02/18/26

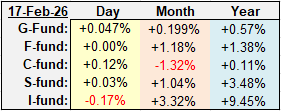

Stocks opened flat, then bounced around in a wide range looking for direction, before closing near the flat line again. The big three indices and small caps closed with small gains, while the I-fund slipped after an early rally in the dollar, which later faded. Bonds were flat as well.

If you didn't like what you saw while the stock market was open for business yesterday, you just had to wait around because it likely changed after that. It traded in a 90-point, 1.3% range, which is basically what a VIX reading near 20 suggested.

The S&P 500 (C-fund) still has the bearish Wyckoff Distribution pattern look going on, so let's get that out of the way, but there are so many mixed messages popping up making the direction of the next larger move quite uncertain. The S&P has now closed below the 50-day average and the red trading channel for three straight days, which is generally a bearish sign, although back in November there was fake out on the downside before the bullish trend resumed.

According to Goldman Sachs: "...the S&P 500 is off to its worst year of relative performance versus ACWI ex. US since 1995."

I'm not sure how accurate that is, but as far as I can tell, the C-fund caught up pretty well by the end of 1995. We didn't have an I-fund back then, but that is the equivalent return of the ACWI ex. US from 1995.

And here is the ACWX (I fund). The lower support line came up big again after a morning test of the bottom of it trading channel. The trend is strong, but support is very thin if there is any kind of shakeout.

The dollar (UUP) rallied early yesterday, hit the 50-day average and reversed lower, closing below both the 50 and 200-day averages again. There may be some support from the old red resistance line near 26.90, but for now this is still trending lower.

The 10-Year Treasury Yield was down early but reversed higher after nearly filling in an open gap from late November. Visually it may be considered filled, but technically there is a little white space before hitting the closing price on that last day in November. If this does hold at the bottom of the gap, the F-fund could witness a pullback.

The 30-Year Treasury Yield also filled in its late November gap yesterday. Can it find some support here or are yields and interest rates going lower?

The Dow Transportation Index had a big day gaining 1% after the recent pullback reversed higher last week. This market leader is suggesting a bullish outcome for the followers, and...

... the financial sector also saw some life yesterday. Broad market rallies tend to need the financials to come along for the ride, and the XLF has not been helping. Perhaps the recent positive reversal will create a low - but it does remain below the key moving averages so this is not gimme.

It's a busy week for economic data, highlighted by the latest PCE Pricing inflation data on Friday.

Additional TSP Fund Charts:

The DWCPF (S-fund) was flat after recovering some early losses. It continues to hold at the 50-day average, which is always a good sign after a pullback. That could change today, but right now the bulls are buying the dips here, and falling yields are not hurting the small caps' situation.

BND (bonds / F-fund) was flat and able to hold near the recent highs. Technically, there are enough open gaps below to be leery about jumping into bonds at this level.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks opened flat, then bounced around in a wide range looking for direction, before closing near the flat line again. The big three indices and small caps closed with small gains, while the I-fund slipped after an early rally in the dollar, which later faded. Bonds were flat as well.

| Daily TSP Funds Return More returns |

If you didn't like what you saw while the stock market was open for business yesterday, you just had to wait around because it likely changed after that. It traded in a 90-point, 1.3% range, which is basically what a VIX reading near 20 suggested.

The S&P 500 (C-fund) still has the bearish Wyckoff Distribution pattern look going on, so let's get that out of the way, but there are so many mixed messages popping up making the direction of the next larger move quite uncertain. The S&P has now closed below the 50-day average and the red trading channel for three straight days, which is generally a bearish sign, although back in November there was fake out on the downside before the bullish trend resumed.

According to Goldman Sachs: "...the S&P 500 is off to its worst year of relative performance versus ACWI ex. US since 1995."

I'm not sure how accurate that is, but as far as I can tell, the C-fund caught up pretty well by the end of 1995. We didn't have an I-fund back then, but that is the equivalent return of the ACWI ex. US from 1995.

And here is the ACWX (I fund). The lower support line came up big again after a morning test of the bottom of it trading channel. The trend is strong, but support is very thin if there is any kind of shakeout.

The dollar (UUP) rallied early yesterday, hit the 50-day average and reversed lower, closing below both the 50 and 200-day averages again. There may be some support from the old red resistance line near 26.90, but for now this is still trending lower.

The 10-Year Treasury Yield was down early but reversed higher after nearly filling in an open gap from late November. Visually it may be considered filled, but technically there is a little white space before hitting the closing price on that last day in November. If this does hold at the bottom of the gap, the F-fund could witness a pullback.

The 30-Year Treasury Yield also filled in its late November gap yesterday. Can it find some support here or are yields and interest rates going lower?

The Dow Transportation Index had a big day gaining 1% after the recent pullback reversed higher last week. This market leader is suggesting a bullish outcome for the followers, and...

... the financial sector also saw some life yesterday. Broad market rallies tend to need the financials to come along for the ride, and the XLF has not been helping. Perhaps the recent positive reversal will create a low - but it does remain below the key moving averages so this is not gimme.

It's a busy week for economic data, highlighted by the latest PCE Pricing inflation data on Friday.

Additional TSP Fund Charts:

The DWCPF (S-fund) was flat after recovering some early losses. It continues to hold at the 50-day average, which is always a good sign after a pullback. That could change today, but right now the bulls are buying the dips here, and falling yields are not hurting the small caps' situation.

BND (bonds / F-fund) was flat and able to hold near the recent highs. Technically, there are enough open gaps below to be leery about jumping into bonds at this level.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.