It's getting kind of old, isn't it? The market can't trend anymore. It lurches. One way, and then the other. Pile in when you get the chance, and then sell en masse.

Oh sure, we can call the overall move since March an uptrend, and it is, but it sure has gone way past most trader's expectations. The biggest problem is that nothing has really changed in the global economy. Not significantly anyway. Most of the easy money surely must have been made by now. Which is why I'm not interested in long term exposure to this market. Hit and run. That's all I'll play for now.

Take bonds. There are reasons bonds are so expensive. People want their money back, even if they have to pay someone else to hold it. They certainly want nothing to do with equities. And there's a lot of folks out there using that logic.

If you stop and look back at how the big guys operated over the years, they created all kinds of complicated vehicles like derivatives and leveraged themselves to the hilt. I don't think that's changed much today. Those same entities are still gambling and playing a high risk game, but we have to play in that same sandbox too. Our retirements depend on it.

I just wish someone would change the litter every once in while.

Okay, I'm ready to get down to business now. I needed to vent a little and now I feel better.

A rally was not out of the question. But rallies have tended to be fast moving and not long lasting the past few months. An intermediate term trader has to pick their spots very carefully. More so for us TSPers. And that's what the Seven Sentinels were designed to do. Identify intermediate term trends. But the volatility is still with us.

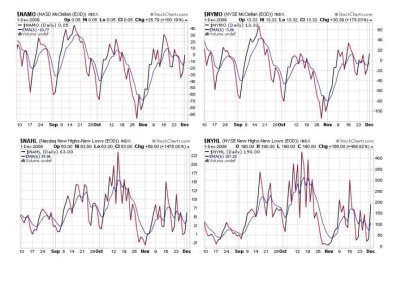

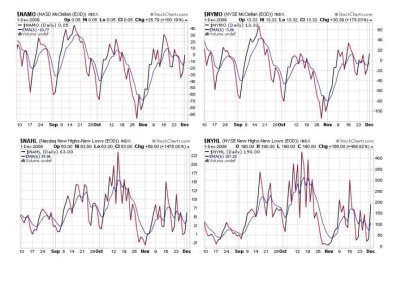

It was only one day, but today pushed the Seven Sentinels close to a buy. One signal (BPCOMPQ) is still holding out, but not by much. Here's the charts:

As we can see, all four flipped to a buy on these charts. But I'm still concerned about NAMO and NYMO. A one day rally is not a trend, and they still appear toppy to me. There just doesn't look like a lot of upside potential unless we finally make that parabolic move I was looking for a few weeks ago. And that's a possiblity.

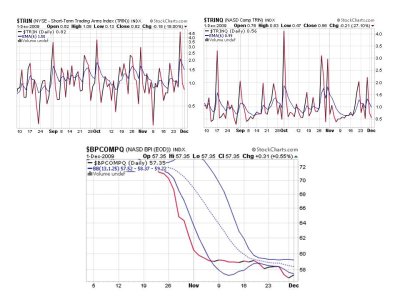

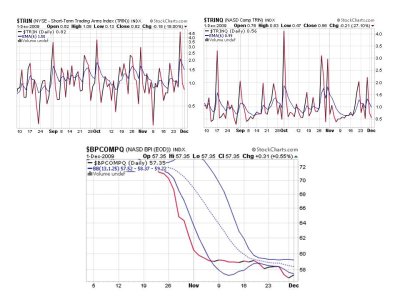

TRIN and TRINQ remained on a buy today, and we can see BPCOMPQ rose just a bit, but fell short of crossing the lower bollinger band.

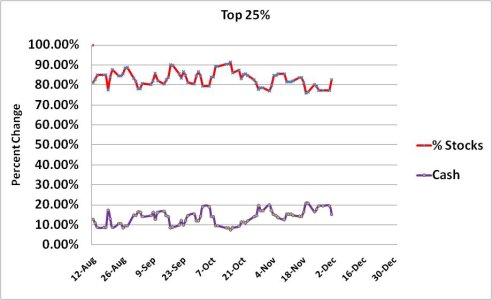

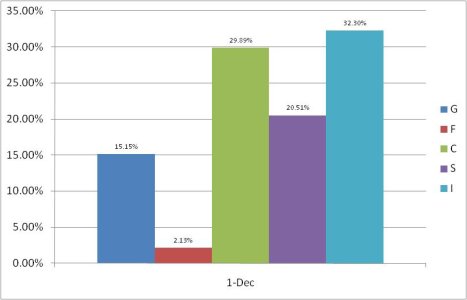

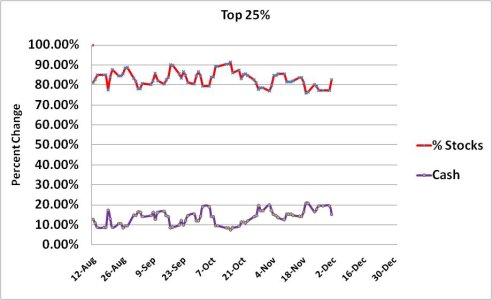

Our Top 15% put some cash to work for today's trading, but most have been holding their position for some time.

If we have any follow-through tomorrow, it might not be a bad idea to try to front-run a potential buy signal. The problem is that past rallies have not lasted long, and NAMO and NYMO continue to look toppy. Consider too that BPCOMPQ has not had a sustained up-leg in over 2 months. Plus, it's only the 2nd of December tomorrow, so we have a lot of time left with only 2 IFTs (for most of us) at our disposal.

I'm not particularly happy with the current "set-up" with the Seven Sentinels and may not follow a buy signal just yet, but should one develop soon it may not care what I think and we could be off to the races to close out the year. And there are traders who think we are breaking out too. But not everyone is so sure.

For me, I'd like more proof, but we each need to make our own decisions.

Of course you can keep on eye on my account talk thread in case I decide to make a move for reasons yet to materialize. This volatility can force quick decisions as the market plays out.

Oh sure, we can call the overall move since March an uptrend, and it is, but it sure has gone way past most trader's expectations. The biggest problem is that nothing has really changed in the global economy. Not significantly anyway. Most of the easy money surely must have been made by now. Which is why I'm not interested in long term exposure to this market. Hit and run. That's all I'll play for now.

Take bonds. There are reasons bonds are so expensive. People want their money back, even if they have to pay someone else to hold it. They certainly want nothing to do with equities. And there's a lot of folks out there using that logic.

If you stop and look back at how the big guys operated over the years, they created all kinds of complicated vehicles like derivatives and leveraged themselves to the hilt. I don't think that's changed much today. Those same entities are still gambling and playing a high risk game, but we have to play in that same sandbox too. Our retirements depend on it.

I just wish someone would change the litter every once in while.

Okay, I'm ready to get down to business now. I needed to vent a little and now I feel better.

A rally was not out of the question. But rallies have tended to be fast moving and not long lasting the past few months. An intermediate term trader has to pick their spots very carefully. More so for us TSPers. And that's what the Seven Sentinels were designed to do. Identify intermediate term trends. But the volatility is still with us.

It was only one day, but today pushed the Seven Sentinels close to a buy. One signal (BPCOMPQ) is still holding out, but not by much. Here's the charts:

As we can see, all four flipped to a buy on these charts. But I'm still concerned about NAMO and NYMO. A one day rally is not a trend, and they still appear toppy to me. There just doesn't look like a lot of upside potential unless we finally make that parabolic move I was looking for a few weeks ago. And that's a possiblity.

TRIN and TRINQ remained on a buy today, and we can see BPCOMPQ rose just a bit, but fell short of crossing the lower bollinger band.

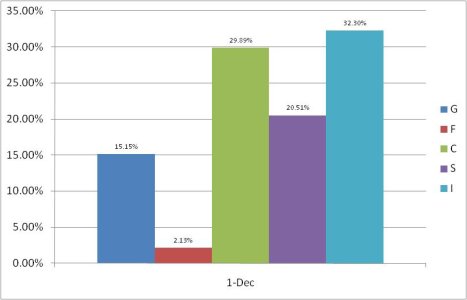

Our Top 15% put some cash to work for today's trading, but most have been holding their position for some time.

If we have any follow-through tomorrow, it might not be a bad idea to try to front-run a potential buy signal. The problem is that past rallies have not lasted long, and NAMO and NYMO continue to look toppy. Consider too that BPCOMPQ has not had a sustained up-leg in over 2 months. Plus, it's only the 2nd of December tomorrow, so we have a lot of time left with only 2 IFTs (for most of us) at our disposal.

I'm not particularly happy with the current "set-up" with the Seven Sentinels and may not follow a buy signal just yet, but should one develop soon it may not care what I think and we could be off to the races to close out the year. And there are traders who think we are breaking out too. But not everyone is so sure.

For me, I'd like more proof, but we each need to make our own decisions.

Of course you can keep on eye on my account talk thread in case I decide to make a move for reasons yet to materialize. This volatility can force quick decisions as the market plays out.