Once again the market trades in listless fashion and ending mostly flat for the day. Even the dollar was relatively flat ahead of next week's main events.

This morning the early read on third quarter GDP showed the economy expanded at an annualized rate of 2.0%, which was a bit better than the previous quarter, but not nearly enough to help the jobless situation.

So we end October quietly, but with the almost certain knowledge that next week will be nothing like this week considering the import of scheduled events.

Here's the charts:

NAMO and NYMO remain on a sell and in negative territory.

NAHL and NYHL are also flashing sells.

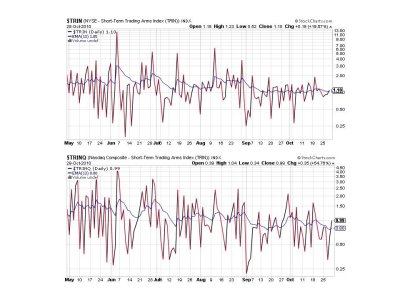

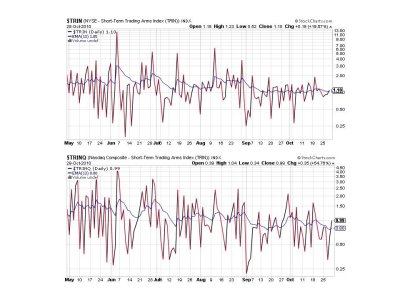

Same with TRIN and TRINQ; two sells.

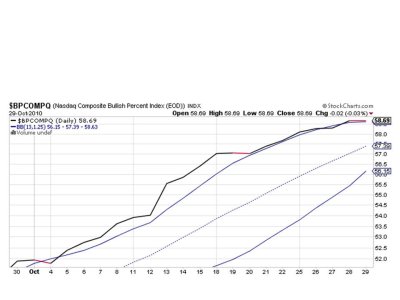

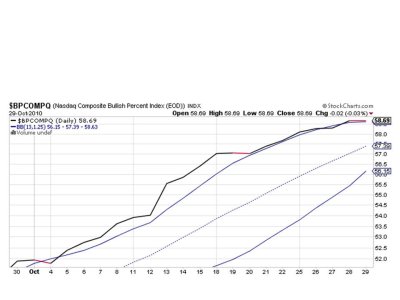

BPCOMPQ remains on a buy, but is once again sitting right no top of that upper bollinger band.

So we have 6 of 7 signals flashing sells, but the system remains on a buy as long as at least one signal is on a buy.

The Sentinels have been very close to a sell several times over the past few trading sessions, but it's not a given that they will actually produce a sell signal, especially given the significant events that will play out next week. But being this close to a sell signal does put me on alert nonetheless. I am anticipating a big move next week, perhaps with severe volatility as the elections and FOMC announcement quickly serve a one-two punch, not to mention a whole plethra of other market data over the week.

And as if we didn't have enough on the horizon, we also have potential terrorist activity in play at the moment. I won't speculate too much here, but I can't help but wonder about the timing of this. And we have 3 days to go before elections.

And sentiment? Our survey did indeed get more bullish than the previous week, but still well away from a sell signal. But that's just our survey. There are others that have been more bullish of late, but overall it may not be enough to consider sentiment a red flag given we are in a bull market.

I am positioned just the way I'd like going into next week, with 15% in stocks, 15% in the bond fund, and the rest in G until I can see where this market is going. We do have 2 new IFTs beginning Monday, so I've also got the flexibility to jump back into the market should market conditions dictate such a move.

Check back this weekend for a read on the tracker charts.

This morning the early read on third quarter GDP showed the economy expanded at an annualized rate of 2.0%, which was a bit better than the previous quarter, but not nearly enough to help the jobless situation.

So we end October quietly, but with the almost certain knowledge that next week will be nothing like this week considering the import of scheduled events.

Here's the charts:

NAMO and NYMO remain on a sell and in negative territory.

NAHL and NYHL are also flashing sells.

Same with TRIN and TRINQ; two sells.

BPCOMPQ remains on a buy, but is once again sitting right no top of that upper bollinger band.

So we have 6 of 7 signals flashing sells, but the system remains on a buy as long as at least one signal is on a buy.

The Sentinels have been very close to a sell several times over the past few trading sessions, but it's not a given that they will actually produce a sell signal, especially given the significant events that will play out next week. But being this close to a sell signal does put me on alert nonetheless. I am anticipating a big move next week, perhaps with severe volatility as the elections and FOMC announcement quickly serve a one-two punch, not to mention a whole plethra of other market data over the week.

And as if we didn't have enough on the horizon, we also have potential terrorist activity in play at the moment. I won't speculate too much here, but I can't help but wonder about the timing of this. And we have 3 days to go before elections.

And sentiment? Our survey did indeed get more bullish than the previous week, but still well away from a sell signal. But that's just our survey. There are others that have been more bullish of late, but overall it may not be enough to consider sentiment a red flag given we are in a bull market.

I am positioned just the way I'd like going into next week, with 15% in stocks, 15% in the bond fund, and the rest in G until I can see where this market is going. We do have 2 new IFTs beginning Monday, so I've also got the flexibility to jump back into the market should market conditions dictate such a move.

Check back this weekend for a read on the tracker charts.