Volume was below average and the action tentative thoughout today's trading activity. Treasuries continue to show pockets of strength and in fact the yield on the 10-year Note fell to a new 52-week low at 3.01%. It would seem market participants are paying a lot of heed to all the bearish news that keeps splashing across the wires on a daily basis.

Other notable news items today include the G-20, which agreed to slash deficits and proposed a more flexible timeline for banks to build capital reserves.

On the economic data front, real disposable income for May increased 0.5%, while the personal savings rate moved up to 4.0%. Core personal consumption expenditures (PCE) also increased 0.2%.

The euro turned negative today, giving up 0.8% against the dollar.

It's somewhat interesting that the 10 year note keeps drawing buyers and I tend to see that as an opportunity for stocks to rise in contrarian fashion. The Seven Sentinels continue to look poised for another run higher and I think I'm seeing signs of stealth buying interest. Let's look at today's charts:

Not much change from yesterday for NAMO and NYMO. Still flashing sells, but very close to their trigger points.

Here's where I believe buying interest is showing signs that we are near a low. Both NAHL and NYHL turned up today and flipped to buys. It's a subtle move, but after Friday's great showing from the Wilshire 4500 I tend to think da boyz are prepping for a run higher.

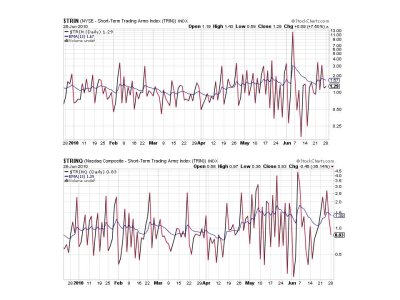

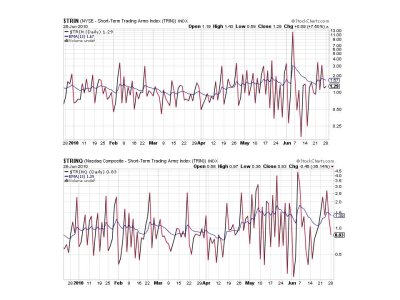

TRIN and TRINQ are flashing buys.

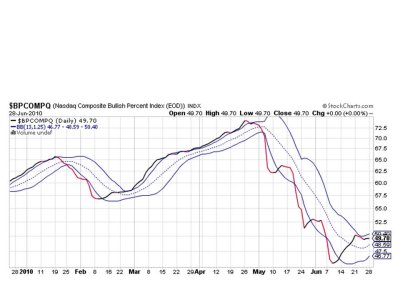

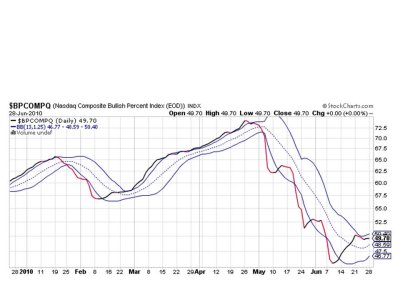

BPCOMPQ continues its sideways action, but remains solidly in buy territory.

So we have 5 of 7 signals now flashing buys, but the system remains on a buy none-the-less. That's it for this evening. See you tomorrow.

Other notable news items today include the G-20, which agreed to slash deficits and proposed a more flexible timeline for banks to build capital reserves.

On the economic data front, real disposable income for May increased 0.5%, while the personal savings rate moved up to 4.0%. Core personal consumption expenditures (PCE) also increased 0.2%.

The euro turned negative today, giving up 0.8% against the dollar.

It's somewhat interesting that the 10 year note keeps drawing buyers and I tend to see that as an opportunity for stocks to rise in contrarian fashion. The Seven Sentinels continue to look poised for another run higher and I think I'm seeing signs of stealth buying interest. Let's look at today's charts:

Not much change from yesterday for NAMO and NYMO. Still flashing sells, but very close to their trigger points.

Here's where I believe buying interest is showing signs that we are near a low. Both NAHL and NYHL turned up today and flipped to buys. It's a subtle move, but after Friday's great showing from the Wilshire 4500 I tend to think da boyz are prepping for a run higher.

TRIN and TRINQ are flashing buys.

BPCOMPQ continues its sideways action, but remains solidly in buy territory.

So we have 5 of 7 signals now flashing buys, but the system remains on a buy none-the-less. That's it for this evening. See you tomorrow.