A late day slide dropped the major averages for modest to moderate losses by the close of trading today. The Dow fell -0.73%, while the S&P 500 dipped -0.41% and the Nasdaq -0.1%. Since the slide came at the end of the session, I can't help but think that was smart money talking. And given the market is still waiting for our pols to end the debt ceiling impasse (with just three trading days left until we hit a brick wall), risk may be beginning to take its toll.

But that's just an observation on my part and does not necessarily mean I am correct in my assessment.

Of note however, was the I fund's performance today, where it managed to tack on a gain of 0.6% thanks in part to a declining dollar.

Earnings season continues to be overall positive, although there have been some disappointments. But neither good or bad reports seem to be driving the overall market action at the moment.

Now let's go the charts:

NAMO and NYMO dipped lower after today's negative action. They both remain in sell conditions.

NAHL and NYHL also dipped lower and remain on sells.

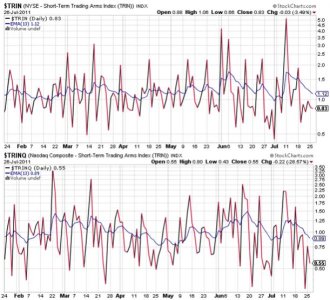

TRIN and TRINQ remain in buy conditions.

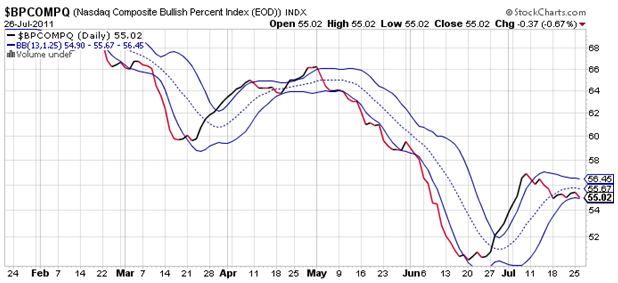

BPCOMPQ ticked a bit lower and that's not encouraging for the bulls. It has remained in a sell condition since the 12th of July.

So just like yesterday, TRIN and TRINQ are the only signals in a buy condition. But consider this; while the Seven Sentinels are technically still in a buy condition, it would not take more than one day of hard selling to trigger an official intermediate term sell signal. NYMO is now only about 14 points from a 28 day trading low, which is critical to trigger a confirmed sell signal.

But again it is a news driven market that could go either way depending on what happens (or doesn't happen) in DC.

I remain 100% G fund for now.