11/25/25

Stocks rebounded for a second day with the AI stocks boosting the Nasdaq to lead the way. Small caps also did well while the I-fund lagged, but they didn't take the same beating that the US TSP funds took during the pullback. The rebound started near a solid support area on the charts and the downtrend is still intact so it's not quite all's clear yet.

This is just day number two off a recent low and the nasty negative reversal day last Thursday which does not look good on any chart. Until some overhead resistance gets taken out, I think we need to be leery, but once that happens, it could remain very good.

For those keeping track, the probability of a 0.25% interest rate cut at the December FOMC meeting is up to 84%. That sure took a round trip from 90's to the low 30's at one point, and now back to the mid-80's, and of course the stock market took the ride with it.

The bond market is also pricing it in as yields are falling again.

The S&P 500 (C-fund) gained 1.55% on the day and the reversal and rebound off the orange 100-day average is looking impressive and encouraging, but as I just mentioned, last Thursday's massive negative reversal day is not something that can always be dismissed. The index is retracing that candlestick now and there's more work to be done to get above resistance. Unfortunately it may take a move above 6800 before the bulls can stop looking over their shoulder.

Interest rates have been a key catalyst for stocks, but bitcoin has also been telling us a little something as well. I have said before that what bitcoin and other crypto-currencies are doing, is a good indication of investor's appetite for risk. Bitcoin peaked a few weeks before the S&P 500, so the huge positive reversal on the 21st is encouraging for the stock market, but of course, that bottom must hold near 80K if retested.

We will get the PPI wholesale inflation data this morning, which could have an impact on interest rates. Watch the bond yields this morning.

From tsp.gov: Holiday Closing: Some financial markets will be closed on Thursday, November 27, in observance of Thanksgiving Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (November 27) will be processed Friday night (November 28) at Friday's closing share prices.

The DWCPF Index (S-Fund) has rebounded nicely off its 200-day average, it moved above the red support line that had broken down last week, but this remains in a down trend and still has something to prove. If yields can continue lower, and bitcoin indicates liquidity is improving, it should translate into small caps having a nice run into the end of the year. But no rate cut, and / or bitcoin making a lower low would kill that theory.

ACWX (I-fund) was up but it is not rebounding quite like the US stock market, but then again the I-fund did not take the same dramatic hit that US stock funds took this month.

BND (bonds / F-fund) was up on the prospect of lower interest rates and it has now closed above the September highs again, and so far that 50-day average has been solid support after the recent pullback.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks rebounded for a second day with the AI stocks boosting the Nasdaq to lead the way. Small caps also did well while the I-fund lagged, but they didn't take the same beating that the US TSP funds took during the pullback. The rebound started near a solid support area on the charts and the downtrend is still intact so it's not quite all's clear yet.

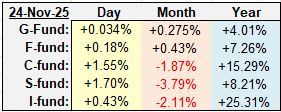

| Daily TSP Funds Return More returns |

This is just day number two off a recent low and the nasty negative reversal day last Thursday which does not look good on any chart. Until some overhead resistance gets taken out, I think we need to be leery, but once that happens, it could remain very good.

For those keeping track, the probability of a 0.25% interest rate cut at the December FOMC meeting is up to 84%. That sure took a round trip from 90's to the low 30's at one point, and now back to the mid-80's, and of course the stock market took the ride with it.

The bond market is also pricing it in as yields are falling again.

The S&P 500 (C-fund) gained 1.55% on the day and the reversal and rebound off the orange 100-day average is looking impressive and encouraging, but as I just mentioned, last Thursday's massive negative reversal day is not something that can always be dismissed. The index is retracing that candlestick now and there's more work to be done to get above resistance. Unfortunately it may take a move above 6800 before the bulls can stop looking over their shoulder.

Interest rates have been a key catalyst for stocks, but bitcoin has also been telling us a little something as well. I have said before that what bitcoin and other crypto-currencies are doing, is a good indication of investor's appetite for risk. Bitcoin peaked a few weeks before the S&P 500, so the huge positive reversal on the 21st is encouraging for the stock market, but of course, that bottom must hold near 80K if retested.

We will get the PPI wholesale inflation data this morning, which could have an impact on interest rates. Watch the bond yields this morning.

From tsp.gov: Holiday Closing: Some financial markets will be closed on Thursday, November 27, in observance of Thanksgiving Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (November 27) will be processed Friday night (November 28) at Friday's closing share prices.

The DWCPF Index (S-Fund) has rebounded nicely off its 200-day average, it moved above the red support line that had broken down last week, but this remains in a down trend and still has something to prove. If yields can continue lower, and bitcoin indicates liquidity is improving, it should translate into small caps having a nice run into the end of the year. But no rate cut, and / or bitcoin making a lower low would kill that theory.

ACWX (I-fund) was up but it is not rebounding quite like the US stock market, but then again the I-fund did not take the same dramatic hit that US stock funds took this month.

BND (bonds / F-fund) was up on the prospect of lower interest rates and it has now closed above the September highs again, and so far that 50-day average has been solid support after the recent pullback.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.