An active week, for additional BLS & Holiday stats see previous blog.

16-Dec Nonfarm Payrolls

18-Dec Consumer Price Index

19-Dec Friday expect above average volume, as Options are set to expire.

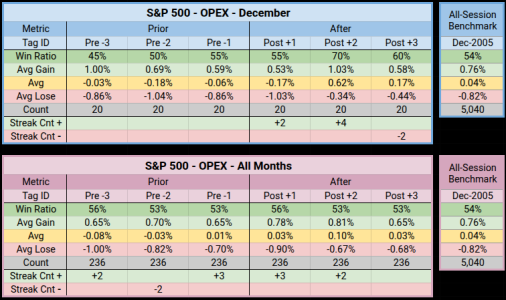

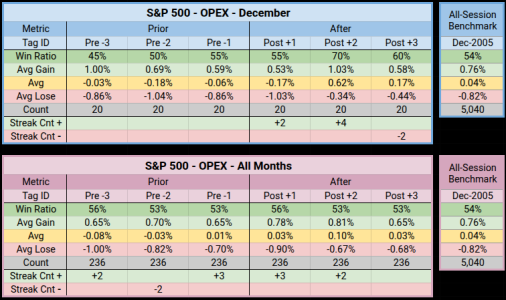

Volume in December Prior to Options Expiration (Pre -1) is usually in the Top 20%, while Post +1 Volume usually falls within the middle 40%

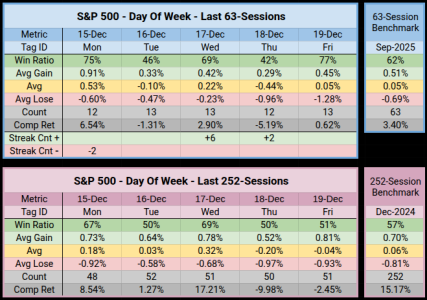

Across 63 Sessions:

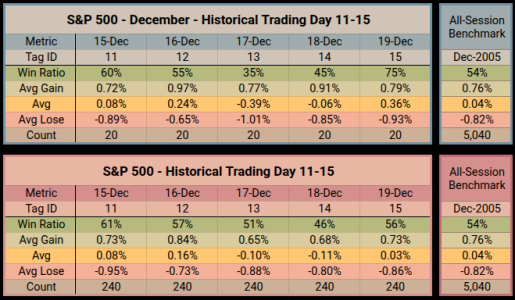

For trading Day of the Month:

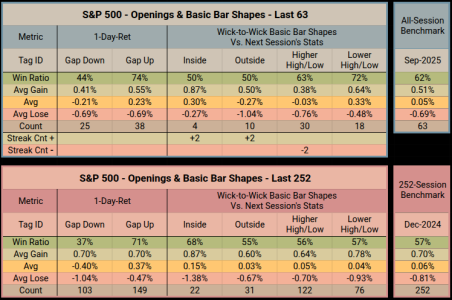

Friday closed with a Lower High/Low, which shows us the next session's returns have a positive bias.

Have a great week.... Jason

Stats: Closing Out 2025

Stats: Closing Out 2025

16-Dec Nonfarm Payrolls18-Dec Consumer Price Index

19-Dec Friday expect above average volume, as Options are set to expire.

Volume in December Prior to Options Expiration (Pre -1) is usually in the Top 20%, while Post +1 Volume usually falls within the middle 40%

- December's Post +2 Stats have an above average Outlier-driven return, due to 4.96% gain on 26-Dec-2018

- About 15% of December's OPEX stats weave in & out of the XMAS holiday bias.

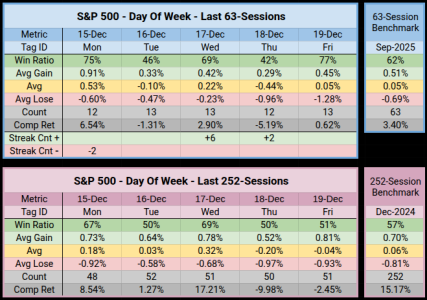

Across 63 Sessions:

- Monday is still the biggest gainer, but has lost some recent steam, the last 2 have closed down.

- Wednesday is working a positive 6-Streak

- Mon-Wed continue to be the bread winners

- In both session time-frames, Thursday has been an absolute tanker

- Thursday has the smallest number of +1% gainers in the set (only 2)

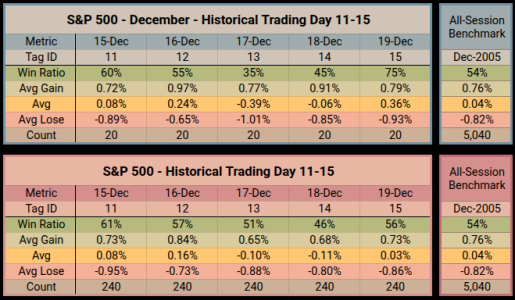

For trading Day of the Month:

- Persistent weakness usually shows up in Sessions 13 & 14

- Both have negative average returns on both the Dec & All-Month time-frames.

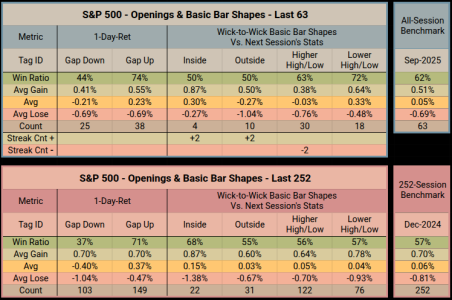

Friday closed with a Lower High/Low, which shows us the next session's returns have a positive bias.

- In theory, if this Monday we add a Gap Up with Friday's Lower High/Low, the performance of those two metrics together is stronger.

- Win Ratio 73%

- Avg Gain 1.05%

- Average 0.59%

- Avg Loss -0.64%

- Count 402

Have a great week.... Jason

Last edited: