More strength leads to fresh 52-week highs. And the DOW is very close to the magic 11,000. It was a choppy day of trade, but the indexes remained in positive territory for most of the day and in the final hour saw a push that helped those indexes close near their highs of the day.

There wasn't much news of note, but the story on Greece seems to be a daily event now. Fitch downgraded Greece's debt rating to BBB-, but as we've seen so often EU officials continued to report progress on their attempts to stabilize the financially distressed country. Supposedly they've come up with a way to provide loans should they be required.

The I fund was the winner today as the dollar posted a 0.7% loss. But C and S had some healthy gains too.

The Seven Sentinels continue to look bullish, but I think we may be in for a surprise on Monday. Here's the charts:

Both NAMO and NYMO are flashing buys, but remain very close to zero, which is neutral.

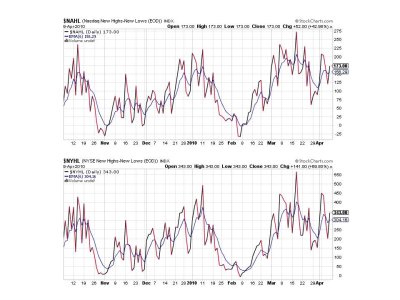

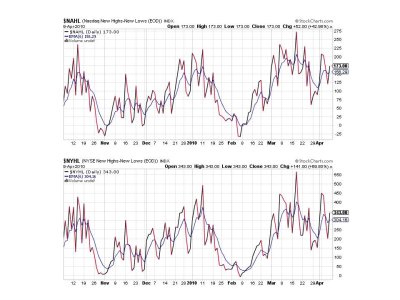

NAHL and NYHL have flipped back to buys today.

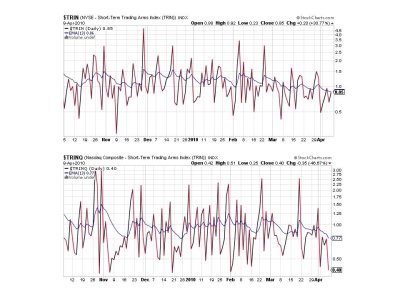

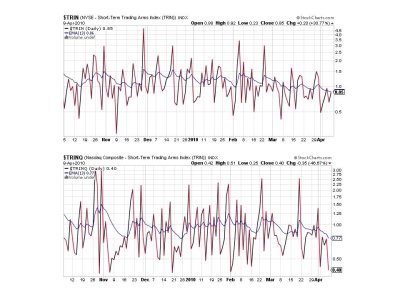

TRIN is on a buy, but close to its 13 day EMA. TRINQ is what got my attention today. It's very low, and that usually means some selling is coming very soon. I'm thinking Monday may be red.

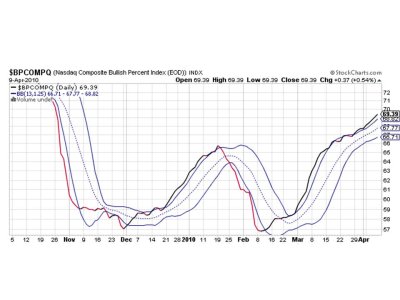

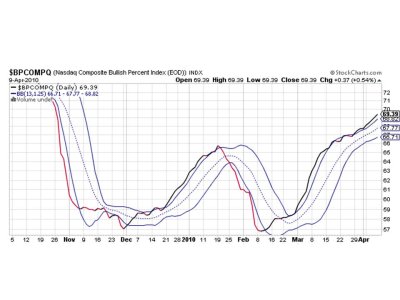

BPCOMPQ continues to look bullish and remains on a buy.

So we have 7 of 7 signals flashing buys, which keeps the system on a buy. As I mentioned, I think we're going to see some selling pressure early on next week, but that's an educated guess. If it comes Monday morning it may not last the day given the strength of this market. But even if Monday closes red I don't think it will last long given where the Sentinels are right now.

That's my take this evening. Hope you're doing well in the market. I'll post Top 15 and 50 charts this weekend. See you then.

There wasn't much news of note, but the story on Greece seems to be a daily event now. Fitch downgraded Greece's debt rating to BBB-, but as we've seen so often EU officials continued to report progress on their attempts to stabilize the financially distressed country. Supposedly they've come up with a way to provide loans should they be required.

The I fund was the winner today as the dollar posted a 0.7% loss. But C and S had some healthy gains too.

The Seven Sentinels continue to look bullish, but I think we may be in for a surprise on Monday. Here's the charts:

Both NAMO and NYMO are flashing buys, but remain very close to zero, which is neutral.

NAHL and NYHL have flipped back to buys today.

TRIN is on a buy, but close to its 13 day EMA. TRINQ is what got my attention today. It's very low, and that usually means some selling is coming very soon. I'm thinking Monday may be red.

BPCOMPQ continues to look bullish and remains on a buy.

So we have 7 of 7 signals flashing buys, which keeps the system on a buy. As I mentioned, I think we're going to see some selling pressure early on next week, but that's an educated guess. If it comes Monday morning it may not last the day given the strength of this market. But even if Monday closes red I don't think it will last long given where the Sentinels are right now.

That's my take this evening. Hope you're doing well in the market. I'll post Top 15 and 50 charts this weekend. See you then.