On a day like this I tend to get excited looking for new buying opportunities, but today isn't one of those days. After a review of systems and charts, I cannot in good faith recommend a buy under these circumstances. What I can do is present a few things and let you draw your own conclusion.

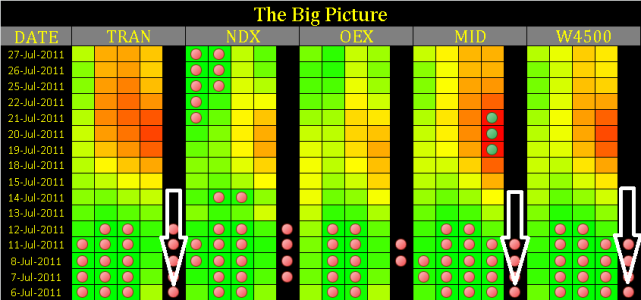

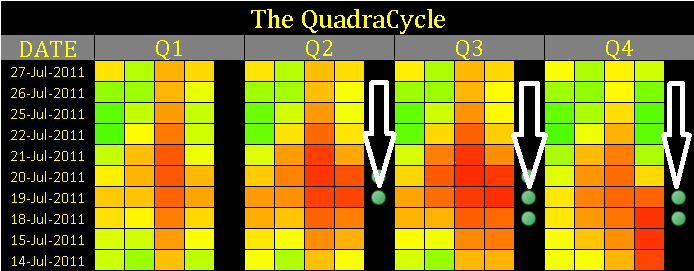

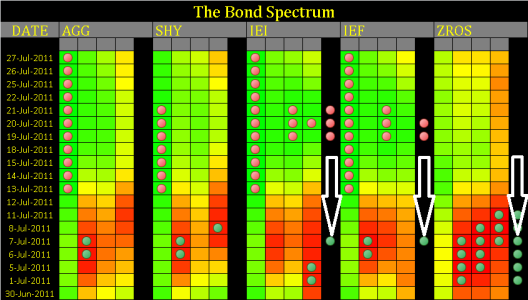

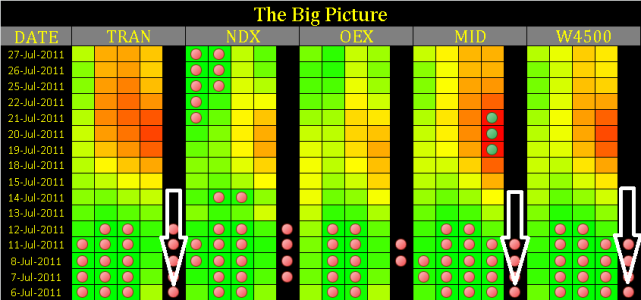

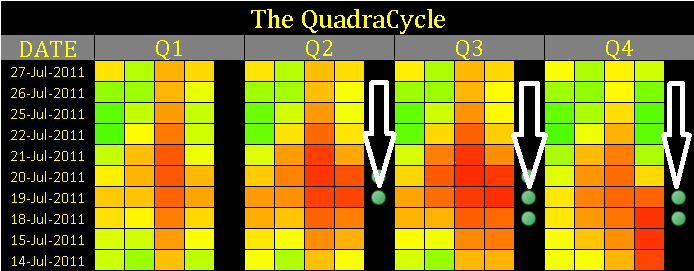

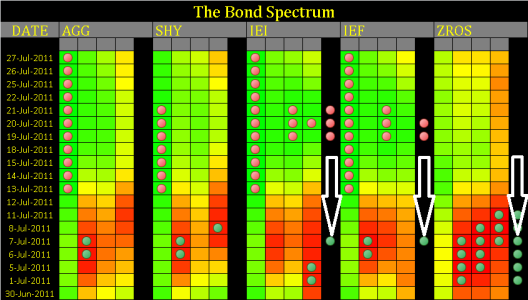

The systems I monitor did not trigger a buy and don't appear to be in any hurry to do so. When prices fall this drastically 1 of 2 things need to happen. Either reality needs to catch up to prices (hence more downside to flat action to follow) or prices need to snap back up to reality with a rally in some form. The Big Picture signaled a valid sell on 6 July, The Quadracycle issued a false-buy on 18 July, while The Bond Spectrum issued a Buy on 7 July. The Quadracycle is only designed for a 4-7 day entry unless confirmation is received from The Big Picture. I second-guessed it by entering stocks a day late, this gave me a difficult entry and as a result I'm vastly on the wrong side of the trade and have no one to blame but myself.

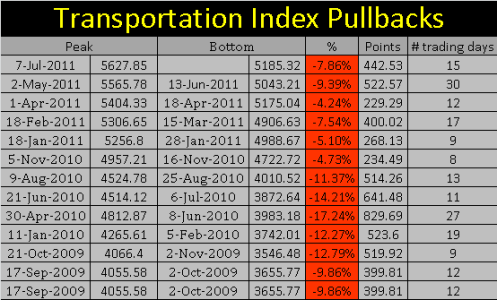

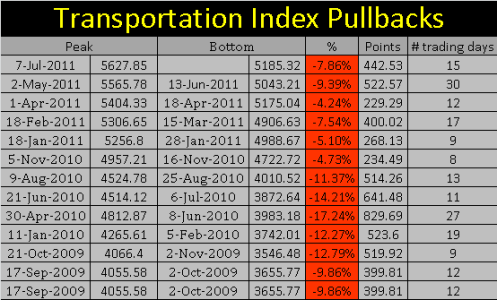

Looking at the pullbacks on the Transports you can see we've drawn down -7.86% only a few days from what could become a correction of greater than 10% I can't tell you how far this pullback will be, I can only give you previous pullbacks to compare it with.

When I look at this chart I see that from the 6-Month High to Low we've closed below 690.55 three times, that's a greater than 50% retracement off these levels. Looking at the waves, we've reversed direction establishing a lower swing high at E6 and a lower (yet to be established) swing low at 6F. This establishes a clearly defined downtrend meaning it's time to get defensive and fade the rallies. Based on the previous down wave and the 200SMA, my current projections take this chart down to 677. This year, besides today there have been 4 other days with a great than 2% loss and not one of them marked the bottom of a swing low. Either ways this chart is clearly giving us plenty of warnings to heed.

As for myself, I'm eating some humble pie, it goes good with a stiff drink. I'm now down over 5% it's more annoying than painful and now days I take these things in stride. Based on these circumstances I'll look to reload IFTs in August, punch out on the next rally then look for a re-entry. I may not recoup the losses, but if I time things better, my next re-entry could get me back to another YTD High.

Take care and trade safe...Jason

The systems I monitor did not trigger a buy and don't appear to be in any hurry to do so. When prices fall this drastically 1 of 2 things need to happen. Either reality needs to catch up to prices (hence more downside to flat action to follow) or prices need to snap back up to reality with a rally in some form. The Big Picture signaled a valid sell on 6 July, The Quadracycle issued a false-buy on 18 July, while The Bond Spectrum issued a Buy on 7 July. The Quadracycle is only designed for a 4-7 day entry unless confirmation is received from The Big Picture. I second-guessed it by entering stocks a day late, this gave me a difficult entry and as a result I'm vastly on the wrong side of the trade and have no one to blame but myself.

Looking at the pullbacks on the Transports you can see we've drawn down -7.86% only a few days from what could become a correction of greater than 10% I can't tell you how far this pullback will be, I can only give you previous pullbacks to compare it with.

When I look at this chart I see that from the 6-Month High to Low we've closed below 690.55 three times, that's a greater than 50% retracement off these levels. Looking at the waves, we've reversed direction establishing a lower swing high at E6 and a lower (yet to be established) swing low at 6F. This establishes a clearly defined downtrend meaning it's time to get defensive and fade the rallies. Based on the previous down wave and the 200SMA, my current projections take this chart down to 677. This year, besides today there have been 4 other days with a great than 2% loss and not one of them marked the bottom of a swing low. Either ways this chart is clearly giving us plenty of warnings to heed.

As for myself, I'm eating some humble pie, it goes good with a stiff drink. I'm now down over 5% it's more annoying than painful and now days I take these things in stride. Based on these circumstances I'll look to reload IFTs in August, punch out on the next rally then look for a re-entry. I may not recoup the losses, but if I time things better, my next re-entry could get me back to another YTD High.

Take care and trade safe...Jason