While trading was tentative for about the first half of the session, stocks managed to put together a rally later in the afternoon, most of which occurred while the Fed Chair, Ben Bernanke, was giving his first press conference. Apparently, the market liked his comments.

At 1230 EST, the latest FOMC policy statement was released, which didn't hold any surprises as the current Fed Funds Rate was kept place (0.00% to 0.25%) and the Fed expects it to remain that way for an extended period.

During the press conference, Mr. Bernanke indicated that the Fed had lowered its 2011 GDP forecast to a range of 3.1% to 3.3%. This was in contrast to the previous forecast of 3.4% to 3.9%. The GDP outlook for 2012 and 2013 were also modestly lowered.

The Fed Chair also announced that unemployment for 2011 should fall between 8.4% and 8.7%. This was a bit more "rosy" than the previous expectation of 8.8% to 9.0%.

While stocks rose moderately higher in reaction to the Fed Chairs comments, gold and silver rose sharply, with gold hitting about $1530 per ounce while silver exceeded $48 per ounce.

The following companies were among those that reported earnings today:

Amazon.com (AMZN 196.63, +14.33), Boeing (BA 76.12, +0.57), WellPoint (WLP 75.54, +2.57), ConocoPhillips (COP 79.83, -1.38), Hess (HES 82.74, +2.07), Baker Hughes (BHI 77.28, +3.22), and Broadcom (BRCM 35.45, -4.96).

Here's today's charts:

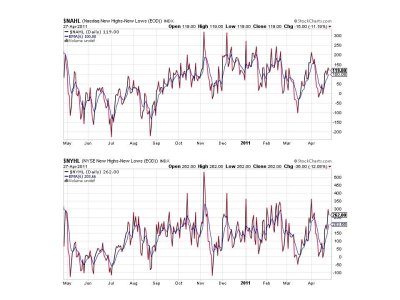

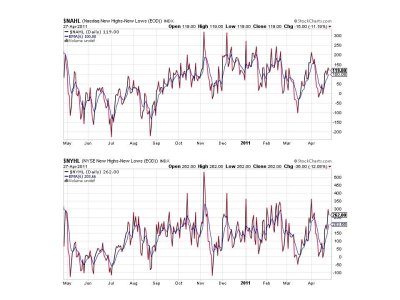

I went to 1 year charts for this evening to get a better idea of where the market may be headed in the next week or two. NAMO and NYMO were the two charts I was specifically interested in and we can see that aside from them remaining in a buy condition, they are also approaching a relatively high level (for the past year anyway). You can see that once they get near that 40 level, selling pressure can come back into play. Yes, it can go much higher as it did last summer, but the overall market was at much lower levels. I'm inclined to think we don't go parabolic at this stage of the game. We can go higher, I just don't expect it to be by leaps and bounds. But I also don't expect selling pressure to be too intense if we get it in the next week or so. For the time being, the latest Fed outlook may help keep a floor under this market.

NAHL and NYHL remain on buys.

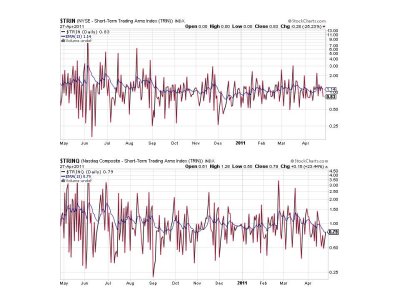

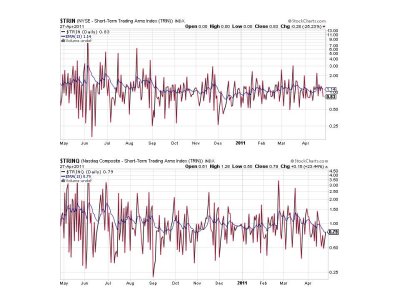

TRIN remained on a buy, but TRINQ just did flip to a sell. They are fairly neutral right now.

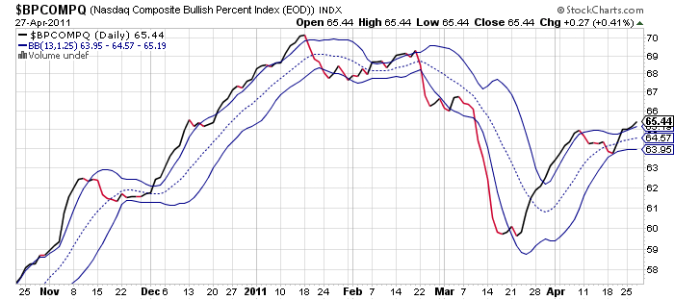

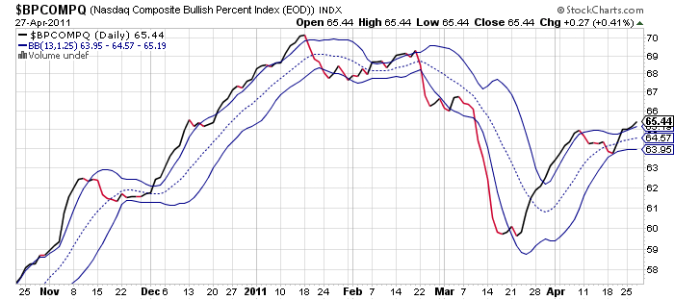

BPCOMPQ lifted up off that upper bollinger band a bit today, which suggests we're heading higher.

So all but one signal are flashing buys, which keeps the system in a buy condition.

The charts are looking more bullish again, and it seems just about every time these charts look overly bullish, the market turns. We may not be quite there yet however, but that's been the tendency. It's also possible the signals can moderate some without the market giving up too much. In other words, the market may go sideways with a bias higher. For now though, I think it's important to keep an eye on NAMO and NYMO and see where they begin to falter. Last month we got a modest clue that we were topping when momentum wavered for a few days after the signals got past 40. And then the bottom dropped out. Just something to watch.

At 1230 EST, the latest FOMC policy statement was released, which didn't hold any surprises as the current Fed Funds Rate was kept place (0.00% to 0.25%) and the Fed expects it to remain that way for an extended period.

During the press conference, Mr. Bernanke indicated that the Fed had lowered its 2011 GDP forecast to a range of 3.1% to 3.3%. This was in contrast to the previous forecast of 3.4% to 3.9%. The GDP outlook for 2012 and 2013 were also modestly lowered.

The Fed Chair also announced that unemployment for 2011 should fall between 8.4% and 8.7%. This was a bit more "rosy" than the previous expectation of 8.8% to 9.0%.

While stocks rose moderately higher in reaction to the Fed Chairs comments, gold and silver rose sharply, with gold hitting about $1530 per ounce while silver exceeded $48 per ounce.

The following companies were among those that reported earnings today:

Amazon.com (AMZN 196.63, +14.33), Boeing (BA 76.12, +0.57), WellPoint (WLP 75.54, +2.57), ConocoPhillips (COP 79.83, -1.38), Hess (HES 82.74, +2.07), Baker Hughes (BHI 77.28, +3.22), and Broadcom (BRCM 35.45, -4.96).

Here's today's charts:

I went to 1 year charts for this evening to get a better idea of where the market may be headed in the next week or two. NAMO and NYMO were the two charts I was specifically interested in and we can see that aside from them remaining in a buy condition, they are also approaching a relatively high level (for the past year anyway). You can see that once they get near that 40 level, selling pressure can come back into play. Yes, it can go much higher as it did last summer, but the overall market was at much lower levels. I'm inclined to think we don't go parabolic at this stage of the game. We can go higher, I just don't expect it to be by leaps and bounds. But I also don't expect selling pressure to be too intense if we get it in the next week or so. For the time being, the latest Fed outlook may help keep a floor under this market.

NAHL and NYHL remain on buys.

TRIN remained on a buy, but TRINQ just did flip to a sell. They are fairly neutral right now.

BPCOMPQ lifted up off that upper bollinger band a bit today, which suggests we're heading higher.

So all but one signal are flashing buys, which keeps the system in a buy condition.

The charts are looking more bullish again, and it seems just about every time these charts look overly bullish, the market turns. We may not be quite there yet however, but that's been the tendency. It's also possible the signals can moderate some without the market giving up too much. In other words, the market may go sideways with a bias higher. For now though, I think it's important to keep an eye on NAMO and NYMO and see where they begin to falter. Last month we got a modest clue that we were topping when momentum wavered for a few days after the signals got past 40. And then the bottom dropped out. Just something to watch.