The bull market remains intact, but market dynamics have changed dramatically since the end of April. We have a dollar that's in rally mode, which has translated into weakness in commodities. And nerves are probably getting frayed as the market gyrates in response to huge dislocations in metals and energy. But support held today for the S&P 500.

The market began the day modestly positive, but that didn't last too long as it chopped into negative territory after the first minutes of trade, spent about an hour in the red and by mid-morning fell hard as the dollar began its climb.

Among the economic numbers that were released this morning, the April Consumer Price Index showed a 0.4% increase, while the core CPI number was a more tame 0.2%. Both numbers were on target with estimates. Also released was the preliminary May Consumer Sentiment Survey, which came in at 72.4, above expectations.

But it was the dollar the market keyed on, and that seems to be the new driver of stock prices at the moment. The dollar index rose 0.8% on the day, which is a one month high.

Now let's take a look at the charts:

NAMO and NYMO moved lower and are back in a sell condition. The charts themselves look neutral overall.

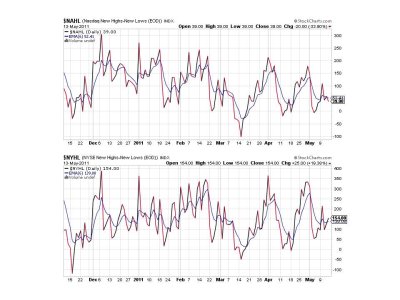

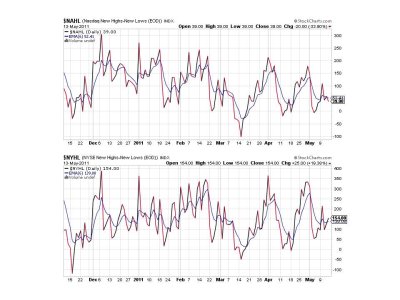

NAHL is on a sell, while NYHL is flashing a buy.

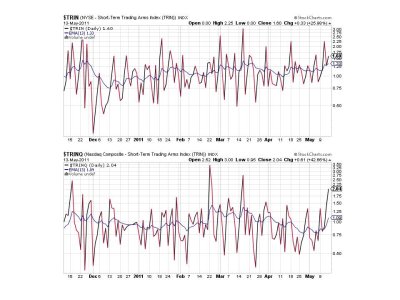

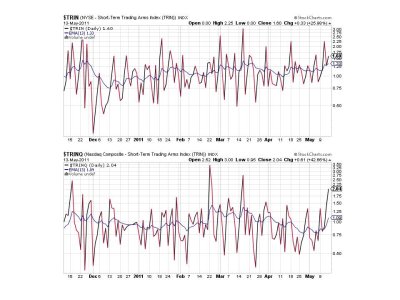

Both TRIN and TRINQ are in a sell condition with TRINQ showing an elevated level that suggests an oversold condition. Lately, these two signals have been showing a tendency to be out of sync with each other. I think that's due to the overall volatile nature of this market.

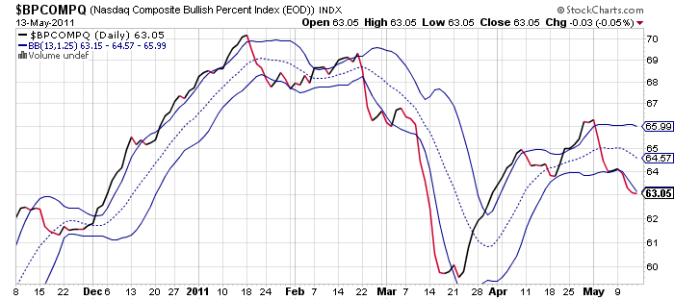

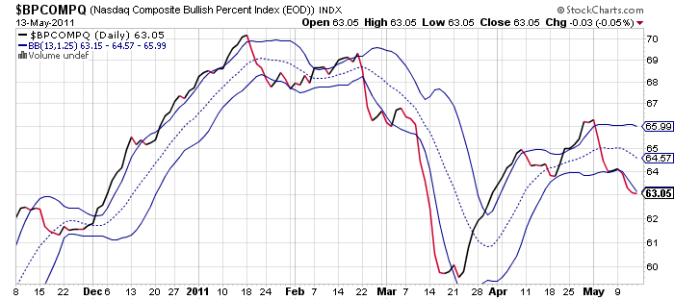

BPCOMPQ just barely ticked lower and may be flattening out for the short term, but it's too early to tell.

So all but one signal are in a sell condition, but the Seven Sentinels themselves remain in a buy condition.

There are several clues on where this market may go next week. First, the S&P 500 held an important support level today. Second, TRINQ suggests an oversold condition. Third, Monday's are often green, and fourth, next week is OPEX, which tends to put a floor under the market, although that doesn't mean we can't see lower prices somewhere during the week.

And our sentiment survey is on a hold, which is also supportive. So I think there's a good chance for another rally next week, but I'm sure we'll see some selling pressure too. Especially if the dollar continues to rally as hard as it did this week. It could be a real roller coaster.

I'll post the Tracker Charts Sunday evening. Maybe we'll get another clue there. See you then.

The market began the day modestly positive, but that didn't last too long as it chopped into negative territory after the first minutes of trade, spent about an hour in the red and by mid-morning fell hard as the dollar began its climb.

Among the economic numbers that were released this morning, the April Consumer Price Index showed a 0.4% increase, while the core CPI number was a more tame 0.2%. Both numbers were on target with estimates. Also released was the preliminary May Consumer Sentiment Survey, which came in at 72.4, above expectations.

But it was the dollar the market keyed on, and that seems to be the new driver of stock prices at the moment. The dollar index rose 0.8% on the day, which is a one month high.

Now let's take a look at the charts:

NAMO and NYMO moved lower and are back in a sell condition. The charts themselves look neutral overall.

NAHL is on a sell, while NYHL is flashing a buy.

Both TRIN and TRINQ are in a sell condition with TRINQ showing an elevated level that suggests an oversold condition. Lately, these two signals have been showing a tendency to be out of sync with each other. I think that's due to the overall volatile nature of this market.

BPCOMPQ just barely ticked lower and may be flattening out for the short term, but it's too early to tell.

So all but one signal are in a sell condition, but the Seven Sentinels themselves remain in a buy condition.

There are several clues on where this market may go next week. First, the S&P 500 held an important support level today. Second, TRINQ suggests an oversold condition. Third, Monday's are often green, and fourth, next week is OPEX, which tends to put a floor under the market, although that doesn't mean we can't see lower prices somewhere during the week.

And our sentiment survey is on a hold, which is also supportive. So I think there's a good chance for another rally next week, but I'm sure we'll see some selling pressure too. Especially if the dollar continues to rally as hard as it did this week. It could be a real roller coaster.

I'll post the Tracker Charts Sunday evening. Maybe we'll get another clue there. See you then.