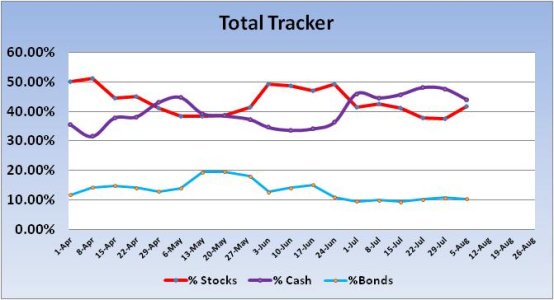

Last week, I had a buy signal from the Total Tracker as total stock allocations were under 40%. That signal was a winner as the S fund jumped 1.77%, the C fund 1.1% and the I fund 1.42%. Here's this week's charts:

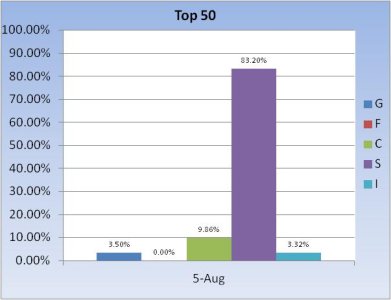

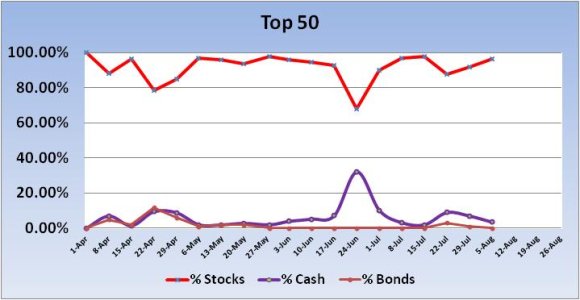

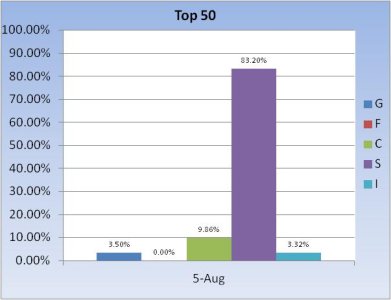

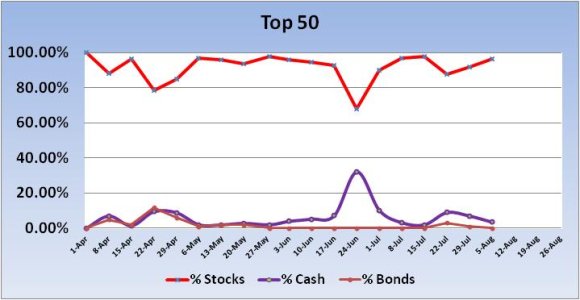

No signal from the Top 50 this week. Total stock allocations rose 4.5%, from 91.88% last week to 96.38% this week. I think that’s bullish.

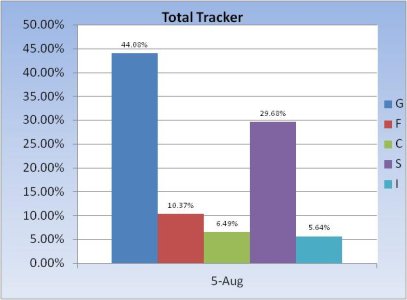

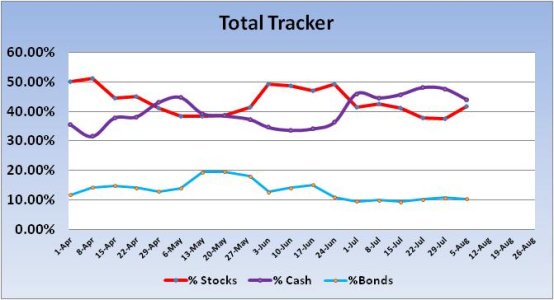

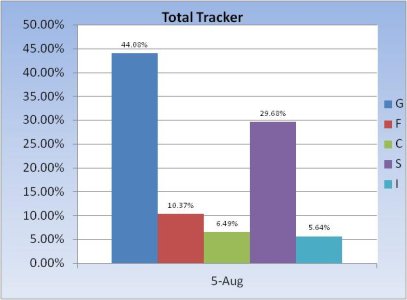

Total stock allocations rose by 4.19% to a total stock allocation of 41.82% for the new week. Take note that total allocations are back above 40%, which turns off the previous buy signal. So there are no signals for the new week.

Price bounced off the longer term support line several times, which was bullish. It then rallied to new all-time highs on Thursday and Friday. MACD had a positive signal cross this week and is rising. The Relative Strength Indicator remains very strong, but a bit overbought. I view this chart as bullish.

Our sentiment survey came in at 55% bulls to 38% bears vs. 42% bulls to 50% bears the previous week. That’s a lot more bulls and a lot less bears, which I see as a bit bearish for next week. And I have no signals from the auto-tracker, not to mention seasonality is negative this week. I think we're due for at least some consolidation and perhaps a bit of downside action. The main caveat is that underlying market support remains firm, which should keep a floor under under the market. That support can change quickly, but it can also remain in place for longer than many expect. And that is what has been confounding the bears most of this year.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.

No signal from the Top 50 this week. Total stock allocations rose 4.5%, from 91.88% last week to 96.38% this week. I think that’s bullish.

Total stock allocations rose by 4.19% to a total stock allocation of 41.82% for the new week. Take note that total allocations are back above 40%, which turns off the previous buy signal. So there are no signals for the new week.

Price bounced off the longer term support line several times, which was bullish. It then rallied to new all-time highs on Thursday and Friday. MACD had a positive signal cross this week and is rising. The Relative Strength Indicator remains very strong, but a bit overbought. I view this chart as bullish.

Our sentiment survey came in at 55% bulls to 38% bears vs. 42% bulls to 50% bears the previous week. That’s a lot more bulls and a lot less bears, which I see as a bit bearish for next week. And I have no signals from the auto-tracker, not to mention seasonality is negative this week. I think we're due for at least some consolidation and perhaps a bit of downside action. The main caveat is that underlying market support remains firm, which should keep a floor under under the market. That support can change quickly, but it can also remain in place for longer than many expect. And that is what has been confounding the bears most of this year.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/.