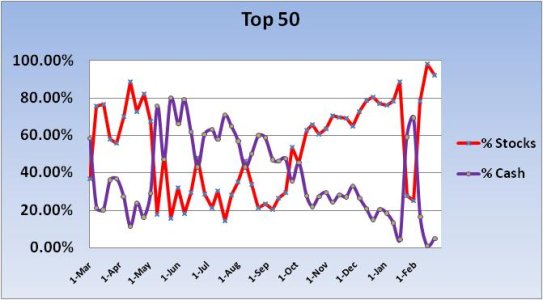

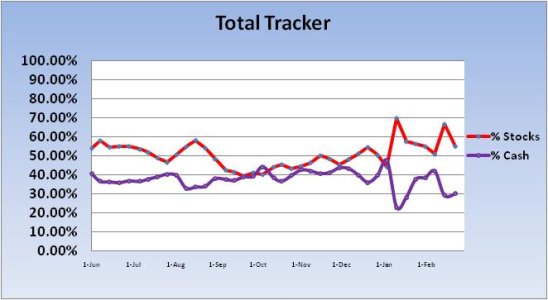

It wasn't anything dramatic, but our collective stock exposure dipped over the past week. Here's the charts:

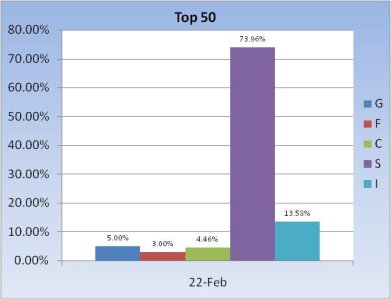

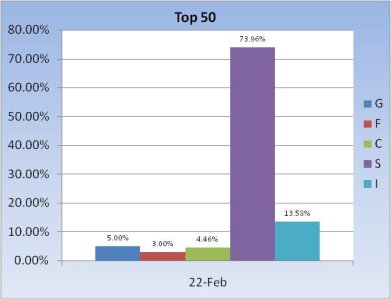

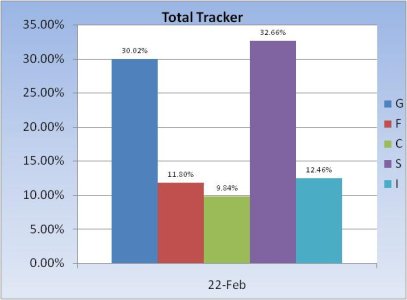

The Top 50 is still overwhelmingly bullish with the S fund leading overall stock exposure by a wide margin.

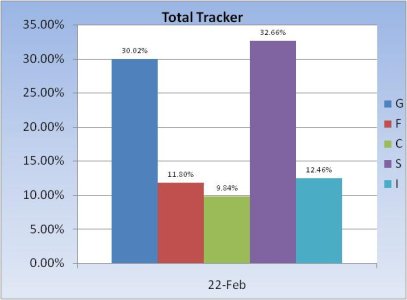

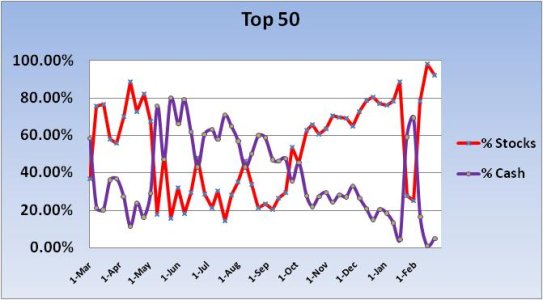

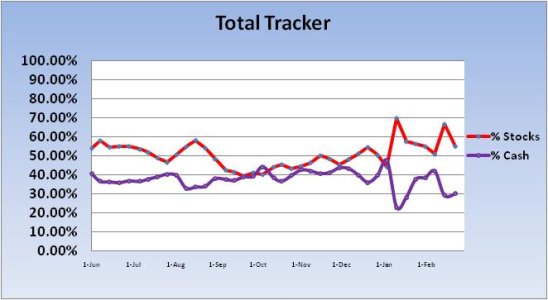

The herd sold about 11.5% of their stock holdings and moved into the F fund (up 8%) and the G fund (up 2%). I'm inclined to believe we're lightening up in response to the global news flow regarding rioting across the Middle East and North Africa as well as our domestic news focusing on a possible Government shutdown when the current CRA expires. News aside, there's still not much to suggest this market is going anywhere but up, minor dips notwithstanding.

When will that cease to be the case? That's the question on many traders and investors minds. Some think we'll trade higher until QE2 is complete, and that if a QE3 is deployed the market will react differently. That's still some ways off though, assuming this theory is even correct.

The Top 50 is still overwhelmingly bullish with the S fund leading overall stock exposure by a wide margin.

The herd sold about 11.5% of their stock holdings and moved into the F fund (up 8%) and the G fund (up 2%). I'm inclined to believe we're lightening up in response to the global news flow regarding rioting across the Middle East and North Africa as well as our domestic news focusing on a possible Government shutdown when the current CRA expires. News aside, there's still not much to suggest this market is going anywhere but up, minor dips notwithstanding.

When will that cease to be the case? That's the question on many traders and investors minds. Some think we'll trade higher until QE2 is complete, and that if a QE3 is deployed the market will react differently. That's still some ways off though, assuming this theory is even correct.