Enjoying that volatility? After an initial gap lower to start the week, the market leveled off and was eventually able to recoup most of its losses later in the afternoon. Perhaps is was today's Permanent Open Market Operation (POMO) that helped ignite the rally, but I would still point out that the major European indices all closed down at least 2% on debt fears.

Asian indexes closed mixed in spite of the ongoing joint naval exercise between the U.S. and South Korea. But I'm sure the area is on high alert and keeping a very wary eye on any further military actions by either side.

So our broader market closed modestly lower for the day, but we're hardly out of the woods on today's comeback rally. We could continue to see some seesaw action before a decisive move is made in either direction.

Here's today's charts:

NAMO and NYMO remain on sells.

NAHL and NYHL are also flashing sells.

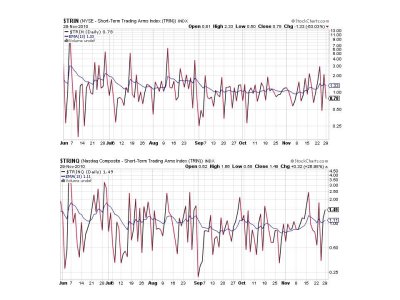

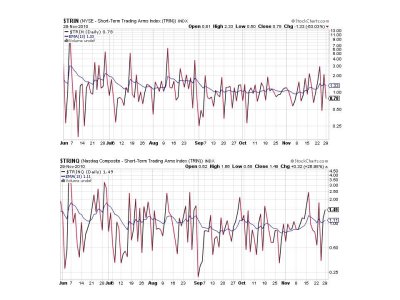

TRIN is on a buy, while TRINQ is on a sell.

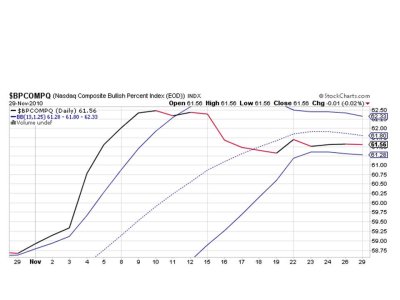

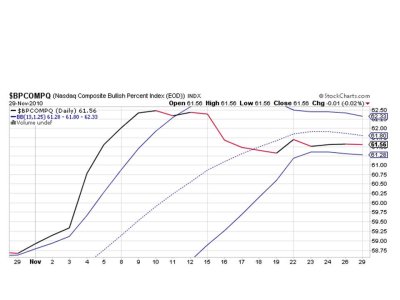

BPCOMPQ continues its sideways action and remains on a sell.

So 6 of 7 signals are flashing sells, which keeps the system on a sell.

I can't say I find these charts or the action in the market bullish. If POMO was the main reason for today's intraday rally then more trouble probably lays ahead. My expectation remains on lower prices as forecast by the seven sentinels, but it could be a tug of war to get there. If sentiment falls to more bearish levels than that expectation may be diminished, but there's still that small matter of a bearish 10-Day OEX P/C ratio, which is highly suggestive of a looming sell-off. But then again, I don't always like obvious bull or bear indicators. So do we fight the Fed and their POMO actions or do we fight the smart money? What a choice. Look for continued volatility in any event.

Asian indexes closed mixed in spite of the ongoing joint naval exercise between the U.S. and South Korea. But I'm sure the area is on high alert and keeping a very wary eye on any further military actions by either side.

So our broader market closed modestly lower for the day, but we're hardly out of the woods on today's comeback rally. We could continue to see some seesaw action before a decisive move is made in either direction.

Here's today's charts:

NAMO and NYMO remain on sells.

NAHL and NYHL are also flashing sells.

TRIN is on a buy, while TRINQ is on a sell.

BPCOMPQ continues its sideways action and remains on a sell.

So 6 of 7 signals are flashing sells, which keeps the system on a sell.

I can't say I find these charts or the action in the market bullish. If POMO was the main reason for today's intraday rally then more trouble probably lays ahead. My expectation remains on lower prices as forecast by the seven sentinels, but it could be a tug of war to get there. If sentiment falls to more bearish levels than that expectation may be diminished, but there's still that small matter of a bearish 10-Day OEX P/C ratio, which is highly suggestive of a looming sell-off. But then again, I don't always like obvious bull or bear indicators. So do we fight the Fed and their POMO actions or do we fight the smart money? What a choice. Look for continued volatility in any event.