It was another amazing comeback for the market today. I watched the initial move higher at the open, but it didn't last long, and when the Chicago PMI was released it began to dive. I then began to wonder how far it would run to the downside, but I didn't have to wonder for long about that either. The market staged an intraday rally and was actually positive for a short period of time this afternoon. As it was rising from the morning low I thought to myself that trying to take this market down was like trying to hold a beach ball under water. And that's very tough to do for any length of time.

I had posted a blog from Mish Shedlock in my account talk thread today and took note of an interesting item. He said in 2002 a poor PMI was the catalyst that began a waterfall sell-off. And the Chicago PMI was not good news for anyone who really believes this market is turning around. Any number under 50 reflects a market in contraction. True, it's a regional number and not reflective of the total US market, but it was notable nonetheless.

I am also seeing more posts from traders who are all but certain that October is going to see some significant downside action, as well as analysis that a dollar rally is underway.

I won't make a prediction about either, but the dollar certainly seems to have hit major support at 76 on the US Dollar Index. It lost a little steam today, but it's been trending higher of late. Not enough to say it's broken the downward trend, but it certainly bears watching at this time. A Dollar reversal could also signal a reversal in the stock market as well. And if you're exposed to the "I" fund and the dollar makes an extended run to the upside, it could really get ugly. Especially if stocks go down simultaneously. So October could be a tough month.

But I'm not ready to buy into that theory just yet. Technically, the market is still very much in a long uptrend and sentiment also supports more upside. I'm actually looking for one last, big, parabolic spike over several trading weeks to put an exclamation point on this rally. I just don't see it reversing without some fireworks first.

So we shall see.

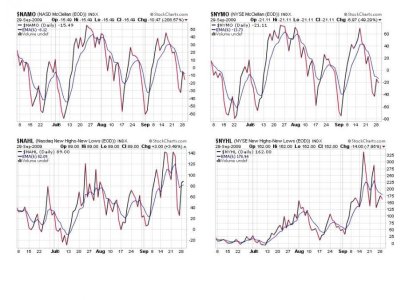

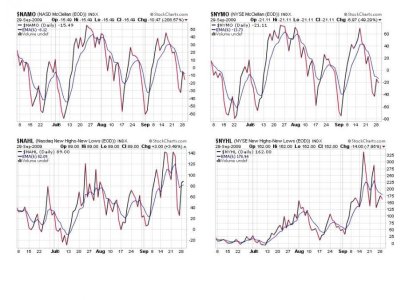

The end-of-day selling pressure we saw this afternoon weakened the Seven Sentinels a little bit from where they stood at yesterday's close. But they still look healthy enough to trigger a buy quickly if the bulls stage another impressive comeback. Here's today's charts:

After today's moderate sell-off all four of these signals went to, or remained in a sell condition. They are now all under their respective 6-day Exponential Moving Average.

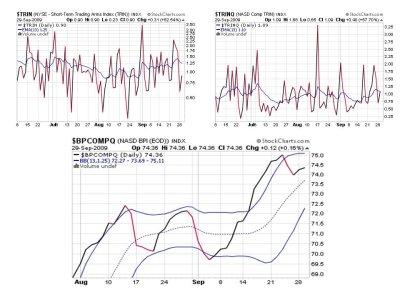

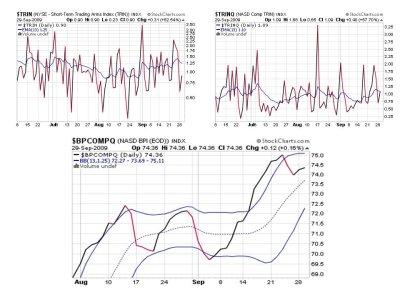

TRIN and TRINQ are still on a buy in these charts and BPCOMPQ remained on a sell.

That gives us 2 buy signals out of 7 and keeps the system on a sell.

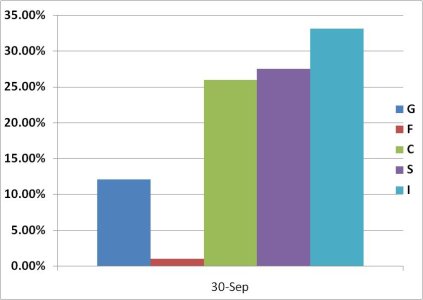

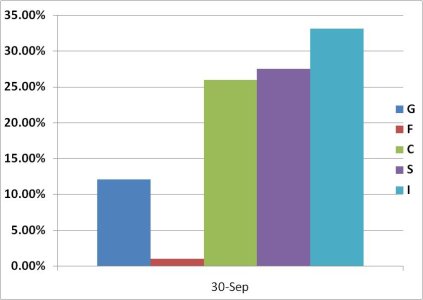

Our Top 25% bailed on the F fund as only about 1% of their total holdings are now committed to that fund. Equity holdings ticked up.

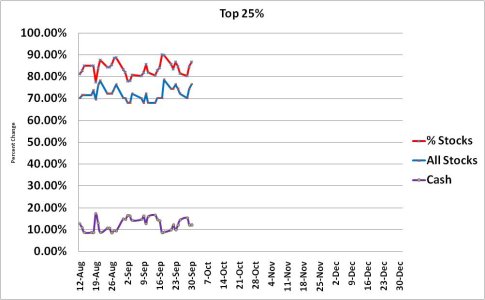

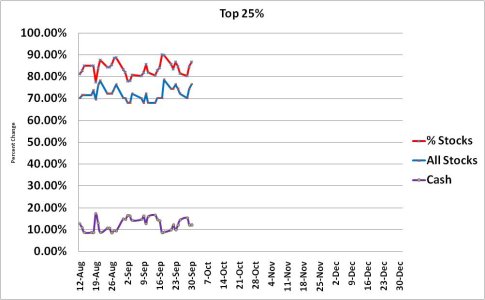

Same story here. These folks are steadfast in their collective bullish bias.

Tomorrow starts a new month and gives us 2 new IFTs, so I'm ready for action again. I didn't expect to see a Seven Sentinels buy signal before the end of the month and that proved true. I am also still looking for the next buy signal early in the month of October. I'm leaning towards seeing it as early as next week, but I'd give it more room. My expectations are only based on how the market has behaved for the last several months, where sell-offs have been contained and relatively brief.

Besides, the beach ball still appears to have a lot of air left in it.

I had posted a blog from Mish Shedlock in my account talk thread today and took note of an interesting item. He said in 2002 a poor PMI was the catalyst that began a waterfall sell-off. And the Chicago PMI was not good news for anyone who really believes this market is turning around. Any number under 50 reflects a market in contraction. True, it's a regional number and not reflective of the total US market, but it was notable nonetheless.

I am also seeing more posts from traders who are all but certain that October is going to see some significant downside action, as well as analysis that a dollar rally is underway.

I won't make a prediction about either, but the dollar certainly seems to have hit major support at 76 on the US Dollar Index. It lost a little steam today, but it's been trending higher of late. Not enough to say it's broken the downward trend, but it certainly bears watching at this time. A Dollar reversal could also signal a reversal in the stock market as well. And if you're exposed to the "I" fund and the dollar makes an extended run to the upside, it could really get ugly. Especially if stocks go down simultaneously. So October could be a tough month.

But I'm not ready to buy into that theory just yet. Technically, the market is still very much in a long uptrend and sentiment also supports more upside. I'm actually looking for one last, big, parabolic spike over several trading weeks to put an exclamation point on this rally. I just don't see it reversing without some fireworks first.

So we shall see.

The end-of-day selling pressure we saw this afternoon weakened the Seven Sentinels a little bit from where they stood at yesterday's close. But they still look healthy enough to trigger a buy quickly if the bulls stage another impressive comeback. Here's today's charts:

After today's moderate sell-off all four of these signals went to, or remained in a sell condition. They are now all under their respective 6-day Exponential Moving Average.

TRIN and TRINQ are still on a buy in these charts and BPCOMPQ remained on a sell.

That gives us 2 buy signals out of 7 and keeps the system on a sell.

Our Top 25% bailed on the F fund as only about 1% of their total holdings are now committed to that fund. Equity holdings ticked up.

Same story here. These folks are steadfast in their collective bullish bias.

Tomorrow starts a new month and gives us 2 new IFTs, so I'm ready for action again. I didn't expect to see a Seven Sentinels buy signal before the end of the month and that proved true. I am also still looking for the next buy signal early in the month of October. I'm leaning towards seeing it as early as next week, but I'd give it more room. My expectations are only based on how the market has behaved for the last several months, where sell-offs have been contained and relatively brief.

Besides, the beach ball still appears to have a lot of air left in it.