Earlier this week I had mentioned that should the Seven Sentinels trigger an "Unconfirmed" sell signal, that I would not ignore it. And that was for several reasons. First, to confirm a sell signal NYMO would have to fall much, much further than where it currently stood at the time or stands after today. And we could see a lot of downside action without ever triggering an official sell condition. Second, this is a bear market, so downside surprises are now part of the landscape. Third, this is September, which has a history of seeing severe downside action. I may even be able to cite the significant events unfolding in the EU as an additional reason to be wary. There's more, but that's enough.

All that said, after today's beat down the Seven Sentinels have triggered an unconfirmed sell condition. Yes, we are at the bottom of the channel and there was a hint of buying pressure towards the end, but it wasn't nearly enough to offset the significant losses the market logged today.

Europe's major bourses saw significant selling pressure before our own open today, which set the tone for us early on. Germany continues to be at the center of the EU storm along with Greece. Today, it was suggested that Germany may chose to support certain banks if Greece defaults on its debt. That was enough to send the DAX to a 4% loss on the day. And euro fell 1.6% as a result of that possibility too. That helped the I fund "limit" its not so paltry losses to 3.47%. Small comfort, I know.

In response to the events in euroland, the Dollar Index spiked 1.2% to a five-month high and is above its 200-day average.

Treasuries rallied on the action today and saw the yield of the 10-year Note close near a record breaking 1.9%.

Here's the charts:

NAMO and NYMO fell again and are now firmly in negative territory. I believe they have further to fall and both are in a sell condition.

NAHL and NYHL are also in a sell condition. I still think they are holding up fairly well all things considered, but that's not enough to off-set all the negatives in my opinion.

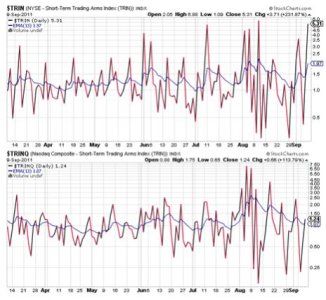

TRIN spiked hard to the upside today and is highly suggestive of an oversold market. But TRINQ is only barely in a sell condition and largely neutral. This is odd, and while I generally expect bullish outcomes with a reading like TRIN is showing, I'm not bullish here.

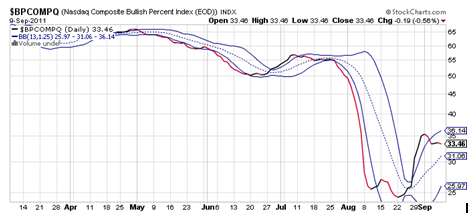

BPCOMPQ turned a bit lower today and that's an ominous sign in a bear market.

So as I stated earlier, the Seven Sentinels are now in an unconfirmed sell condition, but officially remain on a buy. I did not trust this buy signal when it was first issued and I trust it even less now. This volatility is reminiscent of several other periods over the last couple of years or so, which saw the Seven Sentinels whipsawed badly. I believe we are in one of those markets now.

And while there may be a lot of bearishness out there, it's not overwhelming. There are pockets of bullishness too. Even our own survey for next week was neutral. So I would not bet against more downside action in the days and weeks ahead. Any defaults in Europe could have a domino effect and the dislocations could cause even more severe volatility. Using sentiment as a buy/sell trigger point in such an scenario may not be wise. That's not to say a default "will" happen, only that if it does, things could go from bad to worse.