We got some follow-through selling today, but why am I not surprised it didn't hold. Such is this market's strength.

This morning, initial jobless claims fell 18,000 to 460,000 for last week, which was worse than expected. Continuing claims dropped 131,000 to 4.55 million, which was better than anticipated. The market seemed to shrug off this data after the initial sell-off this morning and slowly climbed back to positive territory before closing with modest to moderate gains.

The Seven Sentinels continue to hold their own at this point and at the moment look bullish. Here's the charts:

NAMO is sitting on its 6 day EMA, which I'll consider a buy, while NYMO remains on a sell.

NAHL flipped to a sell today while NYHL remained on a sell. But both of these signals will flip back to buys with modest buying pressure, so nothing to worry about yet with these two.

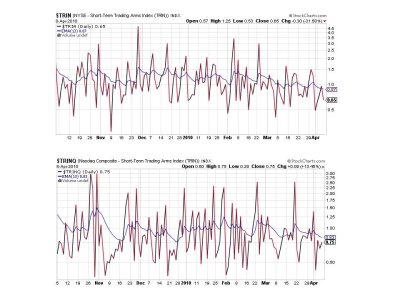

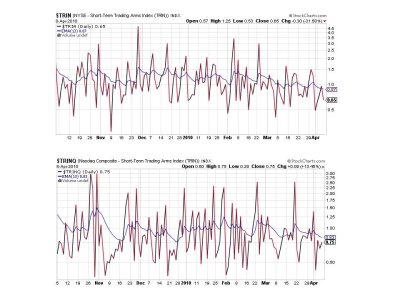

TRIN flipped back to a buy, while TRINQ remains on a buy.

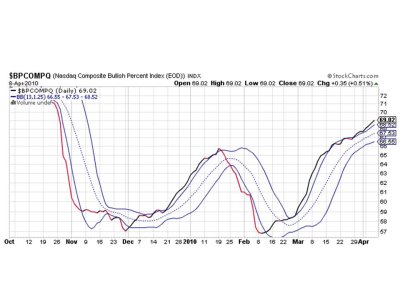

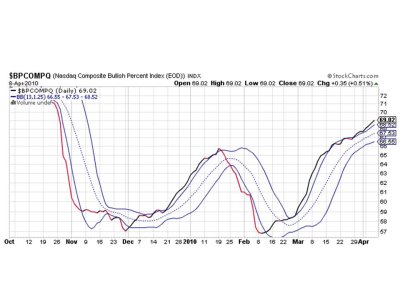

BPCOMPQ, while not moving quickly, does look bullish as it has maintained an upward bias even with recent selling pressure.

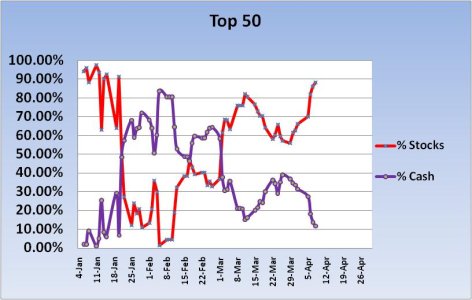

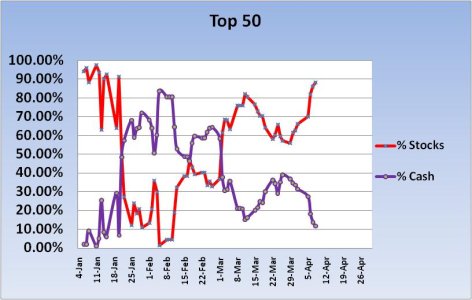

Here's a quick look at the Top 50. These folks have jumped on the train big time. The S fund is still the overwhelming choice for stock fund exposure.

So we have 4 of 7 signals on a buy, which keeps the system on a buy. As of today the overall picture looks bullish. There is very little market data being released between now and Monday so I would expect the market to chop around some unless some news comes out to drive it in one direction or another. That's it for this evening, see you tomorrow.

This morning, initial jobless claims fell 18,000 to 460,000 for last week, which was worse than expected. Continuing claims dropped 131,000 to 4.55 million, which was better than anticipated. The market seemed to shrug off this data after the initial sell-off this morning and slowly climbed back to positive territory before closing with modest to moderate gains.

The Seven Sentinels continue to hold their own at this point and at the moment look bullish. Here's the charts:

NAMO is sitting on its 6 day EMA, which I'll consider a buy, while NYMO remains on a sell.

NAHL flipped to a sell today while NYHL remained on a sell. But both of these signals will flip back to buys with modest buying pressure, so nothing to worry about yet with these two.

TRIN flipped back to a buy, while TRINQ remains on a buy.

BPCOMPQ, while not moving quickly, does look bullish as it has maintained an upward bias even with recent selling pressure.

Here's a quick look at the Top 50. These folks have jumped on the train big time. The S fund is still the overwhelming choice for stock fund exposure.

So we have 4 of 7 signals on a buy, which keeps the system on a buy. As of today the overall picture looks bullish. There is very little market data being released between now and Monday so I would expect the market to chop around some unless some news comes out to drive it in one direction or another. That's it for this evening, see you tomorrow.