02/10/26

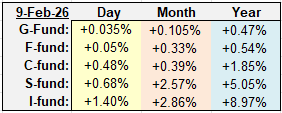

Stocks were able to add onto Friday's gains with another healthy rally on Monday. Once again the higher beta funds, S and I, led on the upside with the I-fund getting an assist from a rollover decline in the dollar. Yields were flat and bonds (F-fund) ticked higher, but that chart is at resistance.

The out performance in the I-fund going back to the lows in last April's tariff tantrum, have been extremely impressive, and it has been a clear shift in leadership and sentiment. If we count only positive years, 2025 was the first year that the I-fund has out performed the C-fund since 2017. There was a year in there that both funds were down and the I-fund was down a little less. Now it's not even a fair contest. But is the fund getting too stretched?

ACWX (I fund) was up over 1% again yesterday and that pushed it to another new all time high. I am getting a little concerned that this fund is getting too far above its 50-day average, when historically it has tended to stick around the average more closely.

The dollar dropped sharply yesterday, helping the I-fund lead again, but that 200-day average on the UUP chart could try to hold as support here. It it fails to hold, then the downside would likely be the clear trend, but as we have seen in other index charts, that average does have some holding properties.

A three year chart of the I-fund's ACWX shows that it tends to fall back to, or bounce up to, the 50-day average fairly quickly when it gets out of whack. Right now it is almost 6% above its 50-day average, but the average is moving up quickly so it wouldn't take that big of a loss to satisfy a test.

Even in 2017, when the I-fund gained more than 25% and led the C-fund by a few percentage points, it found its way back toward the average every several weeks, even if it was just sideways action to do so.

That doesn't mean to sell the I-fund, but we shouldn't be surprise if this pauses at some point in the near future. The question is, will the other stocks funds do better if there is a pullback in the I-fund?

The large cap tech Nasdaq 100 Index has rallied back up to an old broken support line, and the 50-day average. Going forward will be a big test for this index, which includes the Mag 7 stocks, as well as many badly beaten down software companies. It passed the test in late November when it recaptured that resistance, but here it is again.

I see that the Japanese 10-year Treasury Yield is showing life again. This was an issue for the US stock market in January when it spiked up. It has since pulled back, filled in the gap, and is now heading up again. I'm just keeping an eye on this to see how the stock market reacts if it start making new highs again.

The January Jobs Report is scheduled to be released on tomorrow morning. We get retail sales on Tuesday, and the CPI report on Friday.

Additional TSP Fund Charts:

The S&P 500 (C-fund) inched closer to the all-time highs yesterday as it tries to nullify the bearish Wyckoff Distribution pattern that I have been highlighting for weeks. A failure in the chart here and I will bring it back into the mix. For now I will focus on the positive that it is flirting with new highs, but as we get closer to mid-February, having a little concern about the short-term may be wise. Concern and selling are not the same, although buying the bottom of the red trading channel, which it seems to test once per month, and selling near the top, would have certainly outperformed the indices in recent months, and it has already tested the lower in February.

The DWCPF (S-fund) managed to close above the old neckline of the inverted head and shoulders pattern, which is a bullish sign, but it is still in the neighborhood and I will feel better about this after 2 or 3 more closes above 2600.

BND (bonds / F-fund) was up slightly again as it tagged the top of its trading channel. It's only been three trading days since this was at the bottom of the channel, so that was a quick rally and some consolidating for a few days would seem reasonable.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks were able to add onto Friday's gains with another healthy rally on Monday. Once again the higher beta funds, S and I, led on the upside with the I-fund getting an assist from a rollover decline in the dollar. Yields were flat and bonds (F-fund) ticked higher, but that chart is at resistance.

| Daily TSP Funds Return More returns |

The out performance in the I-fund going back to the lows in last April's tariff tantrum, have been extremely impressive, and it has been a clear shift in leadership and sentiment. If we count only positive years, 2025 was the first year that the I-fund has out performed the C-fund since 2017. There was a year in there that both funds were down and the I-fund was down a little less. Now it's not even a fair contest. But is the fund getting too stretched?

ACWX (I fund) was up over 1% again yesterday and that pushed it to another new all time high. I am getting a little concerned that this fund is getting too far above its 50-day average, when historically it has tended to stick around the average more closely.

The dollar dropped sharply yesterday, helping the I-fund lead again, but that 200-day average on the UUP chart could try to hold as support here. It it fails to hold, then the downside would likely be the clear trend, but as we have seen in other index charts, that average does have some holding properties.

A three year chart of the I-fund's ACWX shows that it tends to fall back to, or bounce up to, the 50-day average fairly quickly when it gets out of whack. Right now it is almost 6% above its 50-day average, but the average is moving up quickly so it wouldn't take that big of a loss to satisfy a test.

Even in 2017, when the I-fund gained more than 25% and led the C-fund by a few percentage points, it found its way back toward the average every several weeks, even if it was just sideways action to do so.

That doesn't mean to sell the I-fund, but we shouldn't be surprise if this pauses at some point in the near future. The question is, will the other stocks funds do better if there is a pullback in the I-fund?

The large cap tech Nasdaq 100 Index has rallied back up to an old broken support line, and the 50-day average. Going forward will be a big test for this index, which includes the Mag 7 stocks, as well as many badly beaten down software companies. It passed the test in late November when it recaptured that resistance, but here it is again.

I see that the Japanese 10-year Treasury Yield is showing life again. This was an issue for the US stock market in January when it spiked up. It has since pulled back, filled in the gap, and is now heading up again. I'm just keeping an eye on this to see how the stock market reacts if it start making new highs again.

The January Jobs Report is scheduled to be released on tomorrow morning. We get retail sales on Tuesday, and the CPI report on Friday.

Additional TSP Fund Charts:

The S&P 500 (C-fund) inched closer to the all-time highs yesterday as it tries to nullify the bearish Wyckoff Distribution pattern that I have been highlighting for weeks. A failure in the chart here and I will bring it back into the mix. For now I will focus on the positive that it is flirting with new highs, but as we get closer to mid-February, having a little concern about the short-term may be wise. Concern and selling are not the same, although buying the bottom of the red trading channel, which it seems to test once per month, and selling near the top, would have certainly outperformed the indices in recent months, and it has already tested the lower in February.

The DWCPF (S-fund) managed to close above the old neckline of the inverted head and shoulders pattern, which is a bullish sign, but it is still in the neighborhood and I will feel better about this after 2 or 3 more closes above 2600.

BND (bonds / F-fund) was up slightly again as it tagged the top of its trading channel. It's only been three trading days since this was at the bottom of the channel, so that was a quick rally and some consolidating for a few days would seem reasonable.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.