In spite of our sentiment survey remaining on a buy signal for the past six weeks, losses continue to mount for the bulls. In that time, the S fund has dropped -8.47%, including -3.96% just last week.

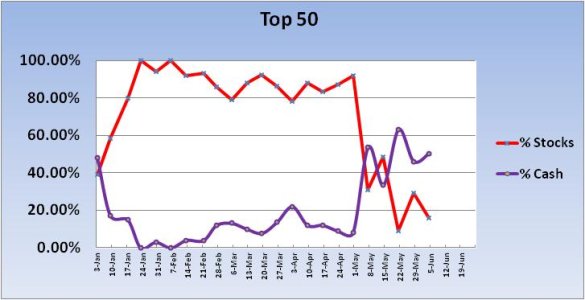

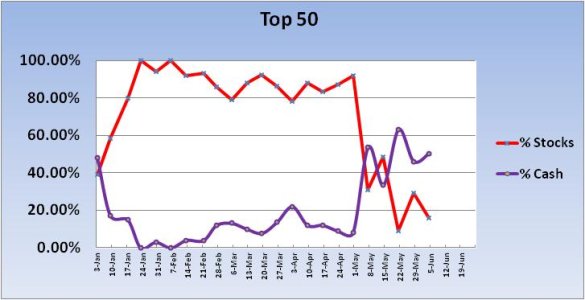

You might remember that going into the previous week, the Top 50 had increased their collective stock exposure by 20%, although total stock allocations remained conservative at just 29%. And on Tuesday (post holiday), those dip buyers were seeing some great upside action as the S fund tacked on 1.34%. Unfortunately, the rest of the week saw some serious selling pressure, which led to the major averages hitting multi-month lows.

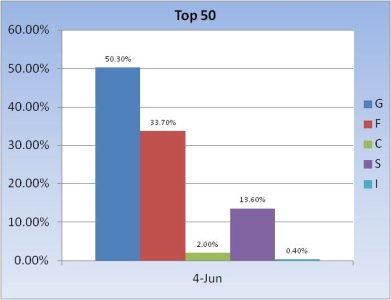

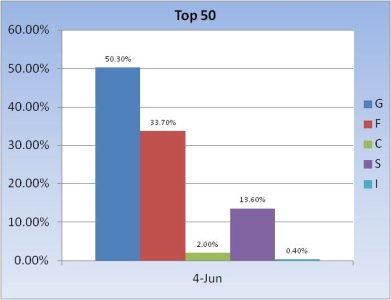

Going into into the new week, the Top 50 dropped their collective stock exposure from 29% to just 16%.

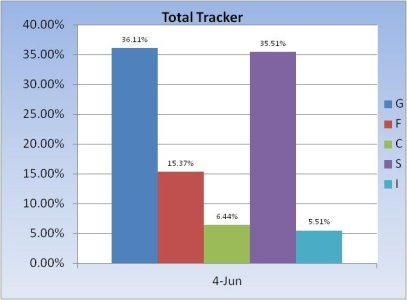

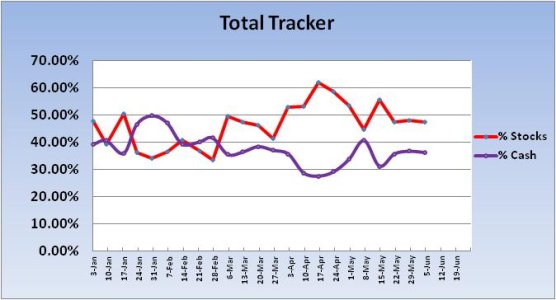

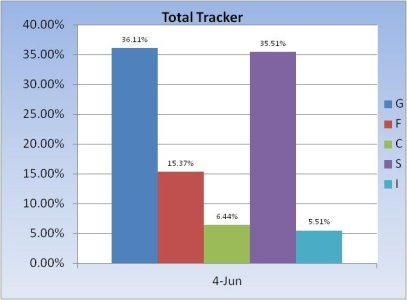

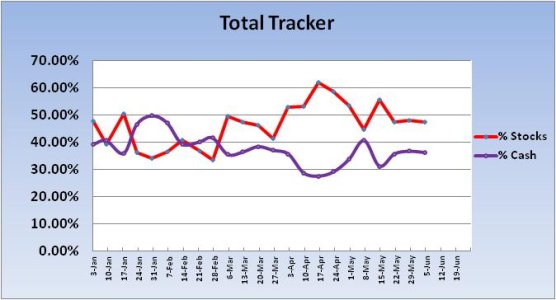

On the other hand, stock allocation across the Total Tracker remained relatively unchanged with a total allocation of 47.46%; down just 0.53% from the previous week.

So our sentiment survey has given back much of its gains from the previous months as has the Seven Sentinels, which still remain in a buy condition, although it did flash an unconfirmed sell signal after Friday's action. But this market continues to be prone to whipsaw action, which makes cash or bonds (G or F fund) look very attractive. At some point, we're going to want to be a buyer in this market, but picking a bottom can be quite tricky. We're due for a bounce, but I'm not so sure it would be anything more than a selling opportunity. Sentiment is not overly bearish across the various surveys, so caution is still warranted.

You might remember that going into the previous week, the Top 50 had increased their collective stock exposure by 20%, although total stock allocations remained conservative at just 29%. And on Tuesday (post holiday), those dip buyers were seeing some great upside action as the S fund tacked on 1.34%. Unfortunately, the rest of the week saw some serious selling pressure, which led to the major averages hitting multi-month lows.

Going into into the new week, the Top 50 dropped their collective stock exposure from 29% to just 16%.

On the other hand, stock allocation across the Total Tracker remained relatively unchanged with a total allocation of 47.46%; down just 0.53% from the previous week.

So our sentiment survey has given back much of its gains from the previous months as has the Seven Sentinels, which still remain in a buy condition, although it did flash an unconfirmed sell signal after Friday's action. But this market continues to be prone to whipsaw action, which makes cash or bonds (G or F fund) look very attractive. At some point, we're going to want to be a buyer in this market, but picking a bottom can be quite tricky. We're due for a bounce, but I'm not so sure it would be anything more than a selling opportunity. Sentiment is not overly bearish across the various surveys, so caution is still warranted.