We mostly saw better-than-expected earnings reports today, but that didn't prevent the market from doing another quick reversal, which wiped out most of yesterday's gains.

Interestingly, some positive after-hours earnings reports are seeing their respective stocks trader higher this evening, which makes me wonder which direction the market will go tomorrow morning. Of course there will be more earnings reports released tomorrow, but we are seeing increased volatility regardless of the news, so it will be interesting to see whether we finally get some follow-through to the down side or if today was yet another dip buying opportunity.

Tomorrow morning, two economic reports are scheduled to be released (Initial Claims and Continuing Claims). That gives us another couple of potential catalysts for market action.

The Seven Sentinels flipped over again and issued a second sell signal in three trading days. I would say that nested signals like this probably mean a big move is coming, and since we are due for a pullback that would be the logical direction we'd go, but if we don't get that follow-through soon we could begin the next up-leg instead. That's not my expectation, but it will depend on how we trade between now and Friday.

Monday's have been big up days for months as most of you know and that's another reason I'm expecting a move lower. The masses have been trained to buy dips and to be in the market on Mondays so this would be a good time to suck the bulls into a moderate correction.

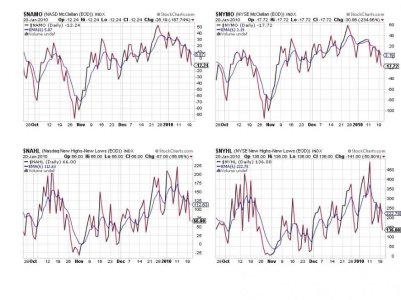

Here's today's charts:

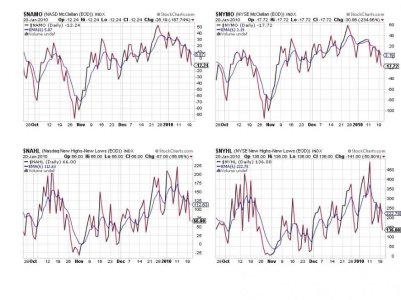

All four are back to sell conditions here and we can see NAMO and NYMO continue to slope downwards.

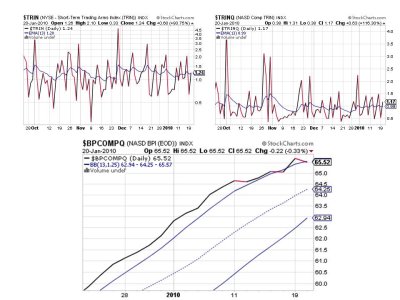

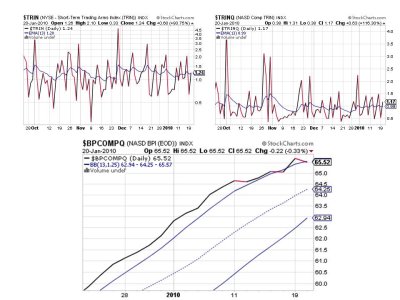

Back to sell conditions here too, but still sitting on support.

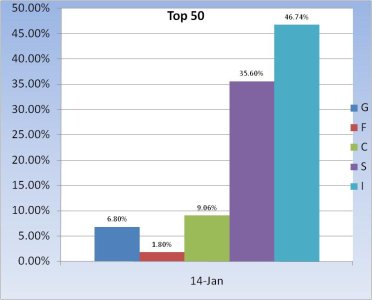

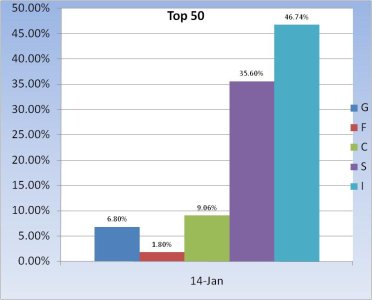

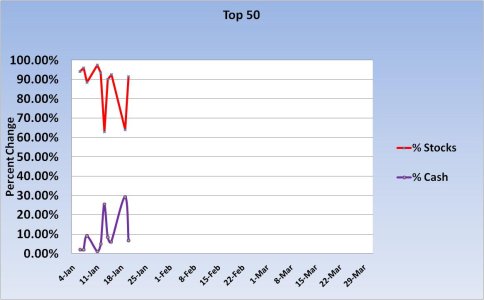

Our Top 50 were clobbered today (especially those folks with significant I fund exposure) so these two charts will change dramatically tomorrow.

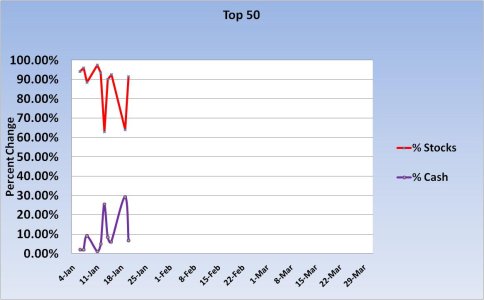

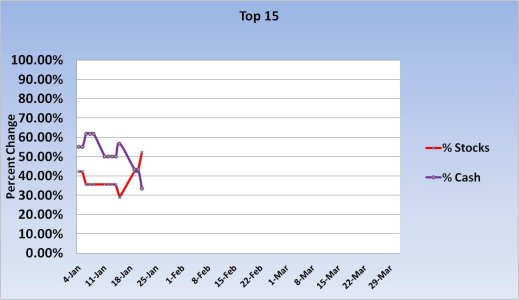

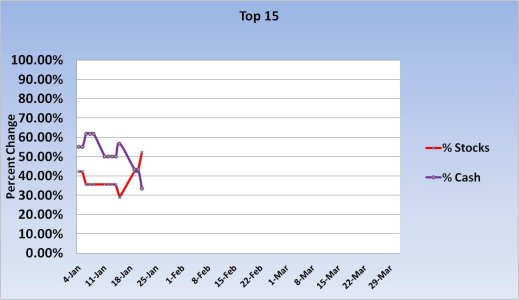

Our Top 15 is doing exactly what I expected. They're slowly moving back into stocks. As we can see they are finally holding more stocks than cash at this time, but I would not call this more than modestly bullish at this point. Further downside action should push stock exposure higher unless things really begin to fall apart.

So the Seven Sentinels system is back to a sell condition and as I've already mentioned I tend to believe that nested signals like this may mean a more significant move is coming soon. I'm expecting it to be to the downside, but the market will have the final say on my prediction.

See you tomorrow.

Interestingly, some positive after-hours earnings reports are seeing their respective stocks trader higher this evening, which makes me wonder which direction the market will go tomorrow morning. Of course there will be more earnings reports released tomorrow, but we are seeing increased volatility regardless of the news, so it will be interesting to see whether we finally get some follow-through to the down side or if today was yet another dip buying opportunity.

Tomorrow morning, two economic reports are scheduled to be released (Initial Claims and Continuing Claims). That gives us another couple of potential catalysts for market action.

The Seven Sentinels flipped over again and issued a second sell signal in three trading days. I would say that nested signals like this probably mean a big move is coming, and since we are due for a pullback that would be the logical direction we'd go, but if we don't get that follow-through soon we could begin the next up-leg instead. That's not my expectation, but it will depend on how we trade between now and Friday.

Monday's have been big up days for months as most of you know and that's another reason I'm expecting a move lower. The masses have been trained to buy dips and to be in the market on Mondays so this would be a good time to suck the bulls into a moderate correction.

Here's today's charts:

All four are back to sell conditions here and we can see NAMO and NYMO continue to slope downwards.

Back to sell conditions here too, but still sitting on support.

Our Top 50 were clobbered today (especially those folks with significant I fund exposure) so these two charts will change dramatically tomorrow.

Our Top 15 is doing exactly what I expected. They're slowly moving back into stocks. As we can see they are finally holding more stocks than cash at this time, but I would not call this more than modestly bullish at this point. Further downside action should push stock exposure higher unless things really begin to fall apart.

So the Seven Sentinels system is back to a sell condition and as I've already mentioned I tend to believe that nested signals like this may mean a more significant move is coming soon. I'm expecting it to be to the downside, but the market will have the final say on my prediction.

See you tomorrow.