11/20/25

It was a very choppy day of trading yesterday leading up to Nvidia's earnings after the closing bell. The highs were made in the first hour of trading but the early 1% gain in the S&P 500 completely evaporated before bouncing back later in the afternoon. Small caps were flat and another rally in the dollar left the I-fund behind.

Nvidia reported earnings after the bell, and the anticipation may have added to Wednesday's choppiness. The stock was up about 5% in after hours trading last I checked, so if that can hold into the opening bell, it could bode well for the large cap indices. But there has been a tendency for Nvidia to fade any earnings triggered large gains quickly afterward, so that's on my radar.

There was a little drama associated with the earnings with Michael Burry of "The Big Short" fame, having shorted the company's stock heavily, and billionaire investor Peter Thiel sold his entire position recently.

In other news, the FOMC Meeting minutes were released showing that there were plenty of dissenting voices on a rate cut in December, and that helped pull the probability of a cut at their next meeting down to 33.6%. A month ago it was 94%.

Some arguments against a cut must be that the Atlanta Fed's GDPNow website has raised their 3rd quarter GDP estimate to 4.2%. That's pretty strong economic data, but it is also rear-view mirror data and precedes the government shutdown period.

On the other hand, we are getting the nonfarm payrolls (jobs report) this morning and they are expected to have risen by 50K in September 2025, up from 22K in August. The unemployment rate is projected to hold steady at 4.3%. This jobs report was originally scheduled for release on October 3rd but was delayed due to the government shutdown. There is also a possibility the report won't include the unemployment rate.

The Fed has what they call a dual mandate, although it sounds like three: "so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Looking at the jobs data recently, it seems like cutting again would be appropriate for the mandate to maximize employment.

But they are also worried about sparking higher inflation by cutting.

From CNBC.com: "The BLS said October payroll data will be released along with a full report for November [in December].

"An unemployment rate for October will not be included in those figures because the data “could not be collected,” the BLS said, citing the shutdown.

"The BLS also pushed back its November jobs data release to Dec. 16 from Dec. 5. The new date is six days after the Federal Reserve concludes its final policy meeting of the year — leaving the Fed with less intel on the state of the economy."

It's interesting that they are moving November jobs report from the 5th to December 16, which will now be 6 days after the next Fed meeting.

The 10-year Treasury Yield and the dollar were up yesterday following those FOMC meeting minutes. They both look like they want to go higher.

The S&P 500 (C-fund) rallied out of the gate on Wednesday, hit the 50-day average and flipped right back over. It had an opportunity to really breakdown at that failure point, but it hung around and closed with a moderate gain. We'll see if Nvidia's gain after hours Wednesday night can hold into today's trading and get it back over the 50-day average. The futures looked good.

On Friday there will be a series of speeches from Fed officials that could impact the markets.

The DWCPF Index (S-Fund) closed flat but those spinning tops where the open and closing prices are similar, with a wide trading range surrounding it, can be considered indecisiveness and often occur near a turning point. We had a similar looking trading day in early October that came near the highs, although the actual high didn't come for another few weeks. Still, it was where the bulls started to run out of steam. Is this a sign that the bears are running out of steam in this area?

ACWX (I-fund) lagged as the dollar is regaining some strength. The chart broke down with the two closes below the 50-day average. A close back above it again could negative the bearish look, but the bears are trying to take control. Will Nvidia help?

BND (bonds / F-fund) was down slightly with yields ticking higher. I still see this area as a key pivot point as the support from the 50-day average tries to hold.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

It was a very choppy day of trading yesterday leading up to Nvidia's earnings after the closing bell. The highs were made in the first hour of trading but the early 1% gain in the S&P 500 completely evaporated before bouncing back later in the afternoon. Small caps were flat and another rally in the dollar left the I-fund behind.

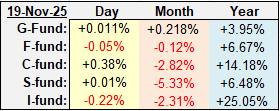

| Daily TSP Funds Return More returns |

Nvidia reported earnings after the bell, and the anticipation may have added to Wednesday's choppiness. The stock was up about 5% in after hours trading last I checked, so if that can hold into the opening bell, it could bode well for the large cap indices. But there has been a tendency for Nvidia to fade any earnings triggered large gains quickly afterward, so that's on my radar.

There was a little drama associated with the earnings with Michael Burry of "The Big Short" fame, having shorted the company's stock heavily, and billionaire investor Peter Thiel sold his entire position recently.

In other news, the FOMC Meeting minutes were released showing that there were plenty of dissenting voices on a rate cut in December, and that helped pull the probability of a cut at their next meeting down to 33.6%. A month ago it was 94%.

Some arguments against a cut must be that the Atlanta Fed's GDPNow website has raised their 3rd quarter GDP estimate to 4.2%. That's pretty strong economic data, but it is also rear-view mirror data and precedes the government shutdown period.

On the other hand, we are getting the nonfarm payrolls (jobs report) this morning and they are expected to have risen by 50K in September 2025, up from 22K in August. The unemployment rate is projected to hold steady at 4.3%. This jobs report was originally scheduled for release on October 3rd but was delayed due to the government shutdown. There is also a possibility the report won't include the unemployment rate.

The Fed has what they call a dual mandate, although it sounds like three: "so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Looking at the jobs data recently, it seems like cutting again would be appropriate for the mandate to maximize employment.

But they are also worried about sparking higher inflation by cutting.

From CNBC.com: "The BLS said October payroll data will be released along with a full report for November [in December].

"An unemployment rate for October will not be included in those figures because the data “could not be collected,” the BLS said, citing the shutdown.

"The BLS also pushed back its November jobs data release to Dec. 16 from Dec. 5. The new date is six days after the Federal Reserve concludes its final policy meeting of the year — leaving the Fed with less intel on the state of the economy."

It's interesting that they are moving November jobs report from the 5th to December 16, which will now be 6 days after the next Fed meeting.

The 10-year Treasury Yield and the dollar were up yesterday following those FOMC meeting minutes. They both look like they want to go higher.

The S&P 500 (C-fund) rallied out of the gate on Wednesday, hit the 50-day average and flipped right back over. It had an opportunity to really breakdown at that failure point, but it hung around and closed with a moderate gain. We'll see if Nvidia's gain after hours Wednesday night can hold into today's trading and get it back over the 50-day average. The futures looked good.

On Friday there will be a series of speeches from Fed officials that could impact the markets.

The DWCPF Index (S-Fund) closed flat but those spinning tops where the open and closing prices are similar, with a wide trading range surrounding it, can be considered indecisiveness and often occur near a turning point. We had a similar looking trading day in early October that came near the highs, although the actual high didn't come for another few weeks. Still, it was where the bulls started to run out of steam. Is this a sign that the bears are running out of steam in this area?

ACWX (I-fund) lagged as the dollar is regaining some strength. The chart broke down with the two closes below the 50-day average. A close back above it again could negative the bearish look, but the bears are trying to take control. Will Nvidia help?

BND (bonds / F-fund) was down slightly with yields ticking higher. I still see this area as a key pivot point as the support from the 50-day average tries to hold.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.