Another listless trading day with a negative tone thanks to a dismal weekly jobless claims report.

Initial jobless claims hit a three month high at 479,000, which was worse than expected. Continuing claims did manage a decline of 34,000, but the 4.5 million total outstanding claims is nothing to cheer about.

So now the spotlight is on payrolls and its associated data. Volume was quite low today ahead of this report, so obviously this is the one the market cares about.

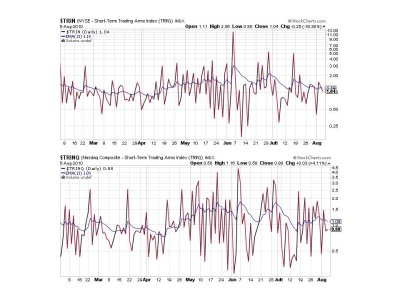

Here's the charts:

Back to sells here, but we're really just treading water at the moment.

Same with the A/D data, although NYHL is still on a buy.

Both TRIN and TRINQ are still flashing buys.

BPCOMPQ remains on a buy, but its about to start bumping up against the upper bollinger band. Still not a worry at this point.

So we have a neutral picture at the moment as it appears the market is waiting for something. But the system remains on a buy in any event.

I'm still 100% S fund, but I've noticed that fund has not been holding up as well as the C and especially the I. I'd like to spread my position out at this point, but I'm not so sure it's worth spending an IFT. I'd prefer looking for an opportunity to sell something into a rally and maybe reposition on the way back in if I can buy a dip. Easier said than done, but that's the way I'd like to do it.

The only other thing I'd like to mention is our message board is leaning decidedly bullish so far in this weeks sentiment survey. I've also noticed an uptick in the overall stock allocation of the Top 50. That could be problematic for the short term, but it could also present a buying opportunity if things get too bullish from a sentiment perspective.

See you tomorrow.

Initial jobless claims hit a three month high at 479,000, which was worse than expected. Continuing claims did manage a decline of 34,000, but the 4.5 million total outstanding claims is nothing to cheer about.

So now the spotlight is on payrolls and its associated data. Volume was quite low today ahead of this report, so obviously this is the one the market cares about.

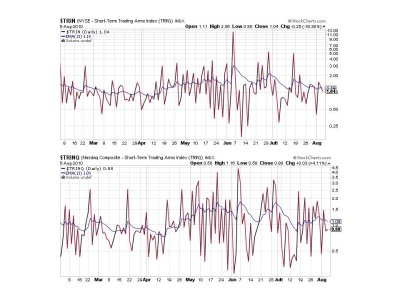

Here's the charts:

Back to sells here, but we're really just treading water at the moment.

Same with the A/D data, although NYHL is still on a buy.

Both TRIN and TRINQ are still flashing buys.

BPCOMPQ remains on a buy, but its about to start bumping up against the upper bollinger band. Still not a worry at this point.

So we have a neutral picture at the moment as it appears the market is waiting for something. But the system remains on a buy in any event.

I'm still 100% S fund, but I've noticed that fund has not been holding up as well as the C and especially the I. I'd like to spread my position out at this point, but I'm not so sure it's worth spending an IFT. I'd prefer looking for an opportunity to sell something into a rally and maybe reposition on the way back in if I can buy a dip. Easier said than done, but that's the way I'd like to do it.

The only other thing I'd like to mention is our message board is leaning decidedly bullish so far in this weeks sentiment survey. I've also noticed an uptick in the overall stock allocation of the Top 50. That could be problematic for the short term, but it could also present a buying opportunity if things get too bullish from a sentiment perspective.

See you tomorrow.