01/08/26

The fourth day of trading in 2026 was a little more choppy, mixed, and probably typical after a big 3-day rally. The Dow shed 466-points after the 1400-point rally in the first three days, so it looked bad, but we know stocks don't go straight up. The Nasdaq held onto a small gain while small caps took a day off. Bonds rallied with yields falling.

There's one day to go to complete that "first five days" January barometer, which often predicts whether we'll see gains or losses for the year. For the S&P 500, the number the bulls need to hold on the S&P 500 is 6845. Anything below that at today's close would be an historically bearish sign. Above that number and the bulls could be in charge. Sounds silly, but it has been predictive.

The S&P 500 (C-fund) had a modest loss yesterday, closing at 6921, so that's a big cushion above 6845. The index made a negative outside reversal day, which is bearish for the very short-term, but the chart still looks OK after running into some resistance near yesterday's highs. While the inverted head and shoulders pattern is very bullish, the blue rising wedge is something to keep an eye on. A break below the rising blue support line could trigger some technical selling.

Interestingly, Friday (trading day #6 in January) may be the most volatile day of the New Year with the December jobs report getting released, and it could be the day that the Supreme Court rules on the legality of President Trump' tariff plan.

Since SCOTUS did allow the Trump administration to continue to collect tariffs while they deliberated on the case, any change to the policy could be very disruptive. I don't know how that would play out logistically, but the stock market would have to then price that decision in.

Since stocks sold off sharply on the prospects of the tariffs in the weeks leading up to Liberation Day, then rallied after shortly they were implemented, will we see a rally if they are taken away - especially if they will have to be paid back, or do stocks rally on the news?

I know the stock market is a discounting mechanism, meaning it incorporates all available information, both known and anticipated, and with the betting markets suggesting a 70% chance that the tariffs will be stopped by the courts, I assume the stock market won't be completely shocked if the tariffs are ended.

What I wonder about is whether the concern over inflation that the tariffs brought, will be reversed if the they are ended. I would think that yields would drop sharply on the news of potentially lower inflation, but remember that tariff driven inflation was not going to be an ongoing problem, and the Fed knew that. So has this been taken into consideration already with the betting market all but telling us SCOTUS will end the tariffs?

But look at the 10-year Treasury Yield surrounding Liberation Day back in April of last year. It was incredibly whippy, so bonds may be a good bet, but they could be more volatile than stocks.

The short-term 10-year Treasury Yield chart shows the bull flag continuing to coil up between thee 50 and 200 day averages for something. My guess - usually wrong surrounding bonds - is that if the tariffs are allowed to remain, this will break to the upside because the expectations that they could end. And bull flags tend to break to the upside. Maybe it will be the jobs report that does it, but something seems to be brewing for a rally in yields, which would send the F-fund lower. Again, the bond market usually has me leaning the wrong way so take that opinion for what its worth.

The estimates for Friday's December jobs report are looking for a gain of about 60,0000 jobs. The unemployment rate is expected to be 4.5%.

Admin notes: I spend a lot of time in a warmer climate during the winter and I am blessed to have friends and family getting out of the cold and coming down to visit. I end up being the party pooper having to work while they're here. For the next week I am going to try to be a better host and give them a little more of my time, keeping the commentary more brief, although every time I say that, I can't seem to stop bloviating.

We have the 2026 version of Guess the Dow contest started for interested forum members. Deadline to enter is Friday at 7 PM ET. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

Also, we plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) made a new high in early trading yesterday, but closed with a moderate loss. The low of the day did hold at the October high, which has remained a key level. The open gap near 2530 is still a consideration, but longer-term the inverted head and shoulders formation is bullish.

The ACWX (I-fund index) looks just fine, but it had been in need of a pause, and the rally in the dollar helped it do that yesterday. It wouldn't be out of the ordinary for this to retest the breakout area near 67 before resuming higher, but there is also some support near 68.

BND (bonds / F-fund) made a move higher yesterday with yields moving lower. I sound like a broken record this chart is trending higher and looking good, but the bearish head and shoulders pattern is still in the picture.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The fourth day of trading in 2026 was a little more choppy, mixed, and probably typical after a big 3-day rally. The Dow shed 466-points after the 1400-point rally in the first three days, so it looked bad, but we know stocks don't go straight up. The Nasdaq held onto a small gain while small caps took a day off. Bonds rallied with yields falling.

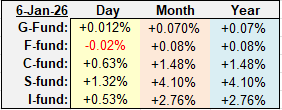

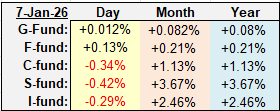

| Daily TSP Funds Return More returns |

There's one day to go to complete that "first five days" January barometer, which often predicts whether we'll see gains or losses for the year. For the S&P 500, the number the bulls need to hold on the S&P 500 is 6845. Anything below that at today's close would be an historically bearish sign. Above that number and the bulls could be in charge. Sounds silly, but it has been predictive.

The S&P 500 (C-fund) had a modest loss yesterday, closing at 6921, so that's a big cushion above 6845. The index made a negative outside reversal day, which is bearish for the very short-term, but the chart still looks OK after running into some resistance near yesterday's highs. While the inverted head and shoulders pattern is very bullish, the blue rising wedge is something to keep an eye on. A break below the rising blue support line could trigger some technical selling.

Interestingly, Friday (trading day #6 in January) may be the most volatile day of the New Year with the December jobs report getting released, and it could be the day that the Supreme Court rules on the legality of President Trump' tariff plan.

Since SCOTUS did allow the Trump administration to continue to collect tariffs while they deliberated on the case, any change to the policy could be very disruptive. I don't know how that would play out logistically, but the stock market would have to then price that decision in.

Since stocks sold off sharply on the prospects of the tariffs in the weeks leading up to Liberation Day, then rallied after shortly they were implemented, will we see a rally if they are taken away - especially if they will have to be paid back, or do stocks rally on the news?

I know the stock market is a discounting mechanism, meaning it incorporates all available information, both known and anticipated, and with the betting markets suggesting a 70% chance that the tariffs will be stopped by the courts, I assume the stock market won't be completely shocked if the tariffs are ended.

What I wonder about is whether the concern over inflation that the tariffs brought, will be reversed if the they are ended. I would think that yields would drop sharply on the news of potentially lower inflation, but remember that tariff driven inflation was not going to be an ongoing problem, and the Fed knew that. So has this been taken into consideration already with the betting market all but telling us SCOTUS will end the tariffs?

But look at the 10-year Treasury Yield surrounding Liberation Day back in April of last year. It was incredibly whippy, so bonds may be a good bet, but they could be more volatile than stocks.

The short-term 10-year Treasury Yield chart shows the bull flag continuing to coil up between thee 50 and 200 day averages for something. My guess - usually wrong surrounding bonds - is that if the tariffs are allowed to remain, this will break to the upside because the expectations that they could end. And bull flags tend to break to the upside. Maybe it will be the jobs report that does it, but something seems to be brewing for a rally in yields, which would send the F-fund lower. Again, the bond market usually has me leaning the wrong way so take that opinion for what its worth.

The estimates for Friday's December jobs report are looking for a gain of about 60,0000 jobs. The unemployment rate is expected to be 4.5%.

Admin notes: I spend a lot of time in a warmer climate during the winter and I am blessed to have friends and family getting out of the cold and coming down to visit. I end up being the party pooper having to work while they're here. For the next week I am going to try to be a better host and give them a little more of my time, keeping the commentary more brief, although every time I say that, I can't seem to stop bloviating.

We have the 2026 version of Guess the Dow contest started for interested forum members. Deadline to enter is Friday at 7 PM ET. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

Also, we plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) made a new high in early trading yesterday, but closed with a moderate loss. The low of the day did hold at the October high, which has remained a key level. The open gap near 2530 is still a consideration, but longer-term the inverted head and shoulders formation is bullish.

The ACWX (I-fund index) looks just fine, but it had been in need of a pause, and the rally in the dollar helped it do that yesterday. It wouldn't be out of the ordinary for this to retest the breakout area near 67 before resuming higher, but there is also some support near 68.

BND (bonds / F-fund) made a move higher yesterday with yields moving lower. I sound like a broken record this chart is trending higher and looking good, but the bearish head and shoulders pattern is still in the picture.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.