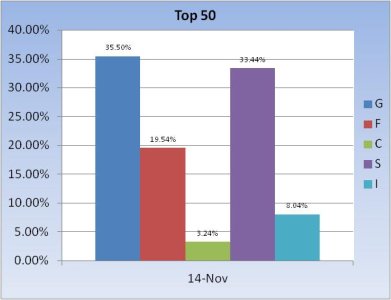

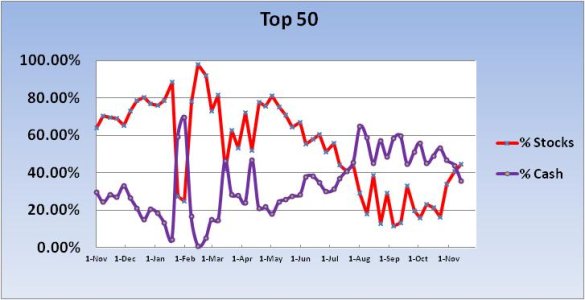

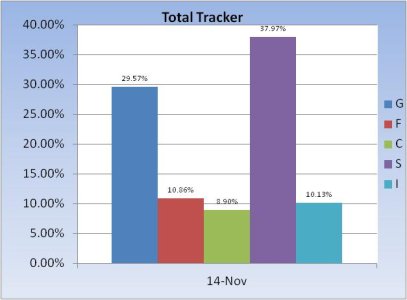

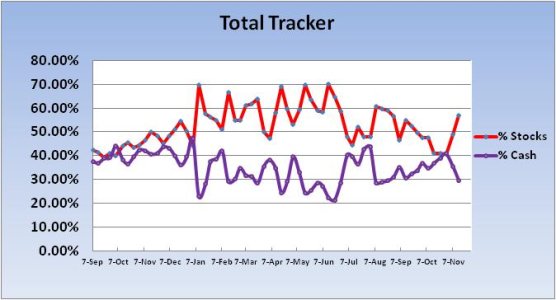

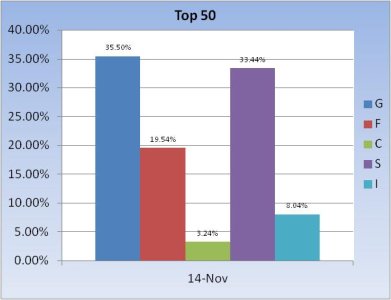

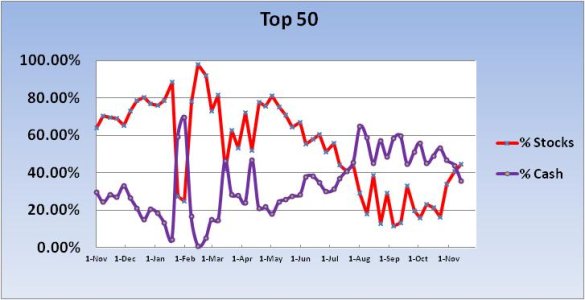

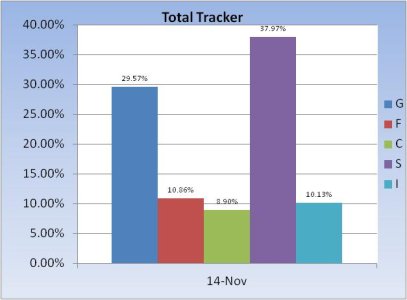

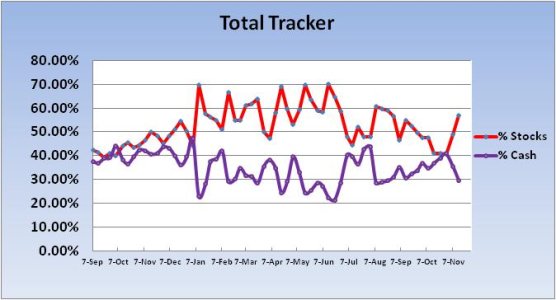

We're getting more bullish. Last week the Top 50 increased their collective stock exposure by 6.6%. The week before that they had increased it by 17.82%. That trend continues this week. The herd also continued to ramp up their collective stock allocations as well. Here's the charts:

As you can see, the Top 50 now have a more stock exposure than G fund exposure. They increased their stock allocatioin by 4.4% this week, but their that allocation is still only totals 44.72%, so it's not over-the-top bullish by any means.

The herd increased their stock allocation the previous week by 8.2%. This week they jumped it up another 8.24%. Their total stock allocation also rose above the 50% mark to 57% for the coming week. That's moderately bullish and well above that of the Top 50.

So we're looking for that Christmas rally. Or should I say hoping the current rally continues. It just might too, but probably not without continued volatility.

The Seven Sentinels do remain on a buy, but they've flashed an unconfirmed sell signal twice in the past two weeks. But that doesn't necessarily mean a significant pullback is near. Not in this market. Although we have more headline risk coming. Today, Italy's Prime Minister stepped down. What will the market do come Monday given that fact. It was expected and it's possible it was a buy the rumor event. And the week after next is the super committee's deadline to reach agreement on a debt deal. Failure to do so will mean both political factions will suffer cuts to those programs they hold dearest.

So if you're in a buying mood, don't dwell on the news or else you may find yourself paralyzed.

Of course in this volatility it helps if you like roller coasters too.

As you can see, the Top 50 now have a more stock exposure than G fund exposure. They increased their stock allocatioin by 4.4% this week, but their that allocation is still only totals 44.72%, so it's not over-the-top bullish by any means.

The herd increased their stock allocation the previous week by 8.2%. This week they jumped it up another 8.24%. Their total stock allocation also rose above the 50% mark to 57% for the coming week. That's moderately bullish and well above that of the Top 50.

So we're looking for that Christmas rally. Or should I say hoping the current rally continues. It just might too, but probably not without continued volatility.

The Seven Sentinels do remain on a buy, but they've flashed an unconfirmed sell signal twice in the past two weeks. But that doesn't necessarily mean a significant pullback is near. Not in this market. Although we have more headline risk coming. Today, Italy's Prime Minister stepped down. What will the market do come Monday given that fact. It was expected and it's possible it was a buy the rumor event. And the week after next is the super committee's deadline to reach agreement on a debt deal. Failure to do so will mean both political factions will suffer cuts to those programs they hold dearest.

So if you're in a buying mood, don't dwell on the news or else you may find yourself paralyzed.

Of course in this volatility it helps if you like roller coasters too.