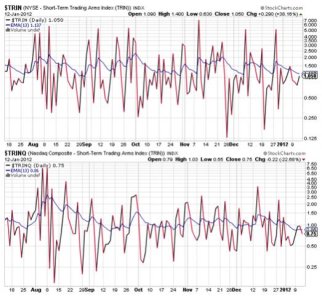

TRIN remained on a buy, while TRINQ flipped to a buy from a sell yesterday.

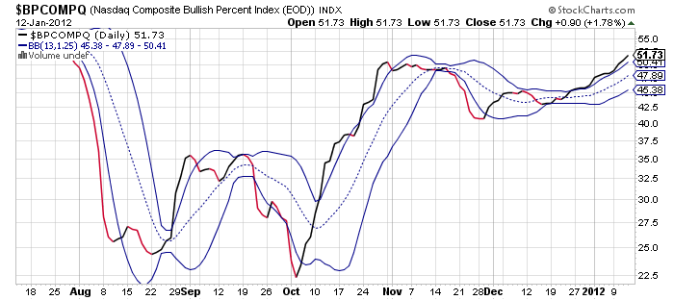

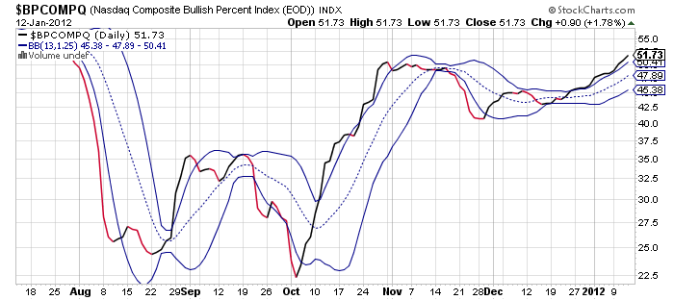

BPCOMPQ continues its trek North too.

So all signals are in a buy condition, which of course keeps the Seven Sentinels in a buy condition.

If you didn't catch it, I mentioned in my account talk thread this morning that our collective stock exposure had risen about 10% since Monday to a 49% stock allocation. So we're slowly increasing our appetite for risk.

I had thought we'd see a negative close today to keep weak handed bulls on the sidelines, but weakness has not been holding. I doubt that will continue to be the case though, if bullish levels continue to rise, but aside from any short term move lower that may present itself the prevailing trend would appear to be up.

Retail sales for December were up a paltry 0.1%, while sales actually fell 0.2% less autos. That was below economists estimates of 0.4% and 0.3% respectively. Prior month numbers were upwardly revised, however.

Initial weekly jobless claims climbed to 399,000 from 375,000 last week. Estimates were looking for something closer to last week's totals. Continuing jobless claims were also up, to 3.63 million from 3.61 in the prior week. Given these numbers are post Christmas, they may not be as soft as they otherwise may appear, but economically speaking, we're still running in molasses.

Overseas, bond sales for both Spain and Italy were successful, which helped offset our domestic data's less than encouraging results. The ECB decided to keep target interest rates steady at 1.00%, which was a positive for Europe, but press conference comments by ECB President Draghi were cautious with respect to the EU's economic future.

Here's today's charts:

NAMO and NYMO continue to trek North. Both remain on buys.

NAHL and NYHL flipped back to buys today.

TRIN remained on a buy, while TRINQ flipped to a buy from a sell yesterday.

BPCOMPQ continues its trek North too.

So all signals are in a buy condition, which of course keeps the Seven Sentinels in a buy condition.

If you didn't catch it, I mentioned in my account talk thread this morning that our collective stock exposure had risen about 10% since Monday to a 49% stock allocation. So we're slowly increasing our appetite for risk.

I had thought we'd see a negative close today to keep weak handed bulls on the sidelines, but weakness has not been holding. I doubt that will continue to be the case though, if bullish levels continue to rise, but aside from any short term move lower that may present itself the prevailing trend would appear to be up.