Sentiment is still very fragile. Give the market any measure of bad news and sentiment wilts quick.

And then the shorts step in and the top calling commences all over again.

And that's the cue for the market to rally.

Wash, rinse, repeat.

It would seem the market is out to punish the bears into insolvency. So do yourself a favor bears. Stop shorting the market.

Okay, I needed to get that out of my system. Let's move on.

We are approaching the 2009 highs for SPX. We may test them, but beyond that this is OPEX week and we can't read too much into what the market is doing until this week passes.

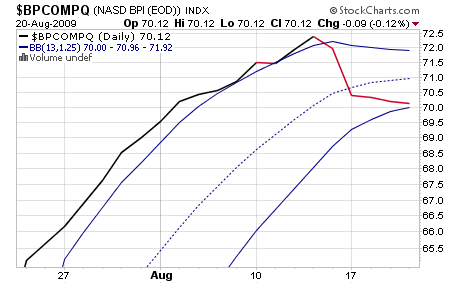

The Seven Sentinels are now showing 6 buy signals, but we need all seven to go to a buy simultaneously to get a true buy signal for market entry. Not surprisingly $BPCOMPQ is still on a sell. Here's the chart:

As you can see it's still on a downward trajectory, although it has leveled off the last 3 trading days. To get this signal to buy mode the red centerline will have to curl back up and cross the upper bollinger band in the upward direction, or cross below the bottom bollinger band and curl back up with a recross in the opposite direction. In other words we need to see that signal cross the upper or lower band in a positive direction.

However, even if that happens in the next few trading days it doesn't necessarily mean another signal won't drop back to sell in the meantime.

So we remain on a sell.

It is possible we are establishing another base before moving higher, which is what happened after the last SS sell signal. That basing could take a few weeks to play out. But by then we're into September and Da Boyz will be back from their vacations (after the Labor Day weekend). Volume may pick up a bit at this point, but will the trend change? The answer may depend on sentiment, and so far we haven't been able to maintain bullish levels for very long, which is why we continue to see short covering rallies. It may take some significant news to break that cycle. Bullish news. Bullish news with much less negativity to go along with it. And that's a tall order in this economy.

And then the shorts step in and the top calling commences all over again.

And that's the cue for the market to rally.

Wash, rinse, repeat.

It would seem the market is out to punish the bears into insolvency. So do yourself a favor bears. Stop shorting the market.

Okay, I needed to get that out of my system. Let's move on.

We are approaching the 2009 highs for SPX. We may test them, but beyond that this is OPEX week and we can't read too much into what the market is doing until this week passes.

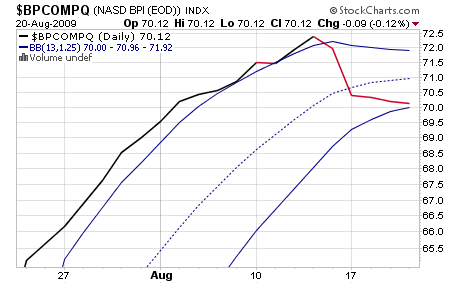

The Seven Sentinels are now showing 6 buy signals, but we need all seven to go to a buy simultaneously to get a true buy signal for market entry. Not surprisingly $BPCOMPQ is still on a sell. Here's the chart:

As you can see it's still on a downward trajectory, although it has leveled off the last 3 trading days. To get this signal to buy mode the red centerline will have to curl back up and cross the upper bollinger band in the upward direction, or cross below the bottom bollinger band and curl back up with a recross in the opposite direction. In other words we need to see that signal cross the upper or lower band in a positive direction.

However, even if that happens in the next few trading days it doesn't necessarily mean another signal won't drop back to sell in the meantime.

So we remain on a sell.

It is possible we are establishing another base before moving higher, which is what happened after the last SS sell signal. That basing could take a few weeks to play out. But by then we're into September and Da Boyz will be back from their vacations (after the Labor Day weekend). Volume may pick up a bit at this point, but will the trend change? The answer may depend on sentiment, and so far we haven't been able to maintain bullish levels for very long, which is why we continue to see short covering rallies. It may take some significant news to break that cycle. Bullish news. Bullish news with much less negativity to go along with it. And that's a tall order in this economy.