It was a relatively quiet day with little data or news to drive the market and it was evident in the day's action. Stocks chopped around most of the day before closing mixed with the S&P and EAFE (I fund) posting a modest gain, while the Wilshire 4500 (S fund) closed with a modest loss. The F fund experienced more selling pressure and closed down 0.48%.

In fact, the yield on the 10-year Note hit a six-month high of almost 3.33% before closing the session at 3.24%.

The selling pressure in the bond market is telling us something, but exactly what I'm not sure as there's several plausible reasons and not all of them are good for the stock market, so my caution flag is out.

Yesterday's charts looked like a mixed bag to me with NYMO dropping two days in a row, while NAHL and NYHL spiked higher. This evening's charts continue to tell me something's not right and are beginning to look somewhat bearish. Let's take a look:

NAMO turned down today, but remained on a buy, while NYMO made it three straight lower closes. That's not encouraging.

After spiking higher yesterday, NAHL and NYHL spiked lower today and flipped to sells. That's not encouraging either.

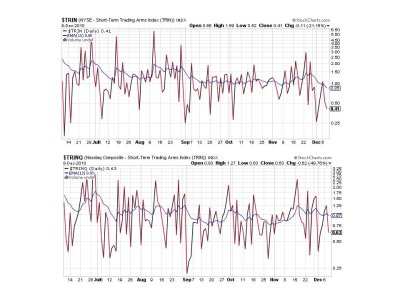

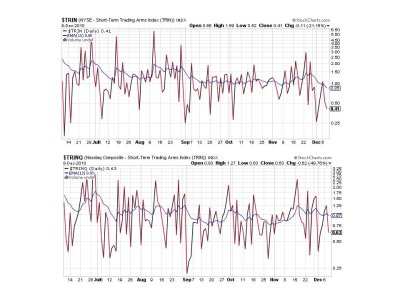

TRIN and TRINQ are both on buys, but suggesting an overbought market.

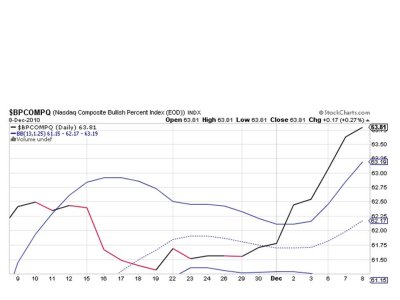

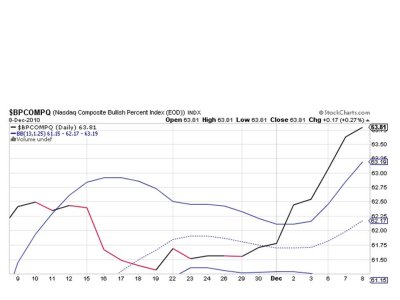

I was not able to show the BPCOMPQ chart yesterday, but we can see it actually rose both yesterday and today. This signal by itself looks bullish and remains on a buy.

The sentinels never confirmed a buy signal after flashing all buys last week as NYMO never hit a new 28 day trading high. So technically the system is still on a sell. And while last week's buying action appeared to suggest the market was turning back up, we may turn back down instead. I am not convinced of anything at this point, but I see risk in these charts. Especially after watching NYMO drop three days straight and now NAHL and NYHL flipping to sells.

I remain on the sidelines and I'm not as anxious about buying any dip as I was earlier this week.

In fact, the yield on the 10-year Note hit a six-month high of almost 3.33% before closing the session at 3.24%.

The selling pressure in the bond market is telling us something, but exactly what I'm not sure as there's several plausible reasons and not all of them are good for the stock market, so my caution flag is out.

Yesterday's charts looked like a mixed bag to me with NYMO dropping two days in a row, while NAHL and NYHL spiked higher. This evening's charts continue to tell me something's not right and are beginning to look somewhat bearish. Let's take a look:

NAMO turned down today, but remained on a buy, while NYMO made it three straight lower closes. That's not encouraging.

After spiking higher yesterday, NAHL and NYHL spiked lower today and flipped to sells. That's not encouraging either.

TRIN and TRINQ are both on buys, but suggesting an overbought market.

I was not able to show the BPCOMPQ chart yesterday, but we can see it actually rose both yesterday and today. This signal by itself looks bullish and remains on a buy.

The sentinels never confirmed a buy signal after flashing all buys last week as NYMO never hit a new 28 day trading high. So technically the system is still on a sell. And while last week's buying action appeared to suggest the market was turning back up, we may turn back down instead. I am not convinced of anything at this point, but I see risk in these charts. Especially after watching NYMO drop three days straight and now NAHL and NYHL flipping to sells.

I remain on the sidelines and I'm not as anxious about buying any dip as I was earlier this week.