I had anticipated a gap up this morning that would eventually give way to selling pressure as the day wore on. Well, we didn't get a gap up after Friday's bull rout, but we certainly saw some selling pressure as the day wore on. That should tell you something. Namely, that this is now a bear market and gains evaporate quickly and also that this market is getting weaker.

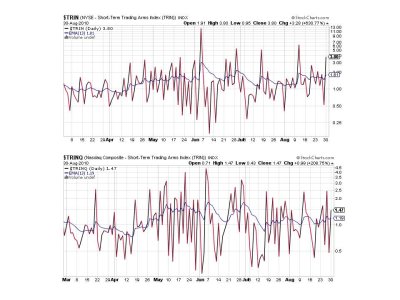

Here's the charts:

Back to the trigger point on NAMO and NYMO. NYMO just did trigger a sell, while NAMO is a borderline buy.

NAHL and NYHL ebbed a bit higher today. I suspect this is a precursor to another run towards Friday's highs.

TRIN and TRINQ both flipped to sells. TRIN in particular suggests another bounce too.

BPCOMPQ edged sideways again. It really isn't looking bullish from my perspective.

So we have 4 of 7 signals on a sell, which keeps the system on a sell. I am looking for another run higher, but I am not expecting the market to hold higher prices for very long. In fact, I'm looking for new lows in the not-to-distant future. I am currently 100% G.

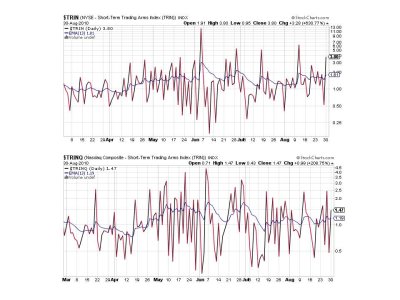

Here's the charts:

Back to the trigger point on NAMO and NYMO. NYMO just did trigger a sell, while NAMO is a borderline buy.

NAHL and NYHL ebbed a bit higher today. I suspect this is a precursor to another run towards Friday's highs.

TRIN and TRINQ both flipped to sells. TRIN in particular suggests another bounce too.

BPCOMPQ edged sideways again. It really isn't looking bullish from my perspective.

So we have 4 of 7 signals on a sell, which keeps the system on a sell. I am looking for another run higher, but I am not expecting the market to hold higher prices for very long. In fact, I'm looking for new lows in the not-to-distant future. I am currently 100% G.