01/23/26

Stocks bounced for a second day in an attempt to recover Tuesday's big losses. In the case of the small caps, they have done recovering and closed at another new record high. However, the S&P 500 is still in the red for the week. Inflation has remained sticky but stabilizing as the PCE Prices data was inline with expectations yesterday. Yields and the dollar were down on the day.

Intel has been one of the hottest stocks so far in 2026, and while it is not the market mover that it once was, it was down sharply after hours on Thursday after reporting earnings. The more than 10% loss last night is steep, but it is only making a small dent in its recent gain so far as the stock was up nearly 50% in January before this report. Sounds like profit taking after disappointing guidance.

Meanwhile we will start getting the Magnificent 7 earnings rolling in starting next week, and those could be market movers. Here's some dates:

Tesla (TSLA) Jan 28

Microsoft Corp (MSFT) Jan 28

Meta Platforms Inc (META) Jan 28

Apple Inc (AAPL) Jan 29

Amazon.com Inc (AMZN) Feb 2

Alphabet Inc (GOOGL) Feb 4

NVIDIA Corp (NVDA) Feb 25

Are we set up for a sell the news reaction?

Also next week, we will get another Fed FOMC meeting, and the government budget will be running out at the end of next week, so buckle up!

The Russell 2000 outperformed the S&P 500 for the 14th consecutive day yesterday and while I continue to question the S&P 500's ability to break out, based on some technical patterns, the market leading Russell and the Dow Transportation Index have had no problems making new highs recently. So, who is going to lead whom?

Both of those indices were up yesterday making those new highs, but we did see a negative reversal in both so we could have some short-term issues and possible retracements.

The S&P 500 (C-fund) is still down for the week despite two strong rallies in the past two days. It has visually filled the open gap from Tuesday's gap down open, although technically there is still a small open area above yesterday's high. The ascending support line broke on Tuesday but the 50-day average held again. But now the gap is filled and those who got their money back from Tuesday's losses, so will the bulls run out of steam?

I won't post the chart again today, but the Wyckoff Distribution pattern is still intact.

I'm still watching this chart, especially now that the distraction of Greenland is behind us. Yes, next week is a busy week with the Fed and earnings, but I want to see if this chart resumes higher once the rising support is tested and / or the gap gets filled.

Admin note: We are having an annual subscription sale this week for new or current subscribers! As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on an additional year or two to your current subscriptions at the sale price. More information. Final days!

Thanks so much to all of you who have taken advantage of the Premium Service's Sale! I am always humbled by the reception and I only hope we can meet or beat your expectations in each service.

As you can imagine, the cost of doing business has risen quite a bit over the past 20 years. Over that time the price of TSP Talk Plus and RevShark's Premium Services have remained the same, and we are planning a modest price increase later this year. This sale provides you and your friends the opportunity to lock in prices that we may not be able to offer again. Spread the word to anyone who you think would benefit from a TSP Talk Premium Subscription.

Additional TSP Fund Charts:

The DWCPF (S-fund) made a new high after another gap up open on Thursday. The index close well off its highs, perhaps setting up a short-term dip, but investors have been quick to buy those dips. Will Intel's disappointing guidance change that and trigger some profit taking from the fund that is already up over 6% this month?

The ACWX (I-fund) didn't take long to get right back into that ascending trading channel. There are plenty of open gaps below that have I-fund holders looking over their shoulder, but technically it remains in good shape, although extended in the short-term

BND (bonds / F-fund) rallied and filled in the open gap from Tuesday as the yield on the 10-year Treasury also filled in its open gap in the opposite direction.

With inflation remaining sticky, GDP getting stronger, and the Fed holding off on rate cuts, yields may remain above the recent broken resistance area near 4.2%.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks bounced for a second day in an attempt to recover Tuesday's big losses. In the case of the small caps, they have done recovering and closed at another new record high. However, the S&P 500 is still in the red for the week. Inflation has remained sticky but stabilizing as the PCE Prices data was inline with expectations yesterday. Yields and the dollar were down on the day.

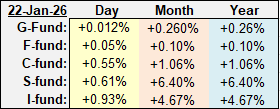

| Daily TSP Funds Return More returns |

Intel has been one of the hottest stocks so far in 2026, and while it is not the market mover that it once was, it was down sharply after hours on Thursday after reporting earnings. The more than 10% loss last night is steep, but it is only making a small dent in its recent gain so far as the stock was up nearly 50% in January before this report. Sounds like profit taking after disappointing guidance.

Meanwhile we will start getting the Magnificent 7 earnings rolling in starting next week, and those could be market movers. Here's some dates:

Tesla (TSLA) Jan 28

Microsoft Corp (MSFT) Jan 28

Meta Platforms Inc (META) Jan 28

Apple Inc (AAPL) Jan 29

Amazon.com Inc (AMZN) Feb 2

Alphabet Inc (GOOGL) Feb 4

NVIDIA Corp (NVDA) Feb 25

Are we set up for a sell the news reaction?

Also next week, we will get another Fed FOMC meeting, and the government budget will be running out at the end of next week, so buckle up!

The Russell 2000 outperformed the S&P 500 for the 14th consecutive day yesterday and while I continue to question the S&P 500's ability to break out, based on some technical patterns, the market leading Russell and the Dow Transportation Index have had no problems making new highs recently. So, who is going to lead whom?

Both of those indices were up yesterday making those new highs, but we did see a negative reversal in both so we could have some short-term issues and possible retracements.

The S&P 500 (C-fund) is still down for the week despite two strong rallies in the past two days. It has visually filled the open gap from Tuesday's gap down open, although technically there is still a small open area above yesterday's high. The ascending support line broke on Tuesday but the 50-day average held again. But now the gap is filled and those who got their money back from Tuesday's losses, so will the bulls run out of steam?

I won't post the chart again today, but the Wyckoff Distribution pattern is still intact.

I'm still watching this chart, especially now that the distraction of Greenland is behind us. Yes, next week is a busy week with the Fed and earnings, but I want to see if this chart resumes higher once the rising support is tested and / or the gap gets filled.

Admin note: We are having an annual subscription sale this week for new or current subscribers! As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on an additional year or two to your current subscriptions at the sale price. More information. Final days!

Thanks so much to all of you who have taken advantage of the Premium Service's Sale! I am always humbled by the reception and I only hope we can meet or beat your expectations in each service.

As you can imagine, the cost of doing business has risen quite a bit over the past 20 years. Over that time the price of TSP Talk Plus and RevShark's Premium Services have remained the same, and we are planning a modest price increase later this year. This sale provides you and your friends the opportunity to lock in prices that we may not be able to offer again. Spread the word to anyone who you think would benefit from a TSP Talk Premium Subscription.

Additional TSP Fund Charts:

The DWCPF (S-fund) made a new high after another gap up open on Thursday. The index close well off its highs, perhaps setting up a short-term dip, but investors have been quick to buy those dips. Will Intel's disappointing guidance change that and trigger some profit taking from the fund that is already up over 6% this month?

The ACWX (I-fund) didn't take long to get right back into that ascending trading channel. There are plenty of open gaps below that have I-fund holders looking over their shoulder, but technically it remains in good shape, although extended in the short-term

BND (bonds / F-fund) rallied and filled in the open gap from Tuesday as the yield on the 10-year Treasury also filled in its open gap in the opposite direction.

With inflation remaining sticky, GDP getting stronger, and the Fed holding off on rate cuts, yields may remain above the recent broken resistance area near 4.2%.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.