Another choppy day of trade, but the market did manage to stage a rally late in the day, which saw the S&P close at 1.1%, but the Wilshire 4500 only managed a tepid 0.16%. The fact that the broader market only managed a paltry gain while large caps gained almost 7 times that amount is still cause for concern.

The euro managed a modest gain as well, which seems to support the notion that the market does well when the euro rallies. Since there's little reason to think the euro can stage a sustained rally given the continuing debt problems in the European theater, I would not expect our domestic market to reverse its current trend any time soon.

The Seven Sentinels continue to paint an unhealthy picture of this market. Take a look at the charts:

Yes, NYMO managed to flip to a buy, but NAMO did not. No strength here.

NAHL and NYHL dipped lower in spite of today's gains.

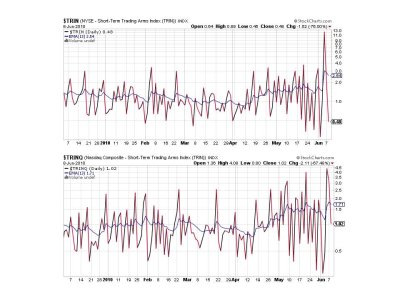

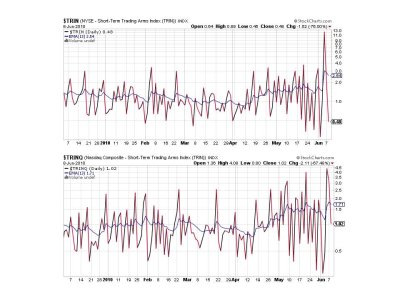

TRIN and TRINQ are back in buy territory, but are indicating an overbought market.

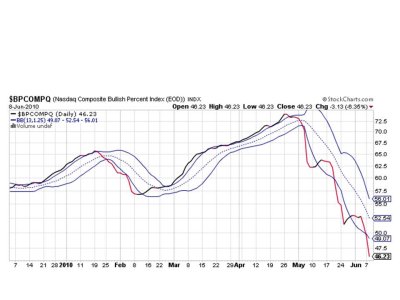

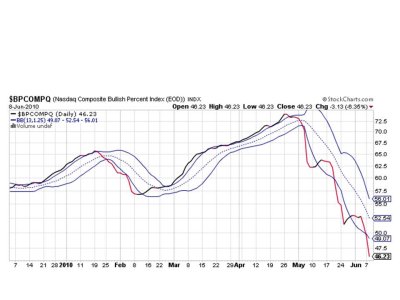

Lower still for BPCOMPQ. Not a good sign.

So we have 4 of 7 signals on a sell, but technically the system is still on a buy. Frankly, given the volatility and severe economic distress we're seeing across the globe, I can't trust a buy signal at this time. Two buy signal whipsaws and a lack of IFTs has me down about 10% from my high last month. But that seems to be a theme across the message board.

Out of 381 folks being tracked on the tracker, only 106 are in positive territory. That means more than 7 out of 10 TSPers are underwater. It certainly doesn't take long for the market to take back what it gives. That's it for this evening. See you tomorrow.

The euro managed a modest gain as well, which seems to support the notion that the market does well when the euro rallies. Since there's little reason to think the euro can stage a sustained rally given the continuing debt problems in the European theater, I would not expect our domestic market to reverse its current trend any time soon.

The Seven Sentinels continue to paint an unhealthy picture of this market. Take a look at the charts:

Yes, NYMO managed to flip to a buy, but NAMO did not. No strength here.

NAHL and NYHL dipped lower in spite of today's gains.

TRIN and TRINQ are back in buy territory, but are indicating an overbought market.

Lower still for BPCOMPQ. Not a good sign.

So we have 4 of 7 signals on a sell, but technically the system is still on a buy. Frankly, given the volatility and severe economic distress we're seeing across the globe, I can't trust a buy signal at this time. Two buy signal whipsaws and a lack of IFTs has me down about 10% from my high last month. But that seems to be a theme across the message board.

Out of 381 folks being tracked on the tracker, only 106 are in positive territory. That means more than 7 out of 10 TSPers are underwater. It certainly doesn't take long for the market to take back what it gives. That's it for this evening. See you tomorrow.