Options Expiration is now behind us until next month and it wasn't as volatile as one might have expected given the relentless news headlines that keep hitting the masses.

But stocks did jump out the gate strong at the open on news that the G7 planned to intervene on behalf of the Japanese currency, which was setting record highs against the dollar in recent trading. But this currency manipulation is having effects in other markets, and those effects are driving the dollar index lower.

News of a Libyan cease fire also seemed to provide support for higher prices as the Libyan regime appeared to take seriously a UN decision to implement a no-fly zone.

Other news items weren't as positive as Japan's nuclear accident alert level went from a 4 to 5 on a scale of 7, but this didn't seem to have much effect on market prices.

It's never advisable to read too much into OPEX action, so today's follow-through gains need to be kept in the context of a rally in an oversold market. And the news headlines will certainly continue to flow, which is probably why stocks slumped in afternoon trading as risk will remain elevated over the weekend.

Here's today's charts:

NAMO and NYMO are much improved after two positive closes. Both are flashing buys.

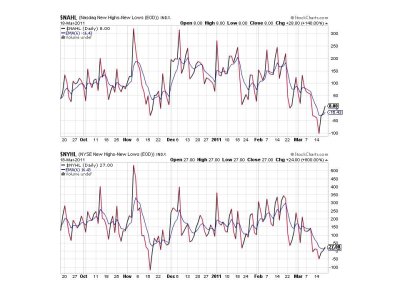

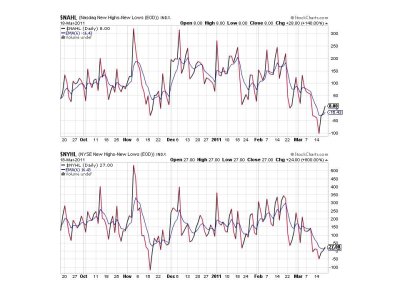

NAHL and NYHL also improved today and are in a buy condition.

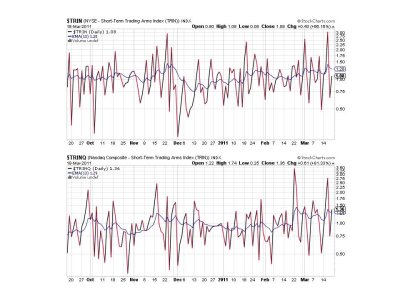

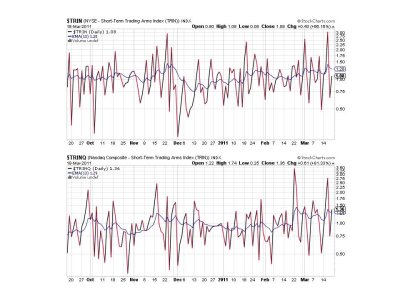

TRIN backed off a bit on its overbought condition and remains on a buy, while TRINQ just did flip to a sell.

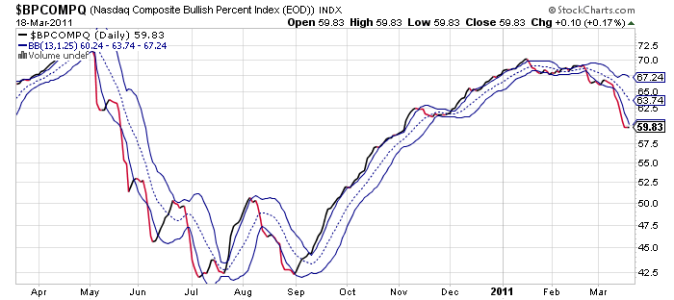

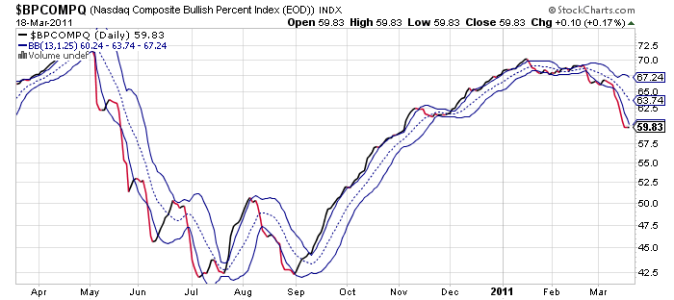

BPCOMPQ ticked higher just a bit today for the first time in eleven trading days. But remember, this is a trend indicator and it remains in a sell condition. I also expanded the time frame to 1 year so we can see what happened back in early May of 2010 where the market fell for a short period of time and then seemed to find some footing, only to collapse again on more than one occasion until it bottomed in early July. Hopefully we don't repeat that sequence this time around.

So 2 of 7 signals remain on sells, which keeps the system on a sell.

Yes, the Seven Sentinels went to a sell condition early this week, but given the decline was swift and news driven I'm not entirely convinced there's lower prices ahead. It is possible we've bottomed. But the real test may be next week now that we've retraced a large portion of this week's losses. I'm of the opinion QE2 matters and we saw how the G7 intervened in the currency market. I'm not too crazy about betting against the market makers, so I'm holding a full stock position here.

But stocks did jump out the gate strong at the open on news that the G7 planned to intervene on behalf of the Japanese currency, which was setting record highs against the dollar in recent trading. But this currency manipulation is having effects in other markets, and those effects are driving the dollar index lower.

News of a Libyan cease fire also seemed to provide support for higher prices as the Libyan regime appeared to take seriously a UN decision to implement a no-fly zone.

Other news items weren't as positive as Japan's nuclear accident alert level went from a 4 to 5 on a scale of 7, but this didn't seem to have much effect on market prices.

It's never advisable to read too much into OPEX action, so today's follow-through gains need to be kept in the context of a rally in an oversold market. And the news headlines will certainly continue to flow, which is probably why stocks slumped in afternoon trading as risk will remain elevated over the weekend.

Here's today's charts:

NAMO and NYMO are much improved after two positive closes. Both are flashing buys.

NAHL and NYHL also improved today and are in a buy condition.

TRIN backed off a bit on its overbought condition and remains on a buy, while TRINQ just did flip to a sell.

BPCOMPQ ticked higher just a bit today for the first time in eleven trading days. But remember, this is a trend indicator and it remains in a sell condition. I also expanded the time frame to 1 year so we can see what happened back in early May of 2010 where the market fell for a short period of time and then seemed to find some footing, only to collapse again on more than one occasion until it bottomed in early July. Hopefully we don't repeat that sequence this time around.

So 2 of 7 signals remain on sells, which keeps the system on a sell.

Yes, the Seven Sentinels went to a sell condition early this week, but given the decline was swift and news driven I'm not entirely convinced there's lower prices ahead. It is possible we've bottomed. But the real test may be next week now that we've retraced a large portion of this week's losses. I'm of the opinion QE2 matters and we saw how the G7 intervened in the currency market. I'm not too crazy about betting against the market makers, so I'm holding a full stock position here.