02/04/26

No break out to new highs yet for the S&P 500 as Monday's close call was reversed yesterday and the index continues to churn in a range. The S-fund was down slightly after an afternoon come back and the chart did something we've been waiting for, and the I-fund actually posted a gain yesterday, and got some payback. Yields and the dollar were mostly flat, so they weren't major factors.

The positive reversal yesterday did coincide with the House of Representative passing the Senate's version of the spending bill. The government shutdown is over. I had my ear plugs in to avoid the noise, and the charts did a good job of telling the story.

The big tech giants were falling again yesterday with three Mag 7 stocks losing over 2% on the day, and the losses were contagious, although by the close we saw stocks, particularly small caps, rebound from the early afternoon lows.

The Nasdaq 100 large cap tech stock index was down 1.55%, but it held at that moving average for a third straight time. The problem here is the NDX has triggered multiple Hindenburg Omen warnings in recent days.

The S&P 500 (C-fund), less tech heavy but still at the mercy of the large cap techs, was down 0.84% with the 59-point loss, but it held at its lows in a very convenient place as well. The bottom of the gap opened on January 20th, was retested, as was the 50-day moving average, and everything held for another day. The longer it churns, the bigger the next move, but it doesn't necessarily mean the move will be upward. That's why the bulls may need to make their move sooner, rather than later, because the window could close. It needs the Nasdaq to cooperate. Both are under Hindenburg Omen Warning watches.

The PMO momentum indicator is still sloping downward, and that's usually not a great sign, but it has been doing that since that indicator peaked last summer. The MACD indicator (moving average convergence / divergence) made a higher low, confirming the S&P 500's higher low.

Then we moved onto the small caps, which also avoided the loss as the Russell 2000 added a modest gain after a midday decline in sympathy with the large cap losses. As you'll down below, the S-fund was down just modestly.

And finally the Dow Transportation Index wasn't concerned about the noise yesterday either, and the economically sensitive index has been riding high on the improving data we've been getting. It made another new all time high yesterday with another 2% gain.

Silver and gold are back to their winning ways with both jumping sharply yesterday. Those are some big moves for these ancient metals.

AMD reported after the closing bell last night, and it was trading sharply lower, which could keep the pressure on tech stocks to start the day today.

Google (Alphabet) is scheduled to report after the closing bell today, and Amazon will report tomorrow..

The January jobs report was scheduled to be released this Friday, but the BLS says it could be delayed because of the government shut down.

Additional TSP Fund Charts:

The DWCPF (S-fund) was down yesterday, but it could have been a lot worse. The best part of the action was that the gap that we have been watching, got filled at the lows yesterday. There's more work to do, but that's another good show from support.

ACWX (I fund) ended the day in positive territory and the channel continues to hold. The I-fund was given a 0.66% gain as payback for Monday's short-change. More impressive relative strength from this fund.

BND (bonds / F-fund) was down early, tested its 50-day average, and rebounded. Yields are trending higher, but not at a pace that is hurting the F-fund or the stock market yet.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

No break out to new highs yet for the S&P 500 as Monday's close call was reversed yesterday and the index continues to churn in a range. The S-fund was down slightly after an afternoon come back and the chart did something we've been waiting for, and the I-fund actually posted a gain yesterday, and got some payback. Yields and the dollar were mostly flat, so they weren't major factors.

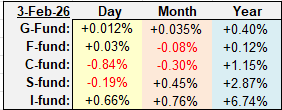

| Daily TSP Funds Return More returns |

The positive reversal yesterday did coincide with the House of Representative passing the Senate's version of the spending bill. The government shutdown is over. I had my ear plugs in to avoid the noise, and the charts did a good job of telling the story.

The big tech giants were falling again yesterday with three Mag 7 stocks losing over 2% on the day, and the losses were contagious, although by the close we saw stocks, particularly small caps, rebound from the early afternoon lows.

The Nasdaq 100 large cap tech stock index was down 1.55%, but it held at that moving average for a third straight time. The problem here is the NDX has triggered multiple Hindenburg Omen warnings in recent days.

The S&P 500 (C-fund), less tech heavy but still at the mercy of the large cap techs, was down 0.84% with the 59-point loss, but it held at its lows in a very convenient place as well. The bottom of the gap opened on January 20th, was retested, as was the 50-day moving average, and everything held for another day. The longer it churns, the bigger the next move, but it doesn't necessarily mean the move will be upward. That's why the bulls may need to make their move sooner, rather than later, because the window could close. It needs the Nasdaq to cooperate. Both are under Hindenburg Omen Warning watches.

The PMO momentum indicator is still sloping downward, and that's usually not a great sign, but it has been doing that since that indicator peaked last summer. The MACD indicator (moving average convergence / divergence) made a higher low, confirming the S&P 500's higher low.

Then we moved onto the small caps, which also avoided the loss as the Russell 2000 added a modest gain after a midday decline in sympathy with the large cap losses. As you'll down below, the S-fund was down just modestly.

And finally the Dow Transportation Index wasn't concerned about the noise yesterday either, and the economically sensitive index has been riding high on the improving data we've been getting. It made another new all time high yesterday with another 2% gain.

Silver and gold are back to their winning ways with both jumping sharply yesterday. Those are some big moves for these ancient metals.

AMD reported after the closing bell last night, and it was trading sharply lower, which could keep the pressure on tech stocks to start the day today.

Google (Alphabet) is scheduled to report after the closing bell today, and Amazon will report tomorrow..

The January jobs report was scheduled to be released this Friday, but the BLS says it could be delayed because of the government shut down.

Additional TSP Fund Charts:

The DWCPF (S-fund) was down yesterday, but it could have been a lot worse. The best part of the action was that the gap that we have been watching, got filled at the lows yesterday. There's more work to do, but that's another good show from support.

ACWX (I fund) ended the day in positive territory and the channel continues to hold. The I-fund was given a 0.66% gain as payback for Monday's short-change. More impressive relative strength from this fund.

BND (bonds / F-fund) was down early, tested its 50-day average, and rebounded. Yields are trending higher, but not at a pace that is hurting the F-fund or the stock market yet.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.