There wasn't much change in allocations over the past week for either the Top 50 or the Total Tracker. Here's this week's charts:

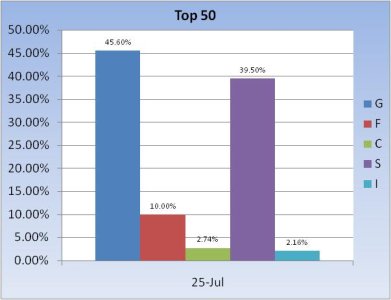

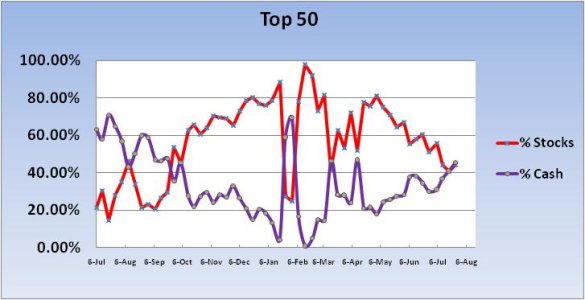

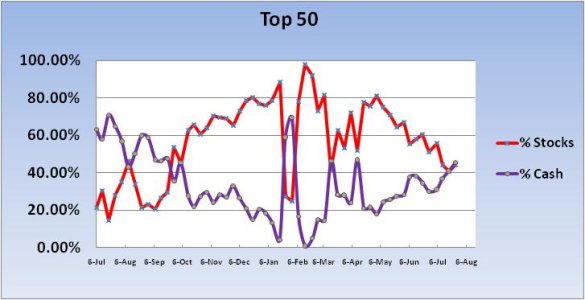

The Top 50 had pulled back a bit going into the past Monday's action, and that paid off considering the hard selling pressure we had that day. But then the market did a huge reversal on Tuesday, which more than made up those losses and added to those gains as the week went on.

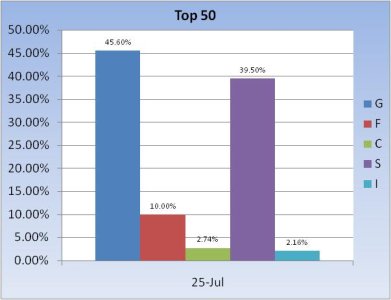

Now we can see that the Top 50 have added a bit to their overall stock position for this coming week, although only by 3.4%, but they've also added to their G fund position by 4.6%. Obviously that means they were selling the F fund. But since they raised their new allocations between stocks and cash, it's also obvious that they remain cautious.

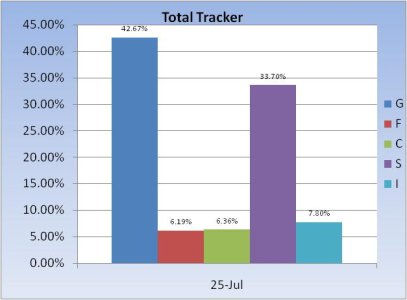

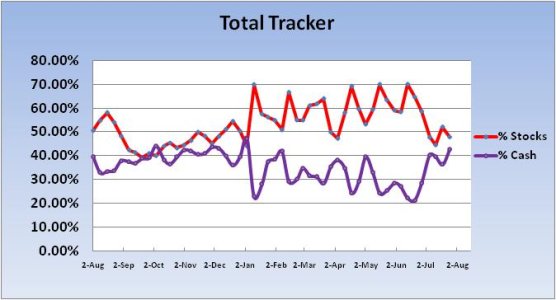

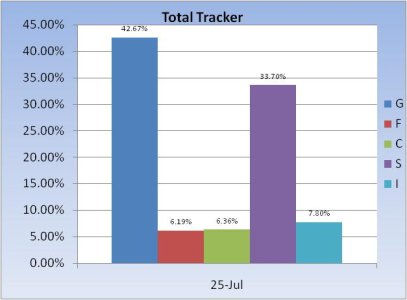

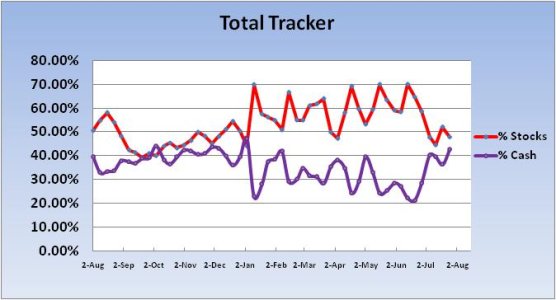

The herd on the hand, had raised their stock exposure going into this past Monday by more than 7.5%. And they were promptly punished for being early to the bull party on Monday. But if they held on, they made up for those losses and then some by the end of the week.

Going into the new week, the herd has lowered stock allocations a bit (selling rallies last week) by 4.24%, and they've raised their cash level by almost 6.5%.

Still, an overall stock allocation of 47.86% is also a conservative position as was the Top 50s allocation.

As far as the market goes, we are back near the top of the channel in the S&P 500 and given this is the last week before the debt ceiling deadline, one would think a big move will occur across the major averages. But which way? It could be both. My gut says that if a resolution is reached, we could rally initially, but then sell-off within a day or so (remember that extreme bullish reading by TRINQ Friday?). But honestly, this is an unpredictable situation. If we do sell-off, my intent is to buy the dip. If this market shows strength in the face of any selling pressure, I'll be buying sooner rather than later. But it will be a tricky entry nonetheless.

My advice? Have a plan A and a plan B ready to go and weigh your risk tolerance. And remember, this is the last week of July, so we'll have two new IFTs coming the following Monday.

The Top 50 had pulled back a bit going into the past Monday's action, and that paid off considering the hard selling pressure we had that day. But then the market did a huge reversal on Tuesday, which more than made up those losses and added to those gains as the week went on.

Now we can see that the Top 50 have added a bit to their overall stock position for this coming week, although only by 3.4%, but they've also added to their G fund position by 4.6%. Obviously that means they were selling the F fund. But since they raised their new allocations between stocks and cash, it's also obvious that they remain cautious.

The herd on the hand, had raised their stock exposure going into this past Monday by more than 7.5%. And they were promptly punished for being early to the bull party on Monday. But if they held on, they made up for those losses and then some by the end of the week.

Going into the new week, the herd has lowered stock allocations a bit (selling rallies last week) by 4.24%, and they've raised their cash level by almost 6.5%.

Still, an overall stock allocation of 47.86% is also a conservative position as was the Top 50s allocation.

As far as the market goes, we are back near the top of the channel in the S&P 500 and given this is the last week before the debt ceiling deadline, one would think a big move will occur across the major averages. But which way? It could be both. My gut says that if a resolution is reached, we could rally initially, but then sell-off within a day or so (remember that extreme bullish reading by TRINQ Friday?). But honestly, this is an unpredictable situation. If we do sell-off, my intent is to buy the dip. If this market shows strength in the face of any selling pressure, I'll be buying sooner rather than later. But it will be a tricky entry nonetheless.

My advice? Have a plan A and a plan B ready to go and weigh your risk tolerance. And remember, this is the last week of July, so we'll have two new IFTs coming the following Monday.